Trump slaps 30% tariffs on EU, Mexico

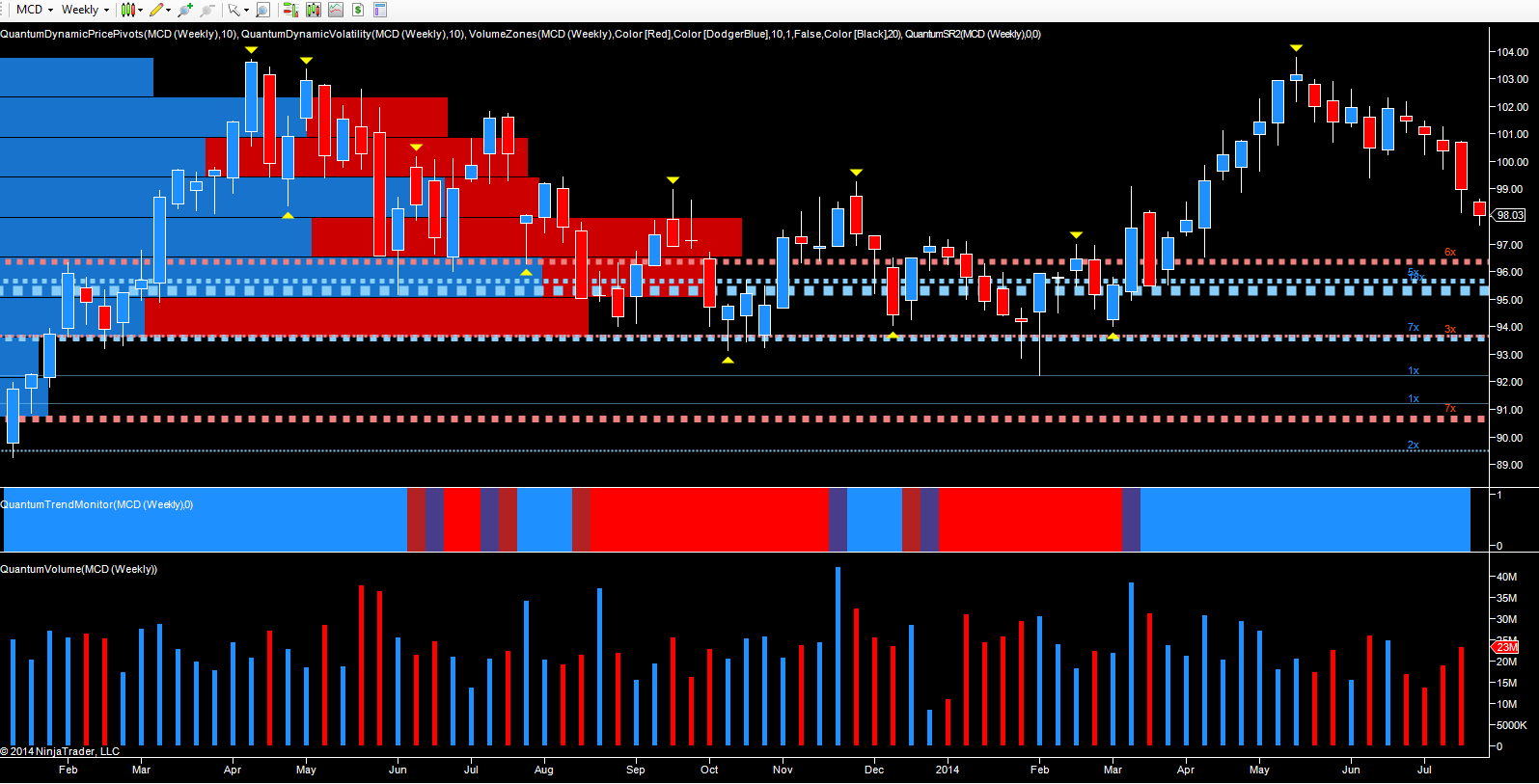

With earning season now in full swing, I thought it would be interesting to consider one of the Dow’s bellwether stocks, namely McDonald's (NYSE:MCD) which is due to report later today. The analysts’ consensus view is that the stock is a mild buy with an EPS forecast for the quarter of $1.43. This is against the reported figure for the same quarter last year which was $1.38. So let’s take a look at the technical picture.

On the daily chart $104 per share has certainly been the tipping point for McDonald's to date with the stock testing this price point twice last year in April and May before declining to find support in the $93.50 region. In 2014 this level has been tested once again, ironically at the same time of year, with the long legged doji candle signalling indecision coupled with falling volumes. The candle of early May was topped off with an isolated pivot high with the subsequent sell-off through the $100 level and down to today’s trading price of $97.98. The volumes over the last three weeks have been rising, suggesting further downside pressure. Any reversal on the fundamental news today will need to be accompanied by stopping volume and associated price action.

The deep platform of support between $95 and $96.50 should prevent the stock price declining further, and provided today’s results are in line (or better), this may the catalyst for a return of some mildly bullish momentum.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI