Introduction

It's easy to remain fixated on the US. Buoyed on by the Trump Presidency, US stocks continue up. But as measured by standard indices such as price/earnings ratios, US markets are high.

So where else, and by what standards do we choose to invest?

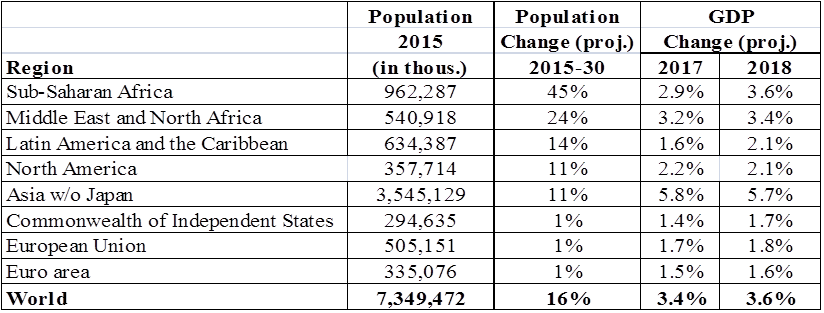

Regional Growth

Consider first what is happening regionally as measured by projected GDP and population growth rates. The table below indicates that the populations of Sub-Saharan Africa are growing most rapidly followed by North Africa and the Middle East. Rapid urbanization is slowing growth rates in other regions. Population growth will at some point become a spur to economic growth as demand from growing middle classes emerges. When it comes to present-day economic growth, Asia leads all other regions.

Table 1:

Countries

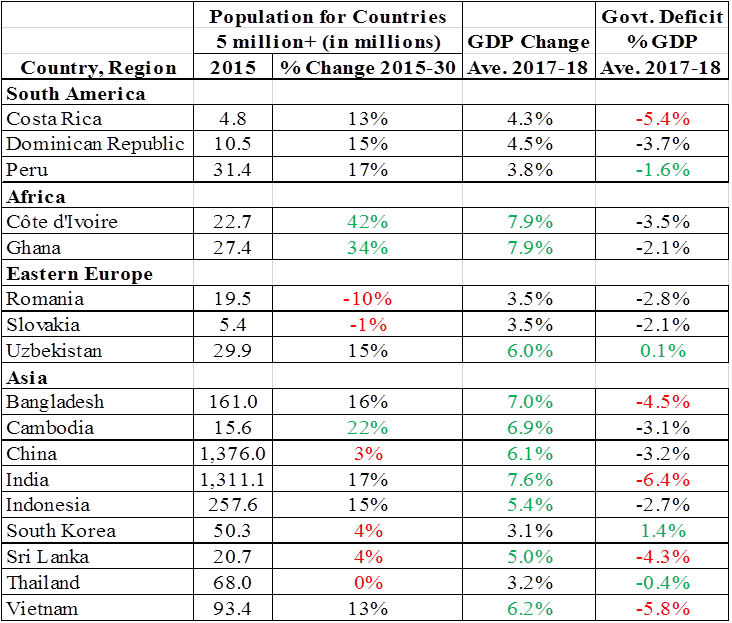

From regions, I went to countries with populations of 5 million and up. I screened out countries facing significant political and military uncertainties. And as in Table 1, I look at countries using economic and population growth as proxies. I also include the size of the government deficit as an indicator of how well the government is managing the country’s finances. Green indicates an impressive number while red signifies a problem area.

Remember BRIC – Brazil, Russia, India and China? At one point, I thought Brazil would be one of the leading countries in the first half of the 21st century. And Russia has serious problems. I worry about India’s rapid growth and its failure to invest in needed infrastructure. China made the infrastructure investments but is now in the tricky process of transitioning from a country driven by export growth to one trying to satisfy the demands of a rapidly growing middle class.

Costa Rica, the Dominican Republic and Peru are my choices in South America. They have progressed steadily over the last decade. The population and GDP growth numbers for the Côte d’Ivoire and Ghana are impressive. In Eastern Europe, Uzbekistan is growing rapidly and is actually running a small government surplus!

In Asia, my favorites are Cambodia, Thailand and Vietnam. They are “smaller” countries but have demonstrated the ability to grow steadily, even during political uncertainties. As I have written, India worries me. A democratic form of government is not well suited for a rapidly developing country.

Table 2:

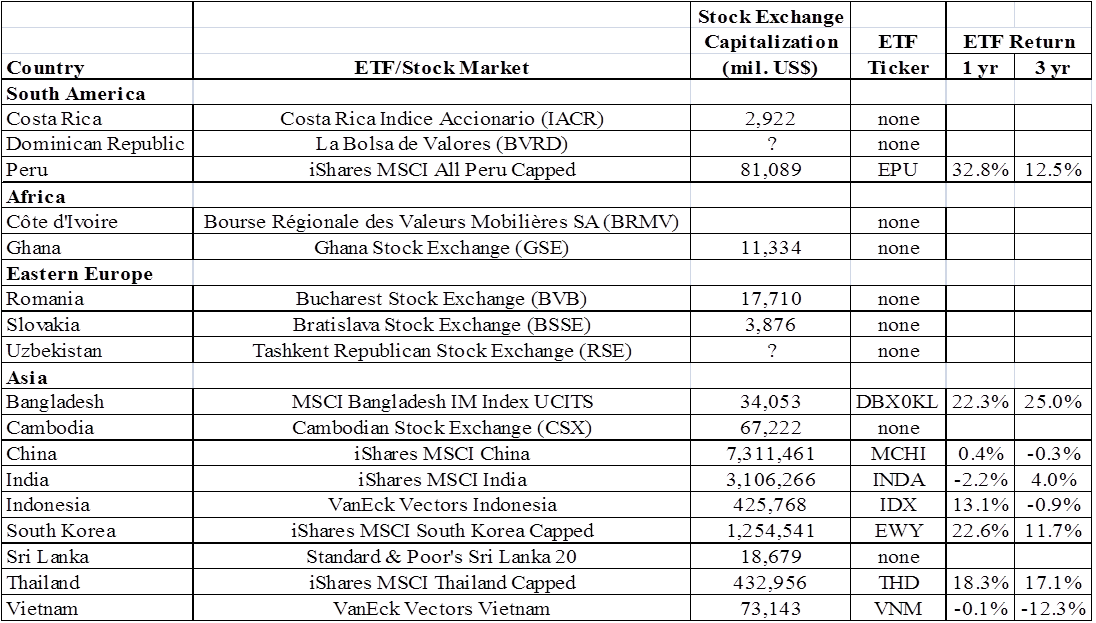

Investment Vehicles

Table 3 provides information on how to invest in countries mentioned above. If a country-specific ETF is not available, I would not invest without physically visiting the country and finding someone I trust to handle transactions.

Table 3:

Sources: World Federation of Exchanges, Yahoo Finance, Bloomberg

The above is a starting point for research on investing around the globe.