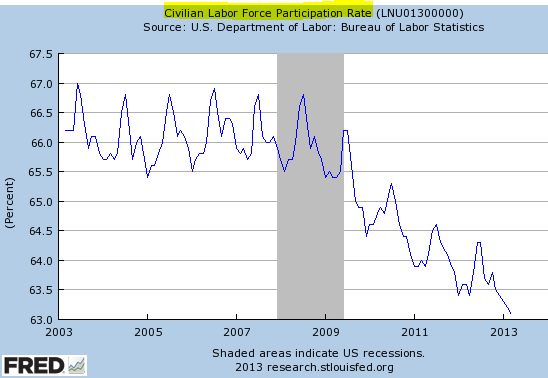

In spite of some improvements in the U.S. job markets, labor force participation continues to decline.

The traditional explanation is that people are discouraged by the lack of job opportunities, and are simply "dropping out" of the labor force after having exhausted their unemployment benefits. That's easier said than done. Most people need some sort of income to survive - so where does that income come from? A portion of the decline can be explained by households with two incomes going to one. But that's by no means all of it. Let's explore some recent trends.

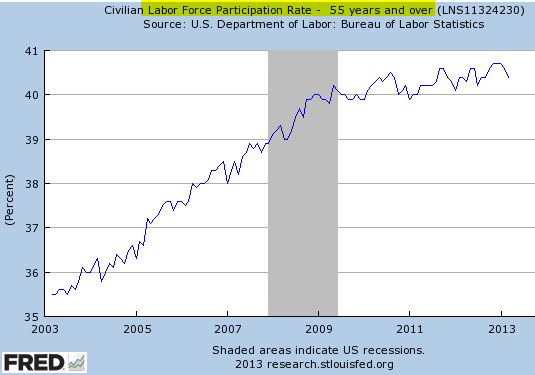

1. One common explanation is older workers retiring earlier and dropping out of the workforce. There is some anecdotal evidence for early retirement, but the data doesn't support it. While participation rate by workers 55 years and older is not growing at the rate it did during the boom years, it's not declining either - which means it can't explain the declines in the chart above. Many people simply can't afford to retire.

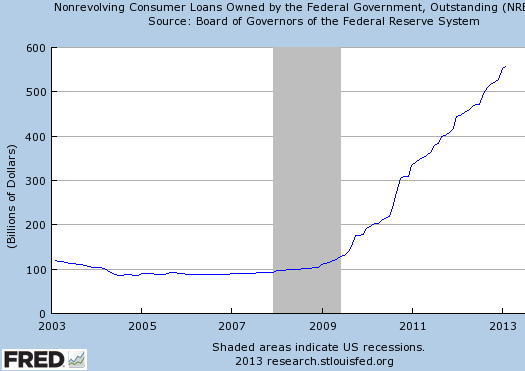

2. Another explanation is that young people who can't find work are going to school. This trend is definitely contributing to the reduction in the overall participation rate. The source of "income" for this group is of course the federal government in the form of student loans. Government-owned student loan balances continue to rise, as people "wait it out" at school while accumulating massive debt.

3. Another source of falling "official" employment participation is the unregistered workforce, as more people get paid "under the table". The underground economy is estimated to be at $2 trillion per year.

CNBC: The shadow economy is a system composed of those who can't find a full-time or regular job. Workers turn to anything that pays them under the table, with no income reported and no taxes paid, especially with an uneven job picture.

"I think the underground economy is quite big in the U.S.," said Alexandre Padilla, associate professor of economics at Metropolitan State University of Denver. "Whether it's using undocumented workers or those here legally, it's pretty large."

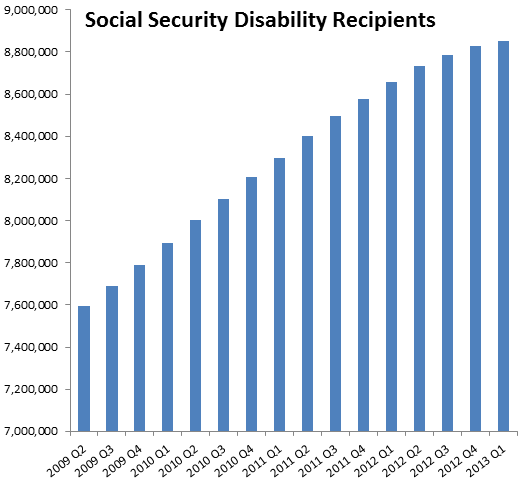

4. Finally, nearly nine million people are now receiving social security disability checks. When unemployment checks run out, some people (nearly a quarter) shift to this other source of income. This is certainly an important program, but it's amazing how many people get "injured" while they are on unemployment. The improving labor markets did reduce the growth rate of this group, but the number of people on disability continues to increase much faster than the population growth.

Whether it's the spouse, the underground economy or the federal government providing the income, there is "life" after the unemployment checks stop coming. Meanwhile, the "official" labor participation rate keeps falling.

Editor's Note: Learn how to profit from the Non-Farm Payrolls Report, one of June's biggest market-moving announcements. Watch expert Steve Ruffley trade the NFP in real time on June 7, 2013 via our Special Live Event. Ruffley has an astounding record of 25 consecutive, profitable sessions during this event, so don't miss this chance to learn how to trade during volatile periods. To find out more, click here.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI