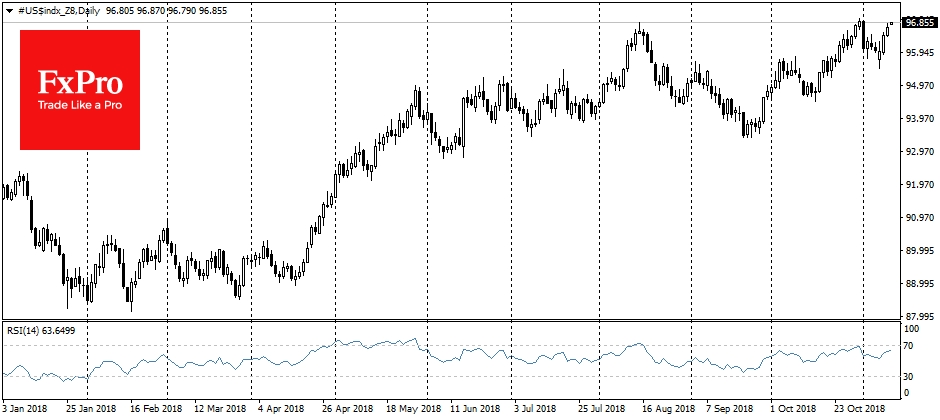

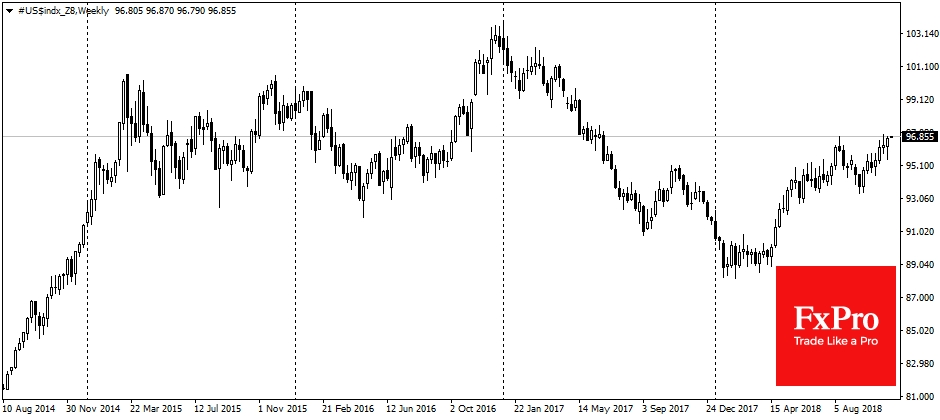

The American dollar has been showing growth during the last four weeks, managing to return to the annual highs area. After all, it had closed the Friday session at the highest level in 16 months. Despite the drawdown at the beginning of the week, caused by the traditional pressure on the currency due to pre-election uncertainty, the dollar quickly shake off these fears and has began to rise. Now USD is fully able to continue this trend because of several reasons.

On the one hand is the hawkish Fed rhetoric that was demonstrated after the last week meeting. The committee did not reflect on the October stock market’ problems and on the growing signs of the global economy slowdown. This fact had increased the contrast in debt markets’ interest rates due to a growth in dollar short-term interest rates.

On the other hand, after the rebound from the end of October, the stock markets of developing countries (especially Asia) had come under pressure again. Moreover, by the end of last week, the positive momentum of growth in US stocks had dried up. And now this trend development is increasing the demand for the dollar as a defensive asset, forming a moderate outflow from other regions.

Asian indices had lost 2/3 of the rebound since the end of October, reflecting the return to the markets’ focus the developing countries’ development. The recent lows retesting could become a trigger for a new serious wave of demand for the dollar as a defensive asset.

At the new week a number of important data from the United States will be published: these are able to support the american currency. Consumer prices and retail sales are expected to show healthy growth, and the subsequent speech by Fed Chairman Powell is expected to shed light on the Fed's position.

In addition to statistical data, traders will pay attention to the USD behavior near the local maxima. Growth above the previous peaks at 97 on the Dollar Index is able to open the way to the subsequent rally up to 102 (the multi-year highs since 2017).

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.