Seagate Technology PLC (STX) is set to report FQ2 2014 earnings after the market closes on Monday, January 27. Seagate is a global leader in hard drive disks and data storage. They produce a variety of products including hard drives for laptops, external hard drives, as well as solid-state and hybrid drives. The industry is well contested and last week red hot competitor SanDisk Corp. (SNDK) beat Wall Street profit expectations for the 7th quarter in a row. SanDisk produces flash memory solutions which are faster, more durable, and are a smaller alternative to hard drives, critically however flash memory is more expensive. SanDisk has done well lately because as a producer of flash memory they have been positioned to take advantage of the smartphone boom.

Seagate may continue to profit from hard drive sales over the next few years, especially if there is demand for hard drives in emerging markets looking for a cheaper data storage solution. On another front Seagate has recently expanded its capacities in the solid state drives industry by acquiring Xyratex. Unlike traditional hard drives, solid state drives are completely electronic and don’t use any actual disk or motors. While this acquisition only adds roughly 3% to the company’s total revenue, they are expecting energy efficient solid state drives to play a big role in the PC industry going forward. Here’s how the buy side expects Seagate to perform this quarter.

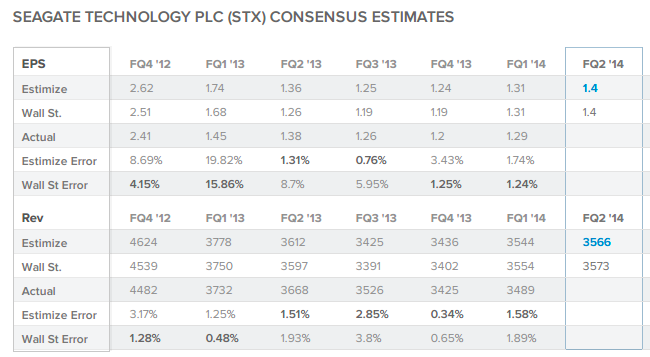

The information below is derived from data submitted to the Estimize.com platform by a set of Buy Side and Independent analyst contributors

The current Wall Street consensus expectation is for Seagate to report $1.40 EPS and $3.573B revenue while the current Estimize.com consensus from 7 Buy Side and Independent contributing analysts is $1.40 EPS and $3.566B revenue. This quarter the buy-side as represented by the Estimize.com community is expecting Seagate to report inline with the Wall Street consensus on profit, but come up short on revenue.

The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. In this case we are seeing a small differential between the 2 groups’ forecasts.

Over the previous 6 quarters the Estimize.com consensus has been more accurate than Wall Street in predicting STX’s EPS and revenue 2 and 4 times repsectively. By tapping into a wider range of contributors including hedge-fund analysts, asset managers, independent research shops, students, and non professional investors Estimize has created a data set that is up to 69.5% more accurate than Wall Street, but more importantly it does a better job of representing the market’s actual expectations. It has been confirmed by an independent academic study from Rice University that stock prices tend to react with a more strongly associated degree to the expectation benchmark from Estimize than from the Wall Street consensus.

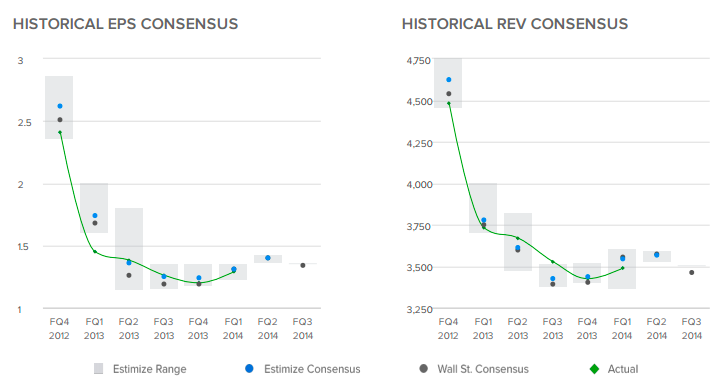

The distribution of estimates published by analysts on Estimize range from $1.36 to $1.42 EPS and $3.520B to $3.590B in revenues. This quarter we’re seeing a very small distribution of estimates compared to previous quarters.

The size of the distribution of estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. A more narrow distribution of estimates signaling the potential for less volatility post earnings, as there is more agreement about how the company is expected to report.

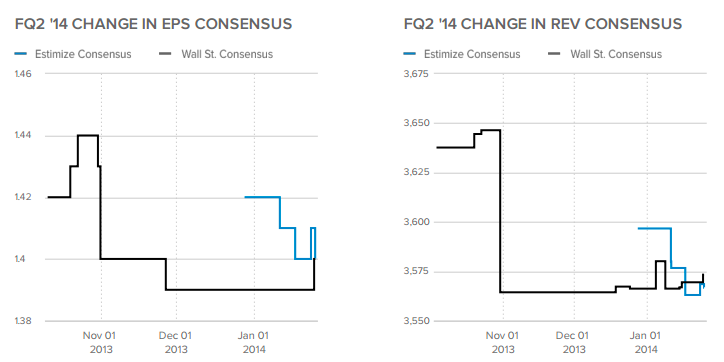

This quarter the Wall Street profit consensus has fallen from $1.42 to $1.40 EPS while their revenue forecast has fallen from $13.638B to $3.573B. The Estimize EPS consensus also opened the period at $1.42 and fell to $1.40 while the Estimize revenue consensus has dropped from a high of $3.597B to $3.566B. Timeliness is correlated with accuracy, and a decrease in the community consensus going into the report is often a bearish indicator.

The analyst with the highest estimate confidence rating this quarter is blandau123 who projects $1.42 EPS and $3.580B in revenue. In the Winter 2014 season, blandau is currently ranked as the 45th best analyst and is ranked 181st overall among over 3,500 contributing analysts. Estimate confidence ratings are calculated through algorithms developed by deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy. This quarter the estimate with the highest confidence score disagrees with the consensus from the Estimize community and predicts that Seagate Technology will beat the Wall Street consensus on both EPS and revenue.

Get access to estimates for Seagate published by your Buy Side and Independent analyst peers and follow the rest of earnings season by heading over to Estimize.com. Register for free to create your own estimates and see how you stack up to Wall Street.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI