What's really changed since Standard & Poor's downgraded the U.S. credit rating on August 5, 2011?

One year has passed and the SPX has gone from a low of 1074.77 on October 4, 2011 to a high of 1426.68 yesterday (Tuesday), as shown on the Daily chart below. A double top has formed at major resistance.

Looming Cliff

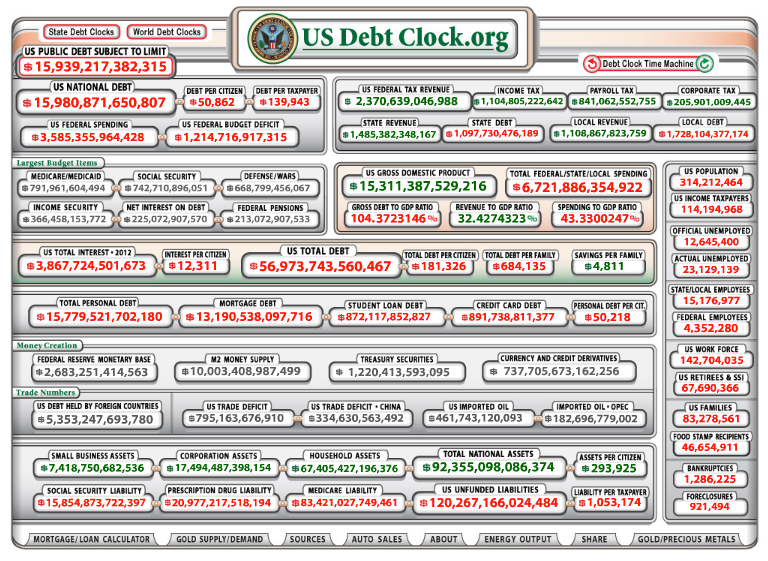

The credit rating has not been upgraded. The Fed also downgraded the economic outlook at its meeting last August as mentioned last year's August 9 post. The Fed remains committed to holding long-term interest rates low for the foreseeable future. Europe's economic condition has weakened. The global economies have slowed. And, finally, the U.S. National Debt continues to rise (unabated) to all-time highs each second. The Fiscal Cliff looms.

Taking Profit

Who is convinced that economic and fiscal conditions have improved since then? The only ones, so far, have been the buyers above the yellow arrows. No doubt they'll begin to take profits at current levels and re-think their positions after the next FOMC meeting in September. A drop-and-hold below June's lows of this year would confirm that its sentiment has changed.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI