Analyst flags 9 bargain stocks in a ‘Black Friday’-style dip

Two central banks are scheduled to make monetary policy announcements on Thursday. While one is expected to be a big driver of volatility for the financial markets, the other will most likely be overlooked as a nonevent.

Since last week, investors around the world have been waiting with bated breath for the European Central Bank monetary policy announcement. Comments from ECB President Draghi last Thursday sparked speculation of greater activism by the ECB. These expectations were further fueled by similar comments from German Chancellor Angela Merkel and French President Francois Hollande. However, since last week we have not heard a peep from European policymakers and perhaps they are becoming wary of the level of expectations they have created in the market.

What to Expect from ECB

Interest rates are expected to remain unchanged in the euro zone, which means the most likely decision by European policymakers will be to allow the EFSF/ESM to purchase bonds on the primary and secondary market and to reactive the Securities Market Program, which would help reduce sovereign yields and funding pressure. The ECB would have to show some sign of willingness to support these measures either at the meeting itself or during Draghi’s press conference.

The Germans oppose the idea of giving the rescue fund a banking license and until they concede, it can't become a reality. We know that the German Finance Minister supports the idea of using the EFSF to buy government bonds and the French paper

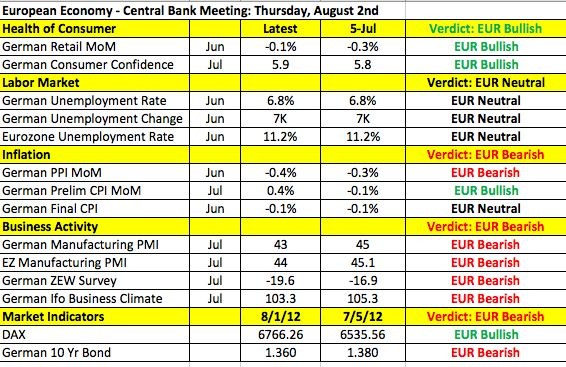

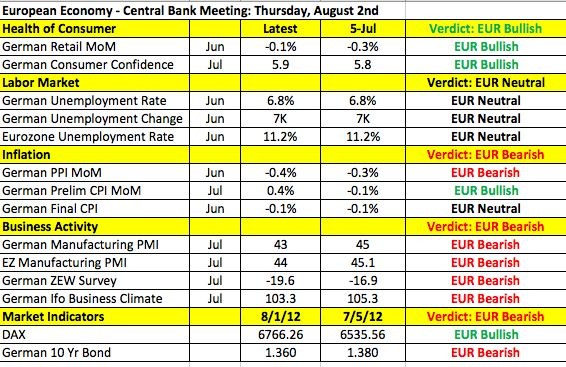

Most of Europe is on hiatus in the month of August and we haven’t received a tremendous amount of European data since the last monetary policy meeting in June. The following table shows how the euro zone and its largest economy (Germany) have performed over the past month. Confidence deteriorated across the region, manufacturing activity continues to contract and retail sales declined for yet another month. The outlook for the euro zone economy is grim and for this reason, the ECB will need to remain in easing mode.

What To Expect From The Bank Of England

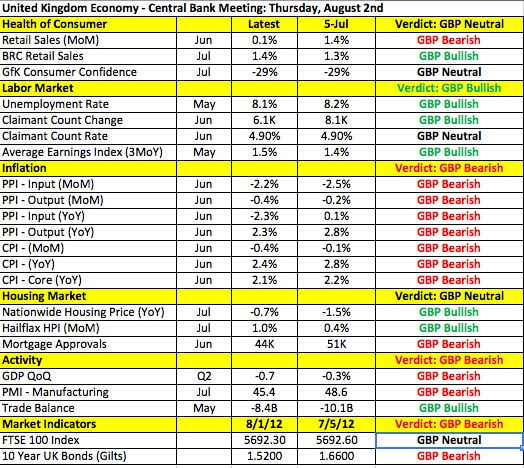

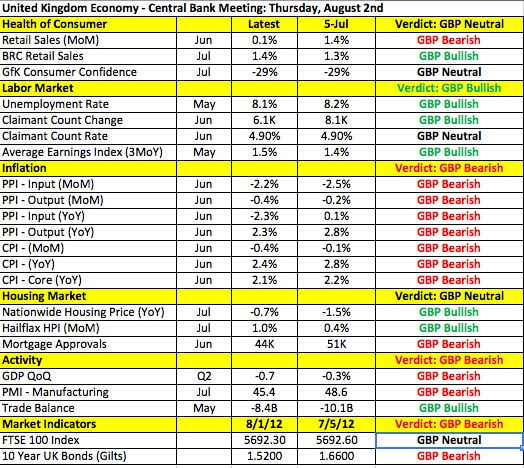

Having just increased asset purchases last month, we are not expecting any action from the Bank of England. As usual, whenever monetary policy is left unchanged, the BoE doesn't release a statement or make further comments. The lack of new information usually makes the BoE meeting a nonevent for the British pound. When that happens, we usually have to wait for the minutes from the meeting, which are released two weeks later. As for the economy, it fell into a deeper recession in the second quarter, consumer demand is weak and manufacturing activity contracted at a faster pace in July. Inflationary pressures remain muted with very little sign of life in the labor market. However, further stimulus from the Bank of England will most likely hinge on developments in the euro zone.

Since last week, investors around the world have been waiting with bated breath for the European Central Bank monetary policy announcement. Comments from ECB President Draghi last Thursday sparked speculation of greater activism by the ECB. These expectations were further fueled by similar comments from German Chancellor Angela Merkel and French President Francois Hollande. However, since last week we have not heard a peep from European policymakers and perhaps they are becoming wary of the level of expectations they have created in the market.

What to Expect from ECB

Interest rates are expected to remain unchanged in the euro zone, which means the most likely decision by European policymakers will be to allow the EFSF/ESM to purchase bonds on the primary and secondary market and to reactive the Securities Market Program, which would help reduce sovereign yields and funding pressure. The ECB would have to show some sign of willingness to support these measures either at the meeting itself or during Draghi’s press conference.

The Germans oppose the idea of giving the rescue fund a banking license and until they concede, it can't become a reality. We know that the German Finance Minister supports the idea of using the EFSF to buy government bonds and the French paper

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Le Monde claims that coordinated action is being planned by the ECB and European bailout fund to lower borrowing costs by buying Spanish and Italian debt. As a result, the most likely decision by European policymakers will be to allow the EFSF/ESM to purchase bonds on the primary and secondary market and to reactive the Securities Market Program, which would help reduce sovereign yields and funding pressure. Taking the deposit rate to negative levels and introducing a third round of long term refinancing operation (LTRO) are also options, but Europe probably needs another near-death experience for either of these to become reality.Most of Europe is on hiatus in the month of August and we haven’t received a tremendous amount of European data since the last monetary policy meeting in June. The following table shows how the euro zone and its largest economy (Germany) have performed over the past month. Confidence deteriorated across the region, manufacturing activity continues to contract and retail sales declined for yet another month. The outlook for the euro zone economy is grim and for this reason, the ECB will need to remain in easing mode.

What To Expect From The Bank Of England

Having just increased asset purchases last month, we are not expecting any action from the Bank of England. As usual, whenever monetary policy is left unchanged, the BoE doesn't release a statement or make further comments. The lack of new information usually makes the BoE meeting a nonevent for the British pound. When that happens, we usually have to wait for the minutes from the meeting, which are released two weeks later. As for the economy, it fell into a deeper recession in the second quarter, consumer demand is weak and manufacturing activity contracted at a faster pace in July. Inflationary pressures remain muted with very little sign of life in the labor market. However, further stimulus from the Bank of England will most likely hinge on developments in the euro zone.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes dozens of winning stock portfolios chosen by our advanced AI.

Year to date, 2 out of 3 global portfolios are beating their benchmark indexes, with 88% in the green. Our flagship Tech Titans strategy doubled the S&P 500 within 18 months, including notable winners like Super Micro Computer (+185%) and AppLovin (+157%).

Which stock will be the next to soar?