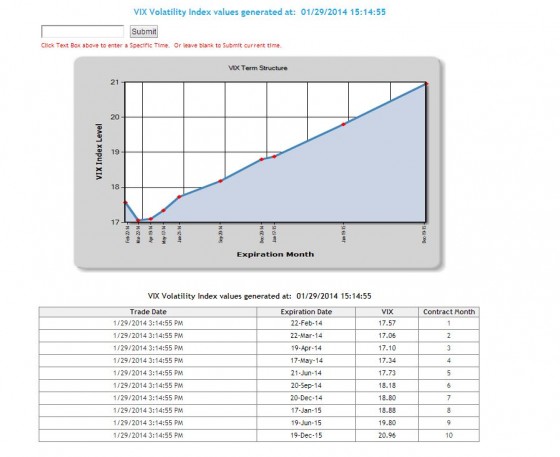

The VIX style calculation for the March 22nd SPX options closed today at 17.06. The data is from the CBOE’s VIX Term Structure website.

The CBOE will use the March SPX options to compute the settlement value for the February VIX Futures when they expire on February 19th.

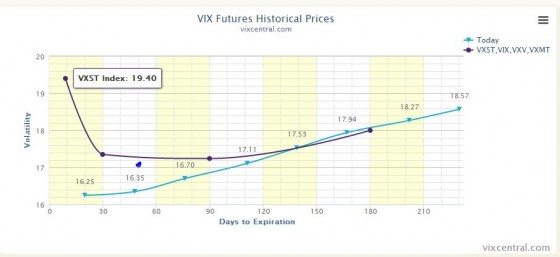

February VIX futures, on the other hand closed at 16.25, a 5% discount to the March SPX options. The blue dot on the chart marks the VIX style calculation for the March SPX options.

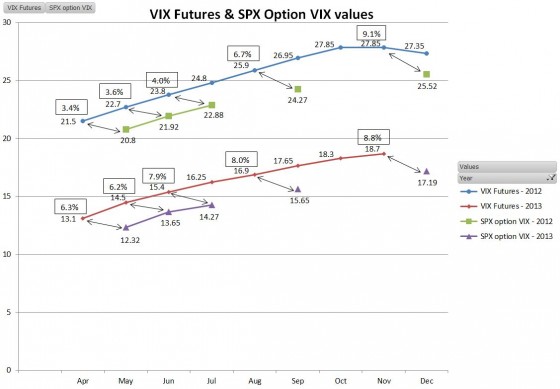

Normally VIX Futures trade at a 3% to 9% premium to the VIX style IVs of the SPX options that will be used to settle them.

This implies to me that profitable arbitrage of VIX futures using SPX options requires a difference between the two of around +-5% or more. Anybody have any insights on this?

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.