UnitedHealth shares surge as Buffett’s Berkshire shows new stake

We've spent a great deal of time discussing Greece, worrying about the default and the implications for the global economy. Clearly Greece is very important with respect to the Eurozone contagion. Everyone talks about the impending collapse of Greece's GDP and it's potential exit from the euro - all constituting major risks.

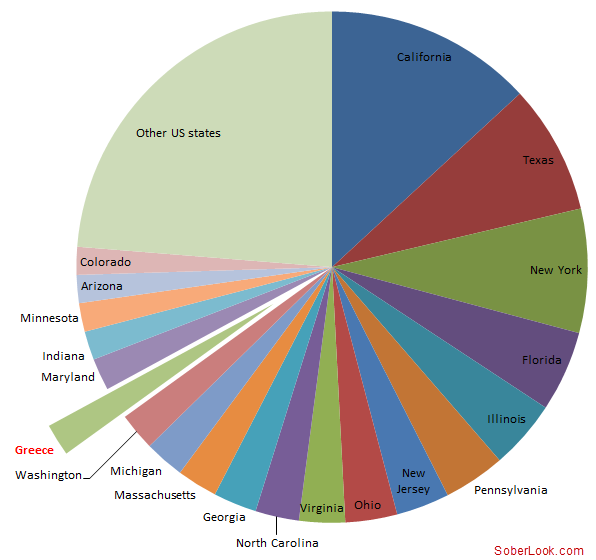

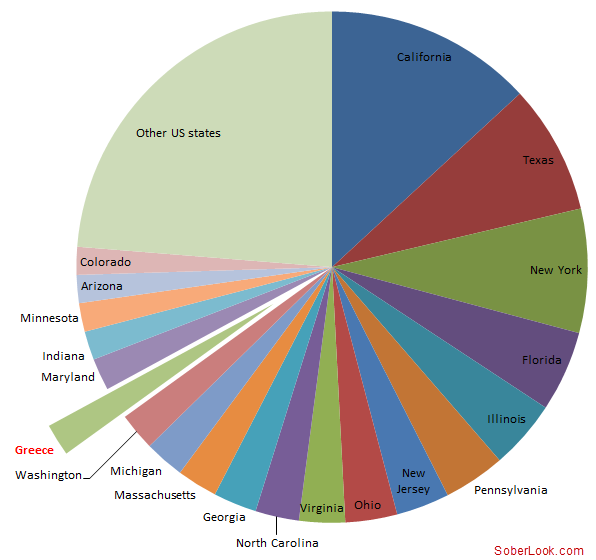

But once in a while it is good to step back and look at the relative scale of Greece's risks to global growth. Imagine for a minute that Greece were the 51st state of the US. Where would it fall relative to other states in terms of its GDP? Using 2010 data, here is the result.

Given the projections for 2012, Greece will fall somewhere close to Minnesota. That should put the impact of Greece's troubles on the rest of world into perspective.

But once in a while it is good to step back and look at the relative scale of Greece's risks to global growth. Imagine for a minute that Greece were the 51st state of the US. Where would it fall relative to other states in terms of its GDP? Using 2010 data, here is the result.

Given the projections for 2012, Greece will fall somewhere close to Minnesota. That should put the impact of Greece's troubles on the rest of world into perspective.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI