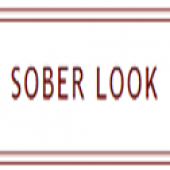

Relying on the absolute levels of consumer survey indicators is usually fruitless. Cultural and historical factors impact how consumers answer questions about the economy. The chart below from Barclays compares consumer views of national economic conditions - percent of survey participants that see them as "good."

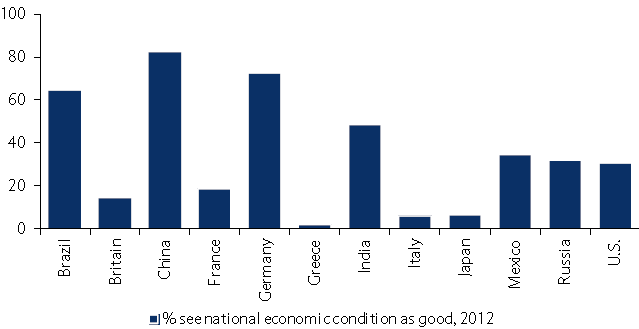

Some of these certainly make sense - such as Greece, the UK, and Italy for example. But from this measure one would think China's consumers are ecstatic about their nation's economy. The reality however is a bit different. The headline MNI China Consumer Sentiment Indicator for example shows a trend that is anything but upbeat.

MNI: The MNI China Consumer Sentiment Indicator dropped for the third month in a row in September to its lowest level since December. The Indicator fell to 89.3 from 90.4 in August. Sluggish economic data and a lack of new government policy stimulus contributed to weaken sentiment. The drop in headline sentiment was due to weak views on current conditions, which fell to 91.3 from 95.0 the month before.

A similar situation is developing in Germany (see this article). With all such survey indicators, relative moves and trends are usually the only meaningful measures.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI