Following the Federal Open Market Committee meeting yesterday, there has been no substantial change in the official statement or the forward looking guidance. The Federal Reserve is still on target to call for two rate increases throughout the rest of the calendar year. The Committee made clear that they intend on remaining consistent with the policy mandate and that they “seek to foster maximum employment and price stability.” After yesterday only four meetings remain this calendar year. Therefore, if the Federal Reserve is to honor its statement, they will need to make the ultimate decision to increase rates sooner rather than later.

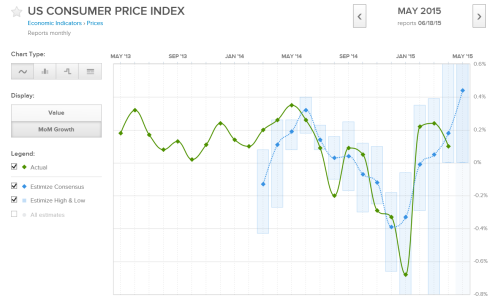

The Committee stated that “inflation is anticipated to remain near its recent low level in the near term.” The most recent reading in April was 0.14%. The Committee does however expect “inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of earlier declines in energy and import prices dissipate.” Therefore in the spotlight this morning will be the inflation data released for May.

The Estimize consensus for Consumer Price Index (CPI) for the month of May is projected at 0.44%. Although this figure is well above the April figure of 0.18%, it is still much lower than the target rate of 2%.

The Estimize community is also expecting an increase in the Core Consumer Price Index (excluding energy and food products) to 0.17% for the May period from the 0.14% recorded in April.

In terms of the mandate’s full employment goal, the Committee made reference to the fact that “the pace of job gains picked up while the unemployment rate remained steady”. Importantly, the statement also mentions that the “underutilization of labor resources diminished somewhat.”

A previous Estimize report drew attention to the fact that underutilization in labor resources were slightly distorting the true read on the unemployment rate. In addition the most recent US Average Weekly Payroll figures actually came in on top of the Estimize consensus figure of $859.25 in May and reached $861.12. Finally, Estimize is predicting a lift in ADP Change in Nonfarm Payrolls to a level of $219.73K which is close to this calendar years high of $220K.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI