Well, it has been an interesting start to the New Year. As I penned yesterday:

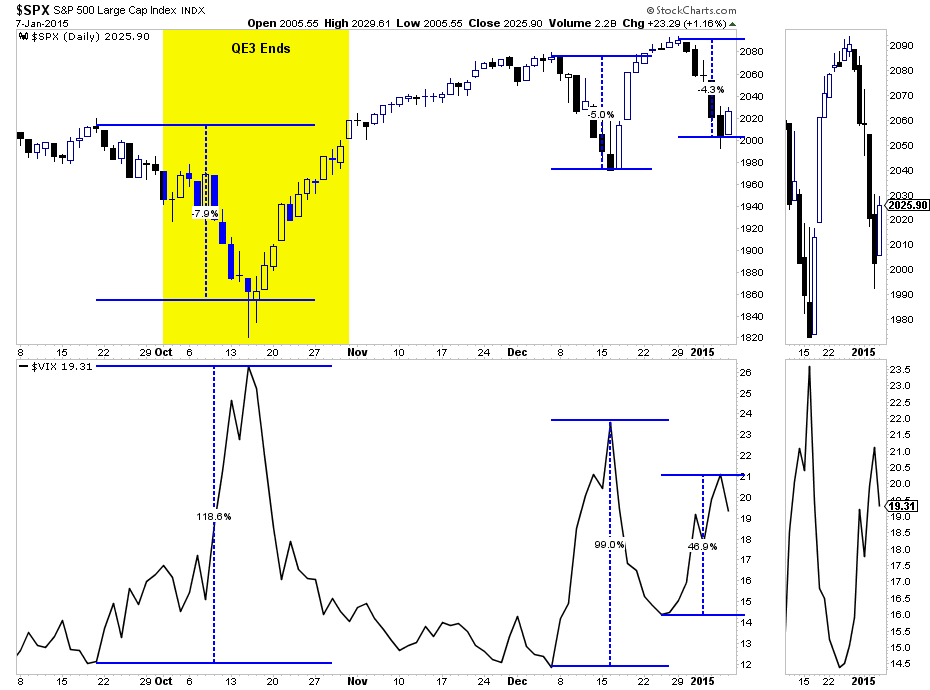

"Since the end of the Federal Reserve's latest QE program, market volatility has picked up markedly. Since October, as QE came to its final bond buying conclusion, the drain of liquidity begin to financial market activity. As shown in the chart below, there have been three fairly sizable selloffs last quarter of 7.9%, 5.0%, and 4.3%."

"Not surprisingly, those selloffs gave birth to sharp spikes in volatility of 118%, 99% and 46.9% currently.

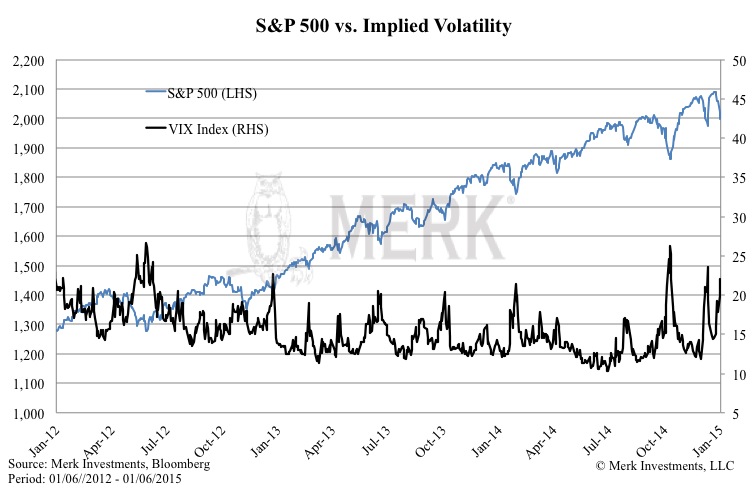

Since the beginning of QE-3, at the end of 2012, the financial markets have been on a seemingly unstoppable rise. While virtually 100% of all economists, analysts, and financial bloggers are currently expecting a continuous rise in asset prices for several more years, the one constant has been a steady decline in volatility. The lack of "fear" in the financial markets has been the "sirens song" for investors to step up to the casino table and place their bets in a seemingly "can't lose" bet. Each dip has now taught investors that such moments are fleeting, and those declines are best ignored. That is a dangerous lesson, to say the least, as things may now be changing."

What I find most interesting is that there is very little concern that something could negatively impact the markets. In fact, if anything would actually happen, it will just be a mild 10%-15% correction. The problem is that historically, such outcomes have only been found in "rarified air." Could this time be different? Sure, anything is possible. However, as an investor my primary concern should be the protection of my limited investment capital against unmitigated destruction.

However, this week's reading list is a smattering of reads about 2015. As a contrarian investor by nature, it was interesting to note how hard it was to find views that were NOT bullishly biased. It seems we may have now entered a market realm where Unicorns and Bears are only things of legend.

1) Another Year To Soar by Ken Fisher via Forbes

"In 2015 expect an S&P 500 and global bull market extension of 15%-plus. Why?

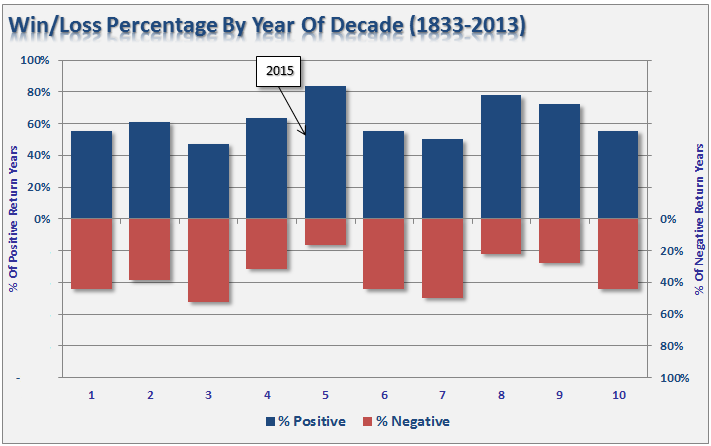

I detailed why fourth quarters in midterm election years were historically positive 86.4% of the time–because markets don’t discount the goodies in increased gridlock–and why that continues for the next two quarters, both also 86.4% positive, history’s most positive continuous three quarters extant. Believe it.

Just so, third years of Presidents’ terms haven’t gone negative since 1939 and that was only -0.9% as Europe literally blew apart. Average third-year return? 18.5%. Excluding four single-digit years, the positives averaged 27.2%. Gridlock is great!"

Read Also: What Does Cycle Analysis Suggest For 2015 by Lance Roberts

2) Is Your Portfolio Ready For A Rough 2015 by Axel Merk via Merk Investments

"Is the recent bout in volatility yet another ‘buy-the-dip’ opportunity or a sign of worse to come? Investors struggle to both keeping up with the markets while protecting themselves against a severe correction. By taking a step back, investors might be able to see the forest for the trees to gauge whether their portfolio is ready for what lies ahead."

• The good: Risky assets have done very well in recent years.

• The bad: Portfolios may be overweight in risky assets, making them vulnerable in a market correction. In fact, as defensive assets underperformed, odds are that tax-loss selling further skewed the portfolio towards risky assets.

• The ugly: Risk-free assets, if there is such a thing, to rebalance to, don’t look so pretty either.

Read Also: In Assessing 2015 Goals, Beware Of Risk Creep by Carl Richards via NYT

3) Why Stocks May Correct In 2015 by Tom Huddleston, Jr. via Fortune

"Here are some reasons why 2015 might be a disappointing year for the stock market:

- Stocks are far from cheap

- Fed will raise interest rates

- Big trouble in little Russia

- Europe is struggling

- China is a growth bummer

- Too much oil

Read Also: What To Make Of Oil, Volatility And The Markets by David Kotok via Cumberland Advisors

4) Outlook For 2015 by Mebane Faber

"However, most of the positive momentum in the world is still in US based assets – stocks, real estate, and bonds. Most of the value is found in foreign equity markets (and arguably commodities, but with less traditional valuation methods). My favorite intersection is when value and momentum intersect. If and when the trend changes I think you could see truly explosive returns for foreign equity markets. But as we all know, and oil is a timely reminder of this now, trends can last a loooonnng time. And if US assets are the final shoe to drop….well then all equities around the world will get cheaper. "

Read Also: The Good Times Are Over by Bill Gross via Janus Capital Group

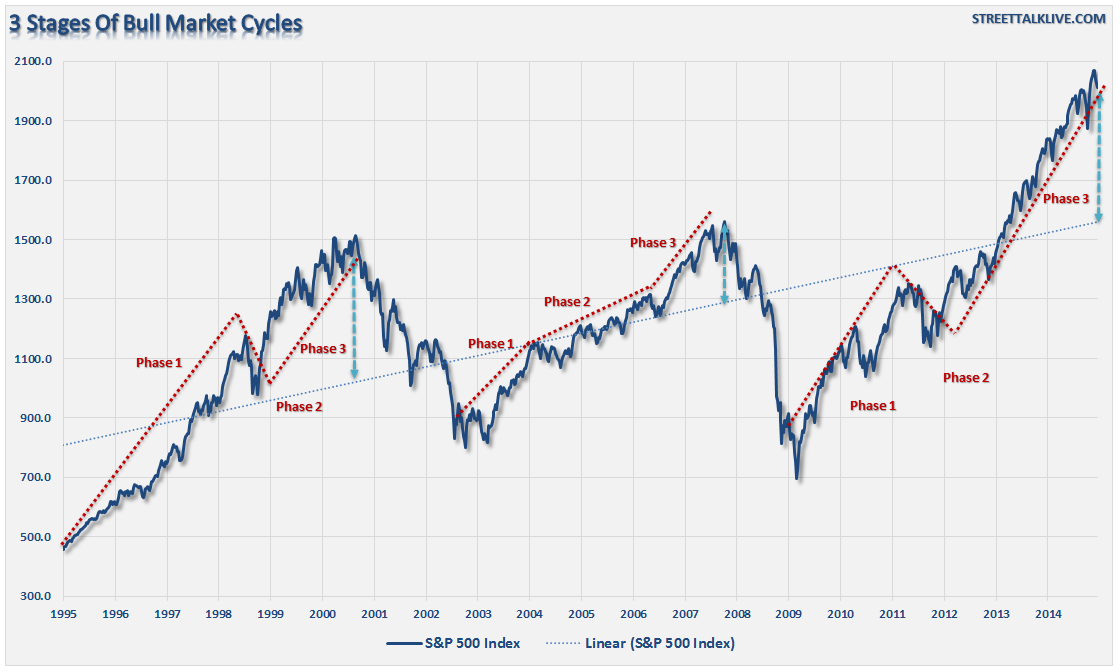

5) Buy Stocks As We Enter The Final Boom Phase by Richard Russell via Financial Sense

"For a month, I’ve told subscribers that I believe we’re now entering the third phase of the bull market. Strangely, most market analysts – almost all of whom are considerably younger than I am – are not acquainted with the sentiment phases of a bull market.

Normally, following the second phase, we have a deep correction followed by a continuation of the bull market into a third and final speculative phase.

From here on, the character of the third phase trumps everything else. All minor ripples in the market, all dips or pops, all of these are contained within the third psychological phase.."

Read Also: 2015: Reap What The Fed Has Sown by Charles Hugh Smith via Zero Hedge

Read Also: I Am Bullish - 12 Lessons For 2015 by John Cassidy via The New Yorker

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI