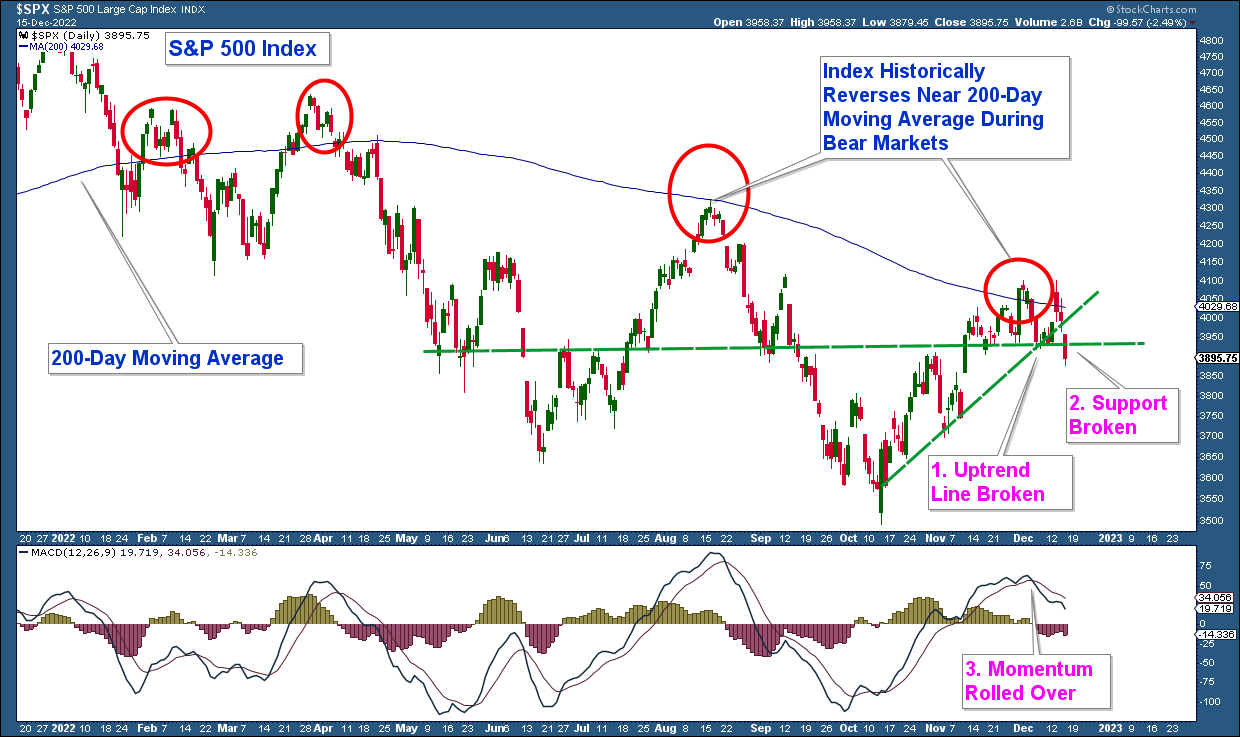

Bear market rallies tend to give people hope, only to dash those hopes with the next move lower. It can be emotionally and financially draining. The recent advance off the October lows showed none of the signs that would suggest a longer-term bottom. So, a reversal at the 200-day moving average was likely given how it has historically tended to be a strong bear market resistance area.

Last month, I laid out three technical factors that I was watching that would suggest the end of the rally. As of today, all three of those have occurred.

Below is the same chart that I posted in that newsletter. In the top panel is a chart of the S&P 500 and in the lower panel is the MACD (a momentum indicator). Here are the three factors:

- A break in the uptrend line.

- A break of support.

- The MACD rolling over.

All three have occurred which signals that the odds of more losses in stocks have risen significantly.

I have no way of knowing how far stocks are going to fall. But what I do know is that we are in a bear market with a recession likely next year. Thus downside risk is huge.

Uptrend lines and support areas can provide traders with logical exit points. Meaning they will hold long positions until those lines get broken. It is common to see strong moves lower when those lines/areas get broken as traders exit positions in mass. Once the levee of support breaks, the price has nowhere to go but down.

As Robert Plant sang: "When the levee breaks, have no place to stay."

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI