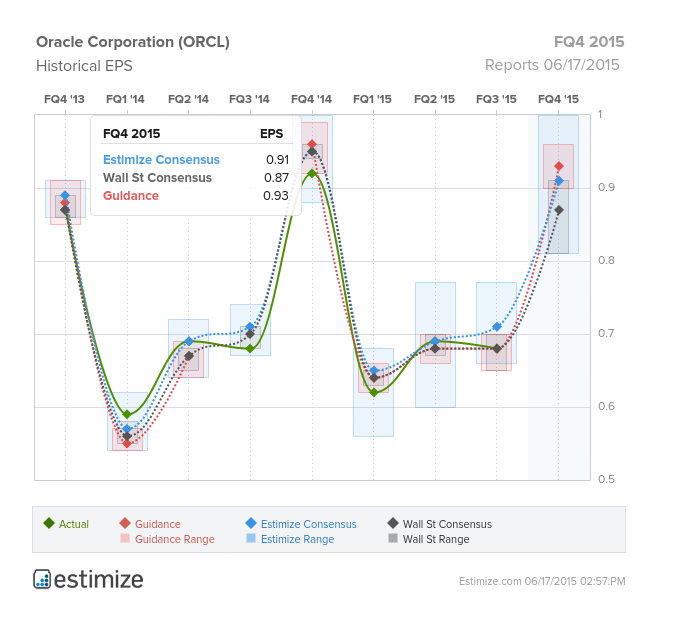

At the close of markets today, investors will likely turn a keen eye to the Californian based software company Oracle Corporation (NYSE:ORCL) as they deliver their quarterly report after the bell. The Estimize community and Wall Street are both projecting earnings figures to come in below company guidance. Estimize and Wall Street analysts are predicting EPS figures of $0.91 and $0.87, respectively, for the FQ4 ’15. This is compared to company guidance of $0.93.

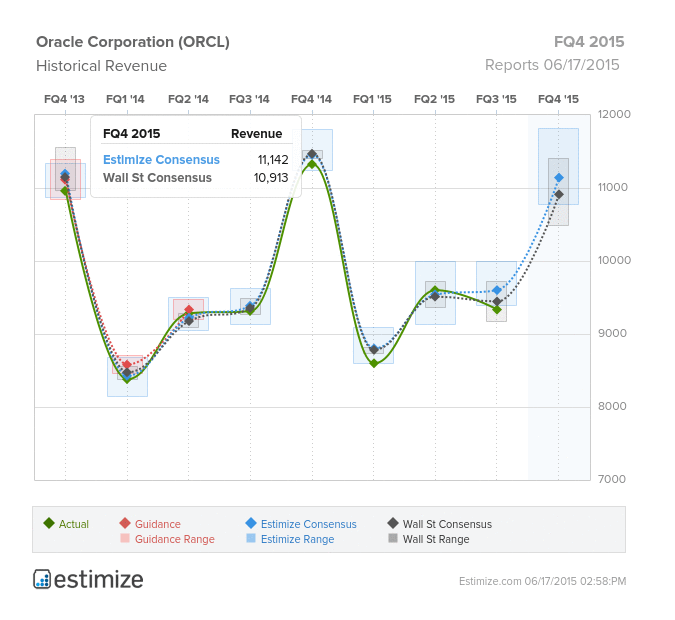

Similar to earnings, Estimize has a higher revenue target than Wall Street with an estimate of $11.145B for the quarter compared to the $10.913B Wall Street is predicting. Both of these projections fall short of Oracle’s actual revenue numbers reported in FQ4 ’14 of $11.326B. Importantly, the stronger US currency is expected to have contributed to lower revenue estimates for this quarter relative to the previous twelve months.

The company has underperformed recently, disappointing investors with a year-to-date (YTD) return of negative 0.76% relative to the S&P 500, which has delivered a 2.13% capital gain. Investors and market commentary have focused on the deterioration in the company’s new software license’s sales, which have been weakening total revenues. However, this is not Oracle’s only issue. New software license’s sales lead to ongoing sales in software updates and support, their main revenue driver. This is a continuing trend for Oracle and will be closely watched by market participants this afternoon.

With the likely continuation of falling revenues from new software licenses, management is relying on a pick up in cloud computing sales to offset that decline. Management has persisted in acquiring businesses operating in the cloud-based product/service industries as well as companies controlling content and data.

Historically, FQ4 has represented a seasonally strong period for the company. The stock did however disappoint twelve months ago when the company missed its guidance, delivering a $0.92 EPS figure compared to guidance of $0.96.

The upcoming result will be the first to fully reflect the benefits from both the MICROS Systems and Datalogix acquisitions, which were finalized in September 2014 and January 2015, respectively. Investors will be eager to see the benefits associated with these acquisitions. The importance of the acquisition of Datalogix is significant as Oracle attempts to further scale its enterprise-level marketing services.

This will be an earnings announcement to watch. Expect the market to pay special attention to Oracle’s comments regarding the traction of their cloud offerings experienced over the quarter.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.