It’s been an incredibly volatile week for the S&P 500. The last five trading sessions produced intraday swings that approached and even exceeded 3%. Tuesday’s price action was no different as a strong open gave way to midday losses, only to see an afternoon bounce push us back into the green, right before a second fizzle left us exactly where we started.

This market is definitely in a hurry, unfortunately, it cannot decide which direction it wants to go. These wild swings are giving both bulls and bears something to crow about, but nothing sticks and strong moves reverse days, if not hours later. This extreme volatility is definitely a concern, but what is it trying to tell us?

I wrote the following last Thursday, and nothing has changed:

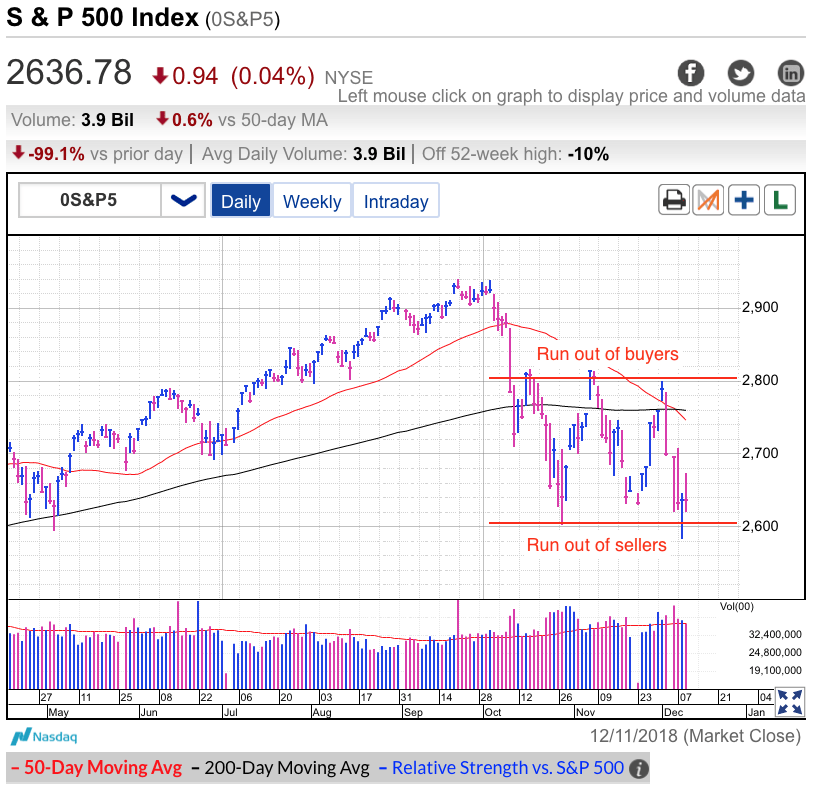

It is shocking to see the amount of gloating going on every time the market moves to one edge of the trading range or the other. We’ve been bouncing between 2,600 and 2,800 for most of the last two months. Today’s dip and reversal count as the 7th time the market challenged and failed to break out of this range.

But rather than use “common” sense and assume each dip is a great buying opportunity, or rally a time to take profits, these impulsive bulls and bears ignore the evidence and proclaim this is finally the big move they’ve been waiting for.

Since I wrote those words, the market again challenged and even briefly violated October’s lows before bouncing decisively off of 2,600 support. And the cycle of bulls and bears yelling at each other and proclaiming they are right continues. All while smart money is making a boatload of money trading against the crowd.

While this volatility is a red flag, even more noteworthy is how resilient this market has been to crashing through support. We had last week’s arrest of a high profile Chinese executive. Then Trump tweets he is perfectly willing to go ahead with his Chinese tariffs. Then today he tells Democrats he would be “proud” to shut down the government.

While the intraday moves have been huge, the directional moves have not. We are still stuck inside the two-month-old trading range between 2,600 and 2,800. The thing to remember about market collapses is they are breathtakingly quick. Markets don’t wait to see how bad things are before they tumble, traders race for the exits at the first hints of trouble. But that isn’t happening here.

Monday’s dip under October’s lows on awful headlines was the perfect setup for bears. But rather than trigger an avalanche of emotional selling, supply dried up and prices bounced 60-points above the morning lows. Rather than sell the weakness, big money is more inclined to buy these discounts. After two months of relentless bad news, it the market chased off most of the weak owners and replaced them with confident dip buyers. That’s why these relentless waves of bad news are failing to dent this market.

Every bottom always feels like things are about to get a lot worse. By rule, it has to. If it didn’t, no one would sell and we wouldn’t dip. At this point, I’m a lot more impressed with the market’s resilience than I am afraid of these fearmongering headlines.

That said, we need to continue respecting support. A dip back under 2,600 support over the next day or two tells us demand is absent and lower prices are ahead of us. But if we hold above the lows for the next few days, the trading range is intact and a run back to 2,800 resistance is in the cards.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.