Bitcoin price today: gains to $120k, near record high on U.S. regulatory cheer

I took some time to visit with David Asmun and Larry Shover on Fox Business News yesterday to discuss the markets, Janet Yellen and some strategies and opportunities to hedge against a potential correction later this summer. With the new year upon us, there are always a plethora of forecasts, predictions and estimates, which are always inherently bullish, to consider. However, what seems to be lacking is any consideration of the risks of a correction. As I state in the interview, our job as investors is to "buy low and sell high." Unfortunately, that advice tends to fall on "deaf ears" when markets rally strongly during a given year.

However, as I discussed recently in 30% Up Years,

"...each 30% return year was also the beginning of a period of both declining rates of annualized returns and typically sideways markets. It is also important to notice that some of the biggest negative annual returns eventually followed 30% up years."

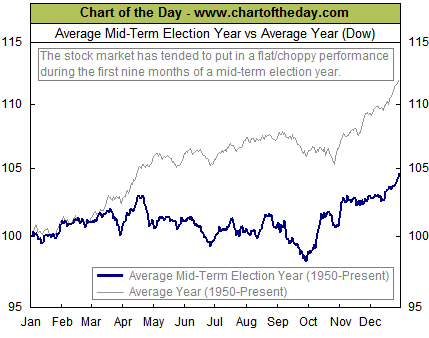

Furthermore, as shown in the chart below, since the 1950's, mid-term election years have been more or less flat with declines coming in the second and third quarters of the year.

The rationale that supports this behavior is that the markets dislike uncertainty. As we head into the mid-term elections in November, it is likely that the markets could stagnate while wating to see if the current gridlock will remain or if the conservatives can gain control of both the House and Senate.

This is why, from a contrarian investment view, I recommended taking a bit more defensive posture heading into the summer months ahead by:

- Raising some cash by trimming winners and selling laggards.

- Adding fixed income as a hedge against a market sell off.

- Gold miners are "hated" and are likely to have a countertrend rally sometime this year.

- Ditto for gold.

- Exchange high beta stocks for boring old dividend stocks.

I am certainly not recommending going to cash, which as I state in the interview, is a mistake that investors too often make. However, being prudent with managing portfolio risk by "selling high" provides the cash to "buy low" when the opportunity presents itself.

When we consider that the Fed has begun to "taper" their bond buying programs, the ebullience of individual investors and extreme extensions in the financial markets - the assumption of a 10% or greater correction sometime this year is not far fetched. The only question is whether you will be in a position to capitalize on it, or just recover from it?

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.