Another day, another reversal – and a positive one for stocks. Universal sectoral weakness gave way to a unison rebound amid constructive outside markets. After weeks of on and off fits over rising Treasury yields, the S&P 500 ran into headwinds on its retreat, and recaptured its lustre yesterday as long-dated Treasuries (iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT)) rolled over to the downside. I guess nothing boosts confidence as much a troubled 7-year Treasury auction.

While it's far from full steam ahead, it's a welcome sight that the reflation trade dynamic has returned, and technology isn't standing in the way. I think we're on the doorstep of another upswing establishing itself, which would be apparent Monday. Credit markets support such a conclusion, and so does the commodities' performance in premarket action. Yes, I am referring also to yesterday's renewed uptick in inflation expectation.

Neither is running out of control, nor declaring the inflation scare as over. Inflation isn't yet strong enough to break the bull run, where both stocks and commodities benefit. It isn't yet forcing the Fed's hand enough.

Now, look for the fresh money avalanche, activist fiscal and moterary policy to hit the markets as a tidal wave. It's a modern monetary theorist's dream come true. Unlike during the Great Recession, the newly minted money isn't going to go towards repairing banks' balance sheets. It's going into the financial markets, lifting up asset prices, and over to the real economy. So far, it's only PPI that's showing signs of inflation.

Any deflation scare in such an environment has a low prospect of success.

That concerns precious metals – which are neither rising, nor falling, regardless of the miners‘ message. After the upswing off the March 8 lows faltered, the bears had quite a few chances to ambush this week, yet made no progress. And the longer such inaction draws on, the more it is indicative of the opposite outcome.

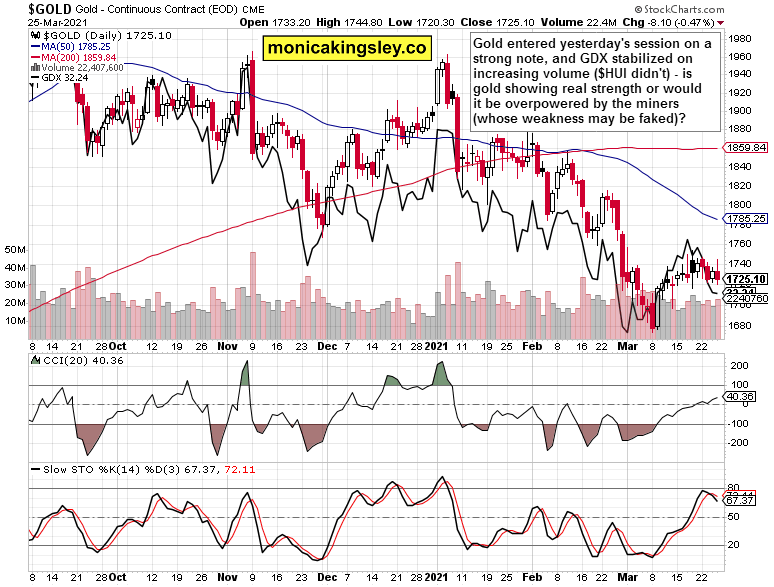

Regarding gold, what I said yesterday holds true today:

(…) Gold is again a few bucks above its volume profile $1,720 support zone, and miners aren't painting a bullish picture. It is resilient when faced with the commodities selloff, but weak when it comes to retreating nominal yields. The king of metals looks mixed, but the risks to the downside seem greater than those of catching a solid bid.

That doesn't mean a steep selloff in a short amount of time just ahead – rather continuation of choppy trading with bursts of selling here and there.

What could change my mind? Decoupling from rising TLT yields returning – in the form of gold convincingly rising when yields move down.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

Gold In Spotlight

The troubled miners got a little less problematic yesterday. The VanEck Vectors Gold Miners ETF (NYSE:GDX) recovered from intraday losses, while gold didn't exactly plunge. Its opening strength was a pleasant sight as, more often than not, miners' weakness while gold goes nowhere is a signal for going short the metal. But as this sign didn't result in a gold slide, my viewpoint is turning bullish again because we might be seeing fake miners weakness that would be resolved over the coming week with an upswing. Now that the Wall Street and Main Street expectation for the coming week aren't as bullish as for the week almost over, an upswing would be easier to pull off (should it come to that).

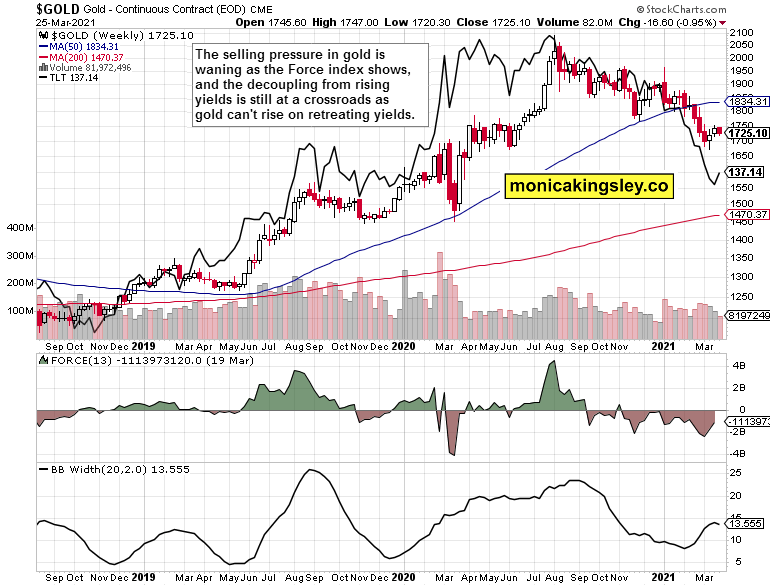

Big picture view remains (positively) mixed. The selling pressure is retreating, but gold isn't yet reacting to declining yields. Once it clearly does, the waiting for a precious metals upswing would be over.

Silver And Miners

Silver staged an intraday reversal, which copper couldn't pull off. Not that it attempted to, but still the commodities selloff appears a bit overdone, given that nothing has fundamentally changed. Both gold and silver miners stabilized on the day, meaning that the sector is in a wait-and-see mode, unwilling to turn bearish just yet.

Summary

The odds of an S&P 500 upswing have gone up, and volatility made a powerful retreat below 20 once again. Value stocks have turned upwards, and the stock bulls appear readying another run.

Miners closed at least undecided yesterday, but gold and silver miners showing outperformance again is missing. Both metals still remain vulnerable to short-term downside. Once gold strengthens on declining yields, that would be another missing ingredient in the precious metals bull market.