The S&P 500 slipped Tuesday, ending a string of four consecutive gains and posting the biggest loss in nearly three weeks.

It’s been a great run since the Christmas lows, with the index surging 10%. But as we know, markets don’t move in straight lines and a down day was inevitable. The question is if this is just one of those steps back before continuing higher, or if Tuesday’s weakness marks the end of the rebound.

Stocks have been surging despite December’s negative headlines sticking around. Nothing has been resolved in Trump’s trade war with China. Global growth continues to slow. The Fed is still planning further rate hikes. And the federal government has been shut down for a month with no end in sight.

Hardly seems like rally material, but that is exactly what happened. While the news has most definitely been bearish, it hasn’t been as bad as the crowd feared when they were scrambling for the exits at the end of last year.

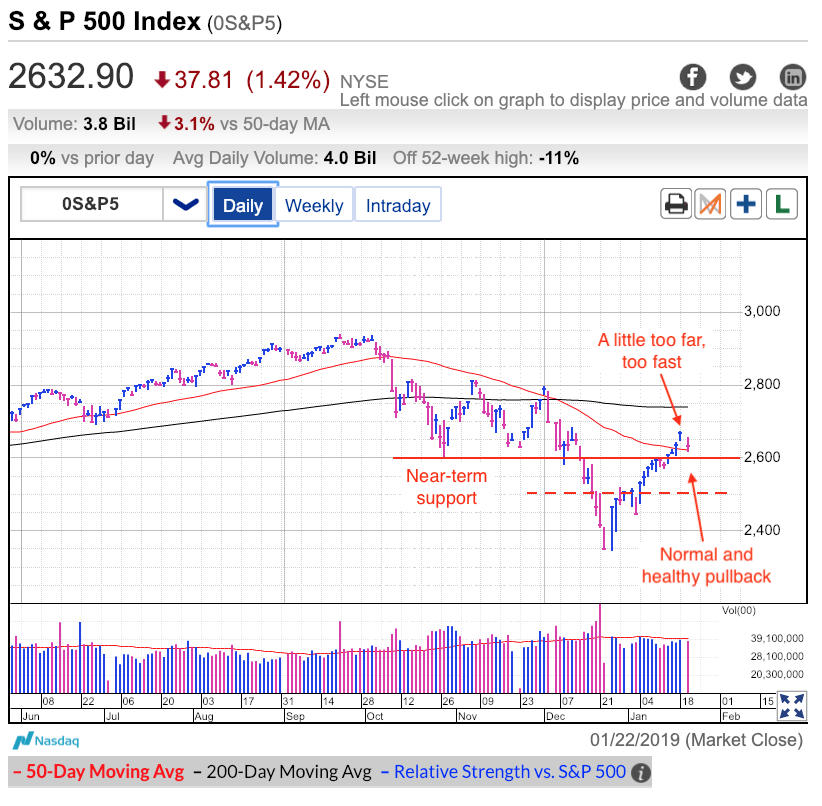

Markets are prone to excess and that means oversized moves in both directions. Last summer we went a little too high. Then we fell too far in the fall. And now there is a good chance January’s rebound went a too far and it is time for a well-deserved rest. Even a pullback would be a normal and healthy way to process these gains.

Where we go from here largely depends on what happens next. Last week we reclaimed the widely followed 2,600 support level that propped the market up through October and November. While any near-term weakness will most likely dip under 2,600, how the market responds to such a violation will tell us what mood traders are in.

In December, fearful owners rushed to sell every hint of weakness. But the thing is, eventually we run out of fearful sellers. That’s because every person desperate to bailout ends up selling to a confident dip buyer who is willing to hold the risks. Out with the weak and in with the strong is how these things get turned around.

While bearish headlines are largely the same, and in some respects have even gotten worse, the market stopped caring. And not only has it stopped caring, it is acting as if everything has been getting better. But that is the way the market works. Buy the rumor, sell the news. While we don’t have a resolution to any of the problems facing us, the market is assuming a solution is coming and anyone waiting for the confirmation will be too late.

But that assumes things turn out less bad than feared. There is an alternative outcome where the situation turns out worse than feared. And that is what it will take to send this market to fresh lows. But until that happens, expect every dip to bounce.

Having surged 300-points since Christmas, it is clearly too late to be chasing the rebound. Instead, we should be shifting to a defensive mindset and preparing for a consolidation. Savvy short-term traders have been taking profits into this strength. The most aggressive and nimble can try their hand at shorting this weakness. For the less bold, a dip under 2,600 support will likely find a bottom near 2,500 and that would be a great dip buying opportunity. If this market is a healthy market, we shouldn’t get anywhere near the lows and retesting 2,400 would be a very bearish sign. Trade accordingly.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.