Some folks in the media are making a big deal out of the US trade deficit decline in December.

The SF Chronicle: - Number of the day: 20.7 percent

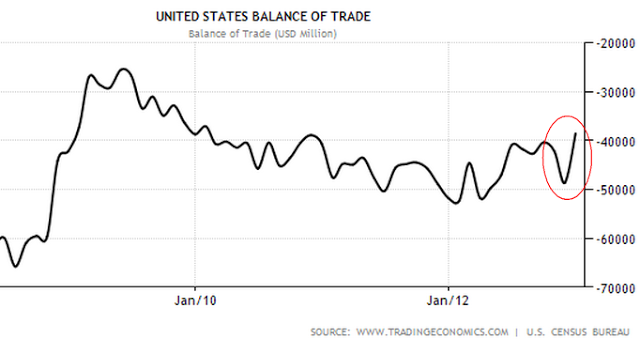

That's how much the U.S. trade deficit shrank in December from the previous month, the U.S. Commerce Department said Friday. The gap between imports and exports was the smallest since January 2010 and much less than the $46 billion expected by 73 economists in a Bloomberg poll. The deficit was cut by record exports of refined petroleum products to countries such as Brazil, combined with lower imports of crude oil. Yes, that's an impressive showing indeed. But let's take a look at the chart, because such numbers should not be viewed in isolation. The decline in deficit follows a sharp increase a month earlier.

The deficit increase in November was driven by hurricane Sandy, and was exacerbated by the Northeast US refineries' shutdowns. Fuel output in November dropped materially. The lower imports in December are therefore distorted by the reversal of the "Sandy effect". Trade deficit excluding fuel in fact declined less sharply than the overall number in December.

This is clearly a welcome result, but the real trend will not be fully visible until the January numbers are out.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.