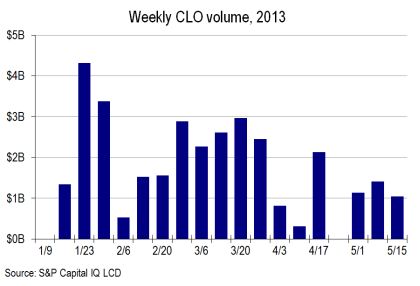

CLO issuance in the U.S. got off to a strong start this year. According to LCD, issuance averaged $1.9 billion per week in January and February. The volume however, has declined sharply since.

There are three key reasons for the decline.

1. Regulatory capital requirements for banks to hold AAA tranches is increasing. CLO managers tried to get their deals done prior to this change, pumping extra volume into the first couple months of the year.

2. There simply aren't enough corporate loans to build a diversified collateral pool quickly enough. We don't see enough LBO deals to generate sufficient amount of new loans - the much anticipated Dell transaction for example didn't take place. Most companies who wanted to refinance, already did.

On the demand side, CLOs now face competition for loans from hedge funds, BDCs, and closed-end loan funds. With few new loans for sale, a manager could end up with too much cash in the collateral portfolio. And you can't pay interest on liabilities with interest "earned" on cash.

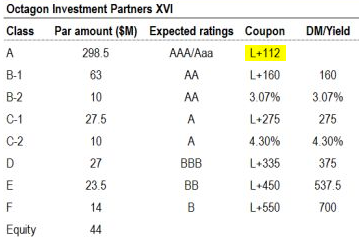

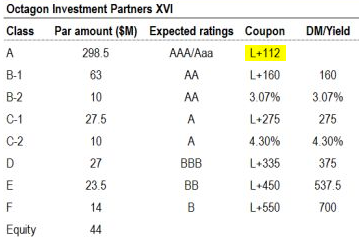

3. Finally, the interest earned on the collateral - even if you can get it - is too low. As the table below shows, the latest CLO deal still pays LIBOR+112bp on its AAA tranche.

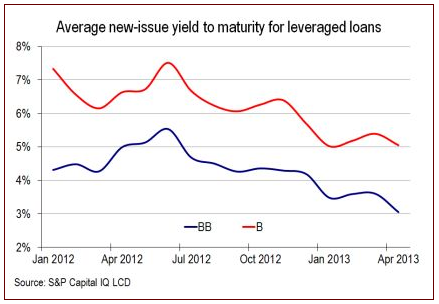

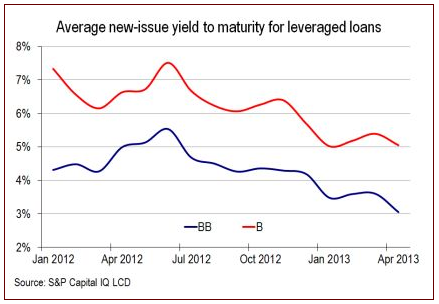

It's a bit lower than the 120bp spread on some earlier deals, but is still pricey relative to the declining spreads on the collateral (chart below). The income received on the collateral less the expense paid on the liabilities (all the tranches) does not leave enough net "juice" for the equity to generate worth while returns. As long as that dynamic is in place, it's going to be increasingly difficult to print new CLO deals.

There are three key reasons for the decline.

1. Regulatory capital requirements for banks to hold AAA tranches is increasing. CLO managers tried to get their deals done prior to this change, pumping extra volume into the first couple months of the year.

2. There simply aren't enough corporate loans to build a diversified collateral pool quickly enough. We don't see enough LBO deals to generate sufficient amount of new loans - the much anticipated Dell transaction for example didn't take place. Most companies who wanted to refinance, already did.

On the demand side, CLOs now face competition for loans from hedge funds, BDCs, and closed-end loan funds. With few new loans for sale, a manager could end up with too much cash in the collateral portfolio. And you can't pay interest on liabilities with interest "earned" on cash.

3. Finally, the interest earned on the collateral - even if you can get it - is too low. As the table below shows, the latest CLO deal still pays LIBOR+112bp on its AAA tranche.

It's a bit lower than the 120bp spread on some earlier deals, but is still pricey relative to the declining spreads on the collateral (chart below). The income received on the collateral less the expense paid on the liabilities (all the tranches) does not leave enough net "juice" for the equity to generate worth while returns. As long as that dynamic is in place, it's going to be increasingly difficult to print new CLO deals.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.