Managing your investments would be easy if you just bought stocks and watched them move higher.

In your dreams!

In the real world, even the best managers must deal with adversity. Our choices, no matter how carefully chosen, do not perform as expected. Something goes wrong.

Dealing with adversity is crucial to investment success. Tonight we have an informative case study in JP Morgan Chase (JPM), a company that I have cited favorably several times and include in my flagship investment program. My most recent favorable mention was just this week in my discussion of Europe.

While it is more fun to write about triumphs, it is just as important to think about losses. Despite my overall record, I certainly make choices that do not work out. I do not endorse "buy-and-hold." I actively manage every program and every position, constantly reviewing the changing prospects for each investment.

Let us take a closer look at how to handle adversity.

What NOT to Do

There are two basic investment mistakes -- mirror images of failure to analyze.

- Blindly holding the position hoping that it gets back to your original "buy" point. This is typical for the average investor. It is about psychology rather than analysis. It is buyer's remorse, a desire to undo the losing decision. "If only I had another chance.....," the investor thinks. This is really stupid. If the investment is a mistake, this mentality can turn a moderate loss into a big one. Some of the biggest companies have gone to zero -- or nearly so. Check out Worldcom, Enron, GM, Lucent, and many others. Meanwhile, if the stock actually does recover, it is probably wrong to sell it at the original entry point.

- Selling instantly and without analysis. This is a trader mentality, which is fine if you are a trader. We have all heard about cutting losses and letting winners run. We also know about "buy low and sell high." It is more difficult than a slogan. I listened to some traders discussing this stock and they opinions were mixed.

I can summarize what investors should do in one simple statement:

Review your investment process with the new information and decide accordingly.

You cannot go back and sell at yesterday's or last week's prices. Each day is a new one. Suppose that you had no position in this stock. Would you buy it at the current price? Is the investment thesis intact?

There are many excellent methods for finding great stocks, so the general advice is to review your own conclusions. In an effort to be more helpful, I am going to review my own process.

Here is a very brief summary of my own method (further details available on request).

Sector Choice

I try to find a sector that is depressed and unloved. This is where you shop for value. You must be prepared for a constant bombardment of pundits on why you are wrong.

Stock Choice

I look for a stock that qualifies on four criteria:

- It must have a great business, with strong profit potential.

- There must be strong management.

- There must be a near-term catalyst, since no one wants to have "dead money."

- Corporate financials -- earnings, cash flow, balance sheet, and risk -- must all be strong.

I constantly review every stock in the portfolio, asking if it still meets the tests. Analysts who set a stock price target and then wait until it is hit are doing a poor job. I adjust price targets constantly. This is why I was able to buy Apple (AAPL) at 63 and hold it through the gains (trimming size to balance the portfolio). There is no substitute for regular review.

Addressing the Bad News

With this in mind, let us go back to JP Morgan. If you are a current investor you should focus on whether the stock is attractive at the current price. I do not yet have a personal conclusion, since I prefer to analyze more data, but I will share my thought process.

- Is this still the premier financial business? Do I still want some exposure to the sector?

- Have I lost confidence in Jamie Dimon? On his show tonight Cramer (long the stock in his charitable trust) announced that Dimon was "just like all of the others." This might be a little harsh, but I have relied on his interviews where he assessed overall risk. Were these misleading? Mostly they discussed counter-party risk, but I need to look deeper.

- Has the potential catalyst changed?

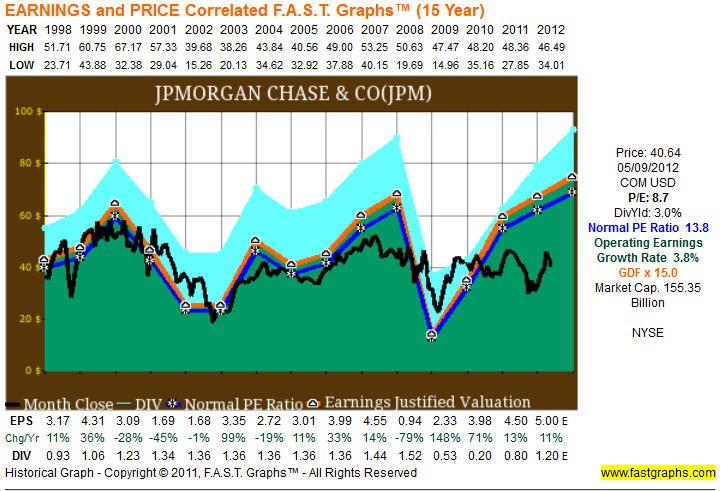

- What about the new financials? The question is whether this is a one-time hit or something that affects future operating earnings. In my experience there have been many "one-hit wonders" where stocks decline on bad news that is a one-time charge (Tylenol poisoning, Intel floating point processor). The market sells first and thinks later. The overall earnings picture before the news was very good, as we can see from this chart from Chuck Carnevale's invaluable site.

Preliminary Conclusion

I wanted to write a timely story, and that meant doing it tonight. We'll know much more tomorrow. Depending on what I see, I might sell or I might add to the position. I have clearly stated the criteria.

Emaphsizing the main point: Do not fall in love with a position.

Each day is a new start. Be cool and analytical. If you have a proven method, use it!

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI