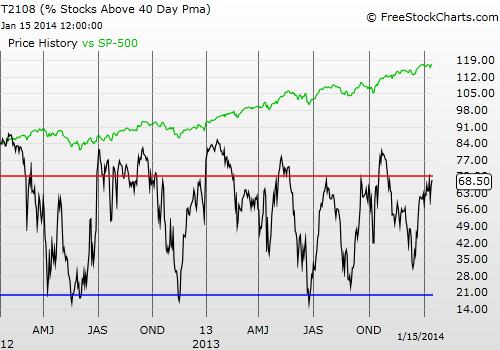

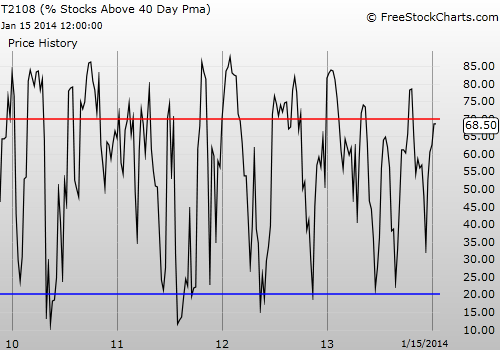

T2108 Status: 68.5%

VIX Status: 12.3

General (Short-term) Trading Call: Short (bearish bias).

Active T2108 periods: Day #134 over 20%, Day #9 over 60% (overperiod), Day #49 under 70%

Commentary

Whiplash Part 2.

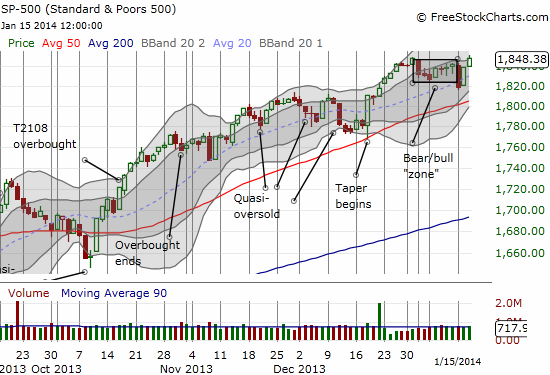

It appears, once again, the sellers simply do not have the firepower to sustain much, if any, follow through. Today, the S&P 500 (SPY) continued yesterday’s comeback with a 0.5% gain that puts the index a hair above the bear/bull zone.

Despite the extension of the buying, I went ahead and bought a second tranche of ProShares Ultra S&P500 (SSO) puts. I am following my rules on this one, but I am not optimistic. I am fully prepared to put the SSO puts behind me as hedging for playing an extended overbought rally. T2108 is almost exactly where it was on Friday when I was preparing for overbought conditions. The big caveat to bullish expectations here is that the volatility index, the VIX, is already extremely low. Whenever any coming rally ends, it will likely end with a bang!

In the last T1208 Update I noted that I see whiplash in a bunch of key trades and that traders need to be ready to seize opportunity in a hurry. I have three live examples today, two of which I was able to trade. I provide these examples to demonstrate how I try to think through the split-second decisions and also to demonstrate how easy it is to miss an opportunity that in hindsight appears obvious.

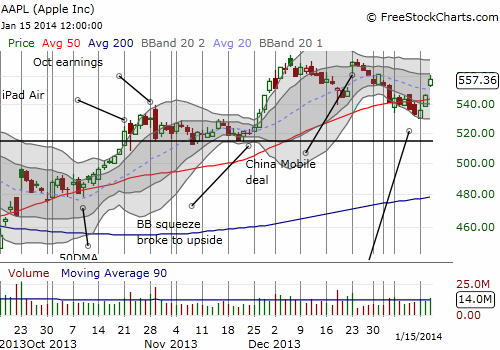

First, (what else?) Apple (AAPL). Going into today, AAPL had high odds of upside (as noted in the last T2108 Update). At the open, AAPL gapped up and ripped higher. See this 5-minute chart…

I have seen this behavior countless times. If I do not make up my mind within the first 5 minutes or so, the trade is over because the risk/reward is not good enough. With the Apple Trading Model (ATM) backing me up, I quickly bought weekly $465 calls. By the time the clock reached the critical end of the first 30 minutes of trading, my calls had almost doubled. I decided that was good enough and put the calls out to pasture. This move happened to turn out fine: the subsequent slow-motion drift would have driven me crazy. For good measure, I bought a put in prep for what could/should be a downside Friday. In the way though is another ATM prediction of upside for Thursday trading. The 73% odds come with a big stability caveat: if AAPL had closed just a few tenths of a percent higher or lower, the ATM would have produced strong odds of downside.

The daily chart shows that AAPL has broken free of the sloppy 50DMA retest and is now, as I like to say, running in the open field. Looks like I will be dead wrong about AAPL retesting the $514 level before earnings!

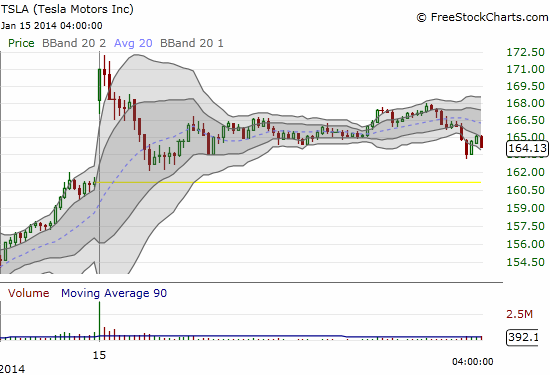

Next up is Tesla Motors (TSLA). This is a play I missed yesterday AND today. This time though the odds were tipped against TSLA. The stock gapped up far above its upper-Bollinger Band (BB), ripe for shorting. Moreover, even the 5-minute chart shows clearly that the open was over-extended. And 5 minutes is about the time I would have had to make up my mind if I had been paying closer attention. Doing this chart review, the opportunity looks obvious in hindsight!

Finally, I have a new entrant, Mellanox Technologies (MLNX). This is an example where I simply do not have the time to flag every opportunity I see in a timely fashion. MLNX is a stock that fell of my radar until on Tuesday I stumbled upon the news of an initiation by Macquarie to Outperform. The market responded with strong buying volume. Even MORE interesting is that the daily chart reminded me of Intuitive Surgical (ISRG). Given the huge success I had with ISRG this week, you can imagine how I snapped to attention. Later last night I discovered that a MLNX insider loaded up $2M worth of stock. That was the last pin to fall for me, and I resolved to get in at the next opportunity. Near the open, I noticed MLNX was down ever so slightly. Not wanting to wait, I put on half a position with the full intent to buy the other half in the event of a bigger pullback in coming days. Instead, out of nowhere, MLNX soared, fell backwards sharply, and then soared again. It is now just below its 200DMA in another eerie similarity to ISRG’s attempted break from consolidation this week. Stay tuned on this one!

Way back in the day when I daytraded, my mentor schooled me on waiting out the first 30 minutes of the trading day, sometimes the whole first hour. His valid concern was that a lot of trickery happens at the open that gets reversed over the course of the trading day. For example, too many retail investors would leave trades to execute at the market at the open because they worried about missing a trade while at or getting to work. These trades are easy pickings for market makers. However, what I see these days is that often times the entire move on the best opportunities is over and done in the first hour or so of trading. I suspect this is a function of high-frequency traders all rushing into the same idea at once. I am still adjusting my thinking in this new, brave world.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Full disclosure: long SPHB and SPLV and SSO puts (pairs trade), long AAPL shares and puts, long MLNX

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Whiplash Part 2: Returning To The Edge Of Overbought

Published 01/16/2014, 05:18 AM

Whiplash Part 2: Returning To The Edge Of Overbought

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.