Bitcoin price today: muted at $118k but altcoins soar as House passes new bills

With the absolute mess that’s going on in the brick and mortar retail world right now, eBay is an intriguing company. The gradual change from physical stores to online shopping has been an obvious trend, but this holiday season it was particularly pronounced. Holiday sales were down and physical retail stores struggled. In the past week alone GameStop (GME) and Best Buy(BBY) watched their stock prices plunge by 15 and 30 percent respectively.

Amazon.com and other e-commerce companies are the obvious winners. UPS (UPS) had to hire an extra 30,000 workers to deal with the unexpected increase in last minute holiday demand, a drastic measure that will take a chunk out of their quarterly profit numbers. eBay may be positioned to take advantage of the big shift this year, but it’s difficult to compare them to Amazon as eBay’s role as an online auction house is fundamentally different than the core of Amazon’s business.

In addition to seeing large growth in other online retailers such as Amazon, eBay’s well known subsidiary PayPal is also under stiff competition. In 2013 we saw the rise of several other alternative payment methods including Square, Stripe, and possibly even Bitcoin.

Here’s how buy-side and independent analysts expect eBay to report earnings and how we can expect the stock price to react. The information below is derived from data submitted to the Estimize.com platform by a set of Buy Side and Independent analyst contributors.

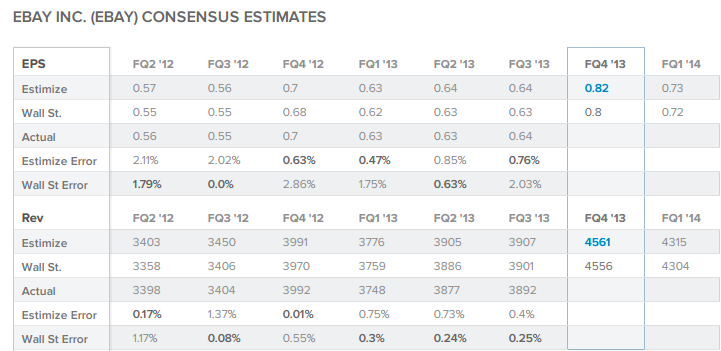

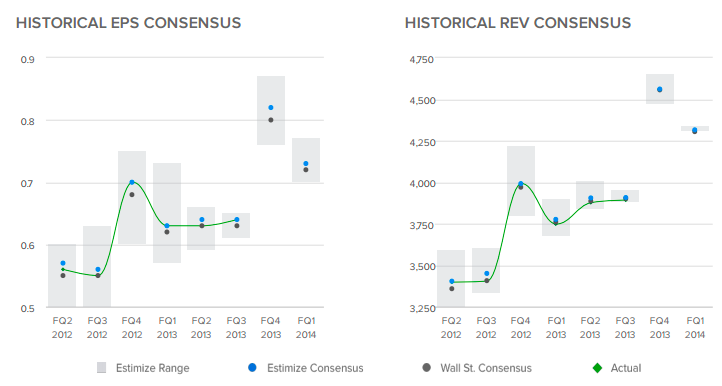

The current Wall Street consensus expectation is for eBay to report 80c EPS and $4.556B revenue while the current Estimize.com consensus from 47 Buy Side and Independent contributing analysts is 82c EPS and $4.561B revenue. This quarter the Estimize.com communtiy is expecting eBay to beat the Wall Street expectatiions by a small margin.

The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. In this case we are seeing a 2c EPS differential between the groups, which is average compared to past quarters.

eBay has met or exceeded the Wall Street profit consensus in each of the past 6 quarters. This quarter the aggregate estimate from Estimize is forecasting that the company will do it again.

By tapping into a wider range of contributors including hedge-fund analysts, asset managers, independent research shops, students, and non professional investors Estimize has created a data set that is up to 69.5% more accurate than Wall Street, but more importantly it does a better job of representing the market’s actual expectations. It has been confirmed by an independent academic study from Rice University that stock prices tend to react with a more strongly associated degree to the expectation benchmark from Estimize than from the Wall Street consensus

.

One of the big questions hanging over eBay this quarter is whether they were able to cash in on brick and mortar retailers’ weakness or if Amazon ate the whole cake. The distribution of estimates published by analysts on Estimize range from 76c to 87c EPS and $4.471B to $4.650B in revenues. This quarter we’re seeing a large distribution of estimates compared to previous quarters.

The size of the distribution of estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. In this case the large range of estimates is signaling that analysts disagree about how well eBay will perform this quarter. Disagreement between analysts may mean that the expected earnings can not be accurately priced in to the stock before the report, so we could see a lot of volatility in the stock price after the earnings release.

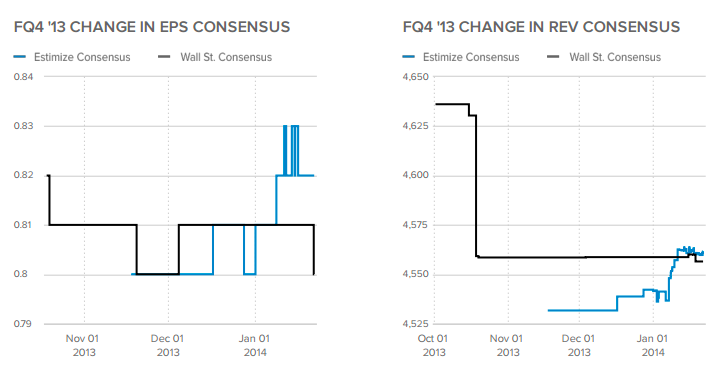

Throughout December into mid January we saw the Estimize.com EPS consensus increase from 80c to 82c, while Wall Street breifly entertained the idea of 81c only to return to 80c at the end of the quarter. Wall Street revenue expectations have dropped from $4.636B to $4.556B while the Estimize consensus has pushed higher from $4.532B to $4.562B

.

The analyst with the highest estimate confidence rating this quarter is OptionsHawk who projects 82c and $4.535B in revenue. In the Winter 2014 season, OptionsHawk is currently ranked as the 76th best analyst and is ranked 12th overall among over 3,400 contributing analysts. Estimate confidence ratings are calculated through algorithms developed by deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy. In this case the highest rated analyst is expecting eBay to beat the Street in profit and report in-line with Estimize. While OptionsHawk expects eBay to beat the Street on profit, he thinks the online auction site will come up significantly short on revenues.

Get access to estimates for eBay published by your Buy Side and Independent analyst peers and follow the rest of earnings season by heading over to Estimize.com. Register for free to create your own estimates and see how you stack up to Wall Street.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.