"It is a bad sign for the market when all the bears give up. If no-one is left to be converted, it usually means no-one is left to buy.” -- Pater Tenebrarum

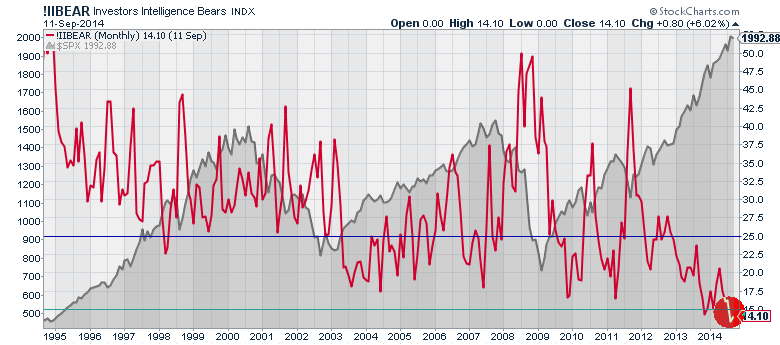

That quote got me thinking about the dearth of bearish views that are currently prevalent in the market. The chart below shows the monthly level of bearish outlooks according to the Investors Intelligence survey.

The extraordinarily low level of "bearish" outlooks combined with extreme levels of complacency within the financial markets has historically been a "poor cocktail" for future investment success.

As Michael Sincere recently stated rather sarcastically:

"If you study history, you know that no one thought the price of tulips, houses, or stocks would ever go down. Even most bulls believe that 'one day' there will be a correction, but that day is far away. After all, the Fed has an unlimited supply of magical tools, and they are determined to keep the market from falling.

Unfortunately for soul-searching bears, the Fed trumps all. As long as new money flows into stocks, interest rates are low, and the market keeps going up, why worry?"

That is the focus of this weekend's list of "Things To Ponder."

1) The Death Of Bears by Pater Tenebrarum via Acting Man Blog

“What prompts this missive is news that yet another prominent bear has apparently given up. The thing is, this bear – Wells Fargo analyst Gina Martin Adams – wasn’t even a bear, but merely a somewhat reluctant bull, whose targets got taken out a few times. It is interesting from a psychological perspective that a not overly foaming-at-the-mouth bull is considered a “bear” by the financial media, a “famous bear” even. She has now recanted, and has apparently been preceded by several others. An SPX target of 1850 points apparently made her the “most bearish strategist” on Wall Street!

‘Gina Martin Adams of Wells Fargo has long been known as the most bearish strategist on Wall Street. After all, at 1,850, she had the lowest year-end S&P target among major strategists. But on Tuesday, she got rid of that year-end target and initiated at 12-month target of 2,100, reflecting a mildly bullish outlook.’

Given that no prominent bearish Wall Street strategists seem to be left now – not even those forecasting 5% dips or flat markets – we won’t be able to report on any additional conversions."

2) The Two Pillars Of Full-Cycle Investing by John Hussman via Hussman Funds

"As value investor Howard Marks observed last week:

'Today I feel it’s important to pay more attention to loss prevention than to the pursuit of gain. Although I have no idea what could make the day of reckoning come sooner rather than later, I don’t think it’s too early to take today’s carefree market conditions into consideration. What I do know is that those conditions are creating a degree of risk for which there is no commensurate risk premium.'

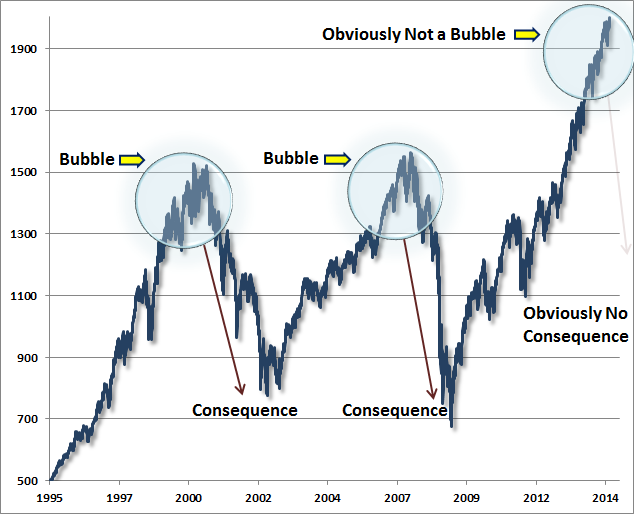

So while many observers pronounce victory at halftime, in the middle of a market cycle, at record highs and more extreme market valuations than at any point except the 2000 peak, remember the two pillars. First, the combination of high confidence, lopsided bullishness, overvaluation, and overbought multi-year advances has predictably been resolved by steep market losses, time and time again across history. Second, strong market return/risk profiles warranting constructive or leveraged investment positions emerge in every market cycle, generally following a material retreat in valuations, coupled with an early improvement in market action. We believe that one of these is descriptive of present market conditions, and the other is well worth our patience.

“History teaches clear lessons about how this episode will end – namely with a decline that wipes out years and years of prior market returns. The fact that few investors – in aggregate – will get out is simply a matter of arithmetic and equilibrium. The best that investors can hope for is that someone else will be found to hold the bag, but that requires success at what I’ll call the Exit Rule for Bubbles: you only get out if you panic before everyone else does. Look at it as a game of musical chairs with a progressively contracting number of greater fools.”

3) Eerie Parallels To 1937 by Dr. Robert Shiller via Project Syndicate

“The current world situation is not nearly so dire, but there are parallels, particularly to 1937. Now, as then, people have been disappointed for a long time, and many are despairing. They are becoming more fearful for their long-term economic future. And such fears can have severe consequences.”

Read Also: For 90% Of Americans There Has Been No Recovery

4) The Tailwind To Stocks Is Gone by GaveKal Capital Blog

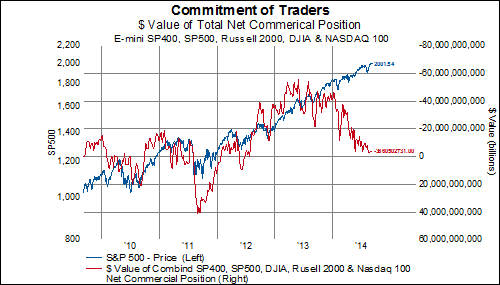

“Generally as equity prices rise, commercial hedgers take on a greater short position, and when price fall they take on a greater long position. When the position of commercial traders is significantly short, it suggests a large short position has been built up. If commercial traders are short and get their directional bets wrong, it provides fuel for the market to propel higher as commercial traders have to cover their shorts by buying stock. In turn, if commercial traders have closed out their short positions, this suggests there may be little fuel left for the upside in stocks.”

“This short covering induced buying has helped the equity markets attain all-time highs. But, now the short covering has largely been completed and will no longer provide much of a tailwind for stocks.”

5) Tracking The Decline Of Risk Aversion by Scott Grannis via Calafia Beach Pundit

“For most of the past five years I've argued that one of the dominant features of this recovery was risk aversion. The Great Recession so scared and shocked the world that risk aversion became exceptionally high. I've also argued that the main purpose of the Fed's QE program was to supply a very risk averse world with safe securities, by essentially converting ("transmogrifying") notes and bonds into T-bill equivalents (aka bank reserves). The point of QE was not to stimulate the economy, as many have argued, but to accommodate the world's intense demand for safe assets.”

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.