This week, eight companies from the S&P 500 tech sector reported earnings for Q4, but the tech parade truly kicks off next week when we get 22 results. Due to continual upward revisions and better than expected results from 9 of the 15 companies that have reported thus far, IT has moved into the third spot for highest Q4 sector growth.

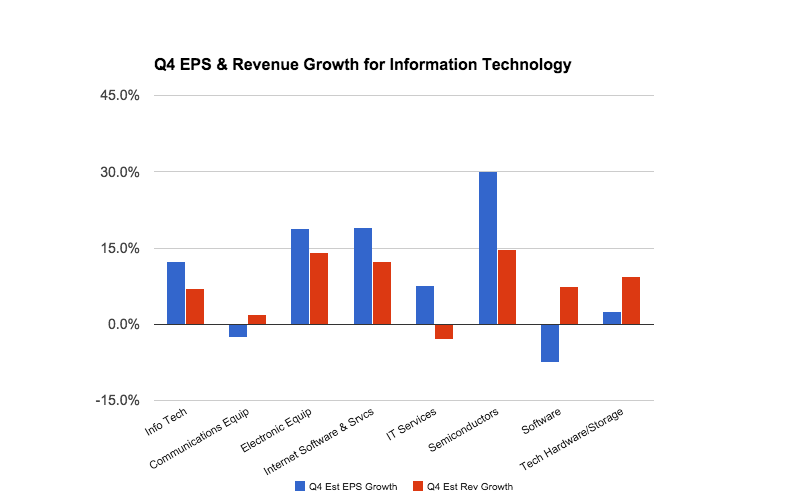

Currently, Estimize contributors expect the sector to grow 12.3% on the bottom-line and 7.0% on the top-line.

Driving growth in the tech space are the semiconductors industry, poised to increase profits by 30.1% and revenues by 14.8% year-over-year, followed by the internet software and services industry.

Semiconductors: Winner

Thus far, six of the 15 companies have reported from the semiconductor space. We saw Intel, KLA-Tencor (NASDAQ:KLAC) and Linear Technology (NASDAQ:LLTC) beat the Estimize EPS consensus, Micron Technology (NASDAQ:MU) and Xilinx (NASDAQ:XLNX) slightly missed and Altera (NASDAQ:ALTR) met. On the top-line, all six companies missed the Estimize consensus, showing a continuing trend this season of weak sales output paired with impressive bottom-line results engineered from a combination of strict cost management and share buybacks. However, despite the misses, every company posted YoY growth in revenues. Next up from from this segment is Texas Instruments (NASDAQ:TXN), reporting on Monday.

Internet Software and Services: Winner

The next biggest winner, internet software and services, contains six companies. The industry is estimated to post EPS growth of 19.0% and revenue growth of 12.3%. Next week we get results for Facebook (NASDAQ:FB), Google (NASDAQ:GOOGL) and Yahoo! (NASDAQ:YHOO), the heavy hitters in the industry. The internet companies are set up for a very interesting quarter as expectations are relatively muted for the big names, relative to the past 4 quarters. For many of the most-watched companies, the Estimize consensus, which represents true market expectations, is in-line with the Wall Street consensus, which is usually quite conservative. Over the last year there have been large deltas between the Estimize and Wall Street consensus, as investors expected more from the internet names. This creates a huge opportunity for large post earnings moves on good numbers, such as Netflix's (NASDAQ:NFLX) results on Tuesday, which caused the stock to pop 18.8% in the after-market.

Software: Loser

The weakest link among IT sectors this quarter is software, with EPS expected to be down 7.6% from the year-ago quarter. Thus far only 4 of the 11 companies from the sector have reported: Adobe Systems (NASDAQ:ADBE), CA Inc, Oracle (NYSE:ORCL) and Red Hat (NYSE:RHT). And while they all beat estimates, only Adobe posted year-over-year growth. The largest company by market capitalization from this industry, Microsoft (NASDAQ:MSFT), will be reporting results on Monday. Analysts are looking for $0.72 a share, which would mark a 7.7% decrease in profits from the year-ago quarter. Revenues are expected to do much better, anticipated to grow 8.5% YoY.

The names that we will be watching next week are Yahoo! (NASDAQ:YHOO), Facebook (NASDAQ:FB), Amazon.com (NASDAQ:AMZN) and Google (NASDAQ:GOOGL).

Yahoo: At Estimize we are expecting EPS of $0.36 vs. the street’s expectation of $0.29. This is the biggest delta we have ever seen between the two estimates and a surprise to the upside is justified considering the company blew expectations out of the water last quarter. In Q3, the consensus was for $0.33, the actual came in much higher at $0.52. Judging by the run up in the stock price, which has increased nearly 20% since last quarter, a big beat is already baked into the markets.

Facebook: The Facebook story is completely different from Yahoo this quarter, with the Estimize EPS consensus of $0.50 in-line with what Wall Street is expecting. Because of the muted expectations, if the company beats it could have a big impact on the stock as no one seems to be expecting it. Note, however, that Facebook has beaten the Wall Street consensus for the past 6 quarters, and the higher Estimize consensus in 5 of the last 6 quarters. Last quarter the social media company surpassed the street’s consensus and not the Estimize consensus, as a result the stock was punished in the after-market… showing that investors have come to rely on the company to put up big numbers.

Amazon: We’re projecting Amazon’s revenue growth rate will drop to 17% in Q4, down from a consistent 20% to 24% over past 2 years. We’re also seeing smaller earnings gains than last year, due to the usual heavy spending and reinvestment story that we’ve come to expect from Amazon. Last quarter the company said they still had $80M of their failed Amazon Fire Phones left in inventory, this might partially explain the expectation for profits to fall 20% YoY.

Google: Even though this company has missed the Wall Street consensus two quarters in a row, Estimize contributors aren’t cutting them a break. The Estimize consensus is calling for a $0.11 earnings beat and 20% YoY growth. Like Amazon, Google’s earnings are very hard to predict as they also spend a lot.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.