U.S. politicians have been attempting to "adjust" the sequester law as the level of pain from spending cuts is expected to get progressively worse.

LA Times: -- It was bound to happen: As the sequester budget cuts are felt around the country, lawmakers are having second thoughts — and trying to tinker with them in a way that could lead to a full-scale government shutdown.

Senators want to load up a routine spending bill with provisions to reopen the White House to tours, shield meat inspectors from furloughs and keep air traffic control towers staffed, among other changes that would rearrange the across-the-board cuts.

Nearly 100 amendments have been filed by senators on both sides of the political aisle, stalling the measure that is needed to keep the government running after March 27. Without approval, the government would shut down, a prospect lawmakers and President Obama have said they want to avoid.

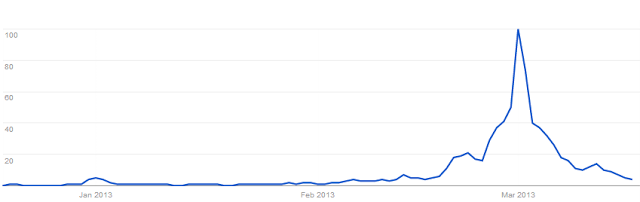

The problem politicians face is that the public doesn't seem to care much. Polls show that a large portion of the voting population doesn't know what "sequester" means -- in spite of it being the "law of the land". And it seems that those who do know are simply ignoring it. According to Google Trends, interest in the word "sequester" spiked at the beginning of March and has collapsed since then.

It's understandable to see U.S. citizens ignore the sequester budget cuts. After all, everyone was gearing up for something to happen with the "fiscal cliff", but the last minute compromise turned it into a non-event (relative to what it could have been). The public is obviously convinced some compromise will be reached and things will go on as usual.

But unlike the public, investors are surely pricing in some risk that the current budget crisis may not proceed as smoothly as the last one. Or are they? The next chart shows how the iShares defense industry ETF (ITA) has been trading relative to the S&P500 from the beginning of the year. We certainly saw it underperform materially in February with concerns about the sequester disproportionately hitting discretionary defense spending. But just like the public at large, investors now believe the sequester law will be reversed in short order. U.S. aerospace and defense shares have rallied to outperform the S&P500.

That's a great deal of reliance on Washington to come to some resolution relatively soon, albeit a temporary one. What happens if they don't?

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI