According to the Wall Street Journal, auto sales in April were down.

This morning, Bloomberg Econoday said last month’s sales were “easily beatable”. By mid-afternoon, Bloomberg said sales were down but one needed to wait for the final numbers.

When the final numbers were posted, auto sales were purportedly up, and down.

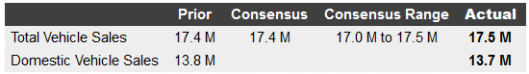

Motor Vehicle Sales Bloomberg Econoday

Let’s kick things off with a look at Bloomberg Econoday's reporting of motor vehicle sales.

Highlights

The consumer kept up pace in May, purchasing vehicles at roughly the same rate as in April. Total unit sales came in at a 17.5 million annualized rate vs 17.4 million in April with North American-made at 13.7 million vs 13.8 million. These are not sizzling numbers but the month-to-month comparison is what counts most. Today’s results point to no significant change for the motor vehicle component of the monthly retail sales report.

Recent History

Unit vehicle sales jumped 4.8 percent in April, giving a major boost to the month’s retail sales report. Unit vehicle sales for May, however, are expected to hold at April’s 17.4 million annualized rate which would point to no change for the motor vehicle component of the retail sales report. Yet April’s 17.4 million rate is easily beatable, surpassed in eight of the last 11 months.

“Easily Beatable”

It turns out things were not so “easily beatable”. Overall sales barely eked out a gain while domestic sales eked out a small loss.

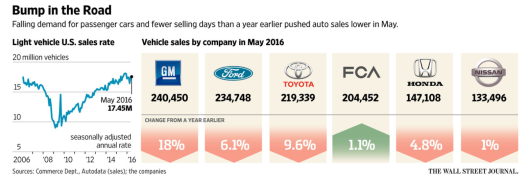

U.S. Auto Sales Slumped in May

The Wall Street Journal reports U.S. Auto Sales Slumped in May. Curiously the link name is “fiat-chryslers-u-s-auto-sales-rose-in-may“.

This report was at 12:22 PM ET before the final numbers were in, but let’s take a look.

The rate of car and light-truck sales in the U.S. likely declined in May as sluggish retail demand cooled a market that initially was expected to deliver a strong start to the summer selling season.

Analysts expected straight month-over-month volume declines, with May’s 24 selling days less than the 26 days in the same period last year. But expectations were for the seasonal adjusted annual selling rate to hit a healthy 17.3 million vehicles.

Instead, General Motors, which posted an 18% decline for the month, estimated the pace at 17 million, below the same period a year earlier. Other major car makers also reported weaker sales compared with a year ago.

Toyota reported a nearly 10% decline compared with a year earlier. Ford, Honda and Nissan also posted year-over-year drops. Strong increases in Jeep sport-utility vehicle sales helped Fiat Chrysler Automobiles NV eke out a 1% U.S. gain over a year earlier.

Researcher WardsAuto.com forecast a 6.5% industrywide decline based on a straight year-over-year comparison. But the firm had expected sales volume to increase 1.3%, adjusting for the disparity in selling days. An overall tally is expected later in the day as more auto makers report sales.

GM’s sales skidded to 240,450 vehicles. The No. 1 U.S. car seller has been sliding for months on a pullback in deliveries to fleet buyers. The Detroit company said deliveries to individual buyers at dealerships slipped 13%, mostly owing to the fewer selling days and “very tight supplies of new launched products.”

GM also said it can’t make enough pickups, SUVs and redesigned sedans.

Ford reported a 6.1% decline overall to 234,748 light vehicles for the month, hurt by a 25% slide in passenger-car sales. Sales of F-series pickup trucks rose 9%, and Ford vans hit their best tally since 1978, driven by Transit sales.

Fiat Chrysler Automobiles’s U.S. sales edged higher in May as demand for Jeeps helped buoy results. The Italian-U. S. auto maker sold 204,452 vehicles in the month—its highest May sales in 11 years. The Jeep brand logged a 14% jump to its best monthly sales ever.

Meanwhile, sales in the Chrysler, Dodge and Fiat brands fell from a year ago and Ram remained flat.

Toyota posted a 9.6% sales decline, Honda sales fell nearly 5% and Nissan sales slipped 1%.

Wall Street Journal Update

At 7:59 PM the Wall Street Journal title was the same, but we have these updates.

Auto dealerships grew a bit quieter in May as U.S. consumer demand for new cars continues to ease, forcing manufacturers to rely more heavily on sales to rental car and other bulk buyers to keep production lines humming.

In total, Americans purchased 1.54 million cars and light trucks last month in the U.S., according to data provider Autodata Corp., 6% fewer than a year earlier. The drop largely is due to two fewer selling days last month; sales were up modestly when adjusted for seasonal factors.

But other key measures fell last month compared with a year ago, including annualized sales pace and consumer purchases at dealers. That shift is fueling worries that demand in the world’s most profitable vehicle market has peaked.

The nation’s largest auto maker, General Motors, which recently has focused more on retail buyers, posted a sharper decline than rivals. Toyota also reported a sales drop, eroding U.S. market shares for two of the biggest auto makers in the world in 2016.

Overall, sales to individual consumers fell 10.6% in May, according to GM. Such sales are considered the best indicator of market demand.

“They’re all just cranking up volume and someone is going to have to blink,” said Mike Sullivan, a Los Angeles-area dealer for Volkswagen, Toyota, and other brands. “They’re building too many vehicles and need to pull back,” he said of car makers.

A U.S. stall would be worrisome because other international markets are shrinking or still trying to recover from the 2008-2009 financial crisis. Russia and Brazil remain down significantly. China has been offering sales-tax discounts to fuel sales gains, and Europe only returned to precrisis volumes in April.

Thomas King, a vice president at market researcher J.D. Power, said U.S. retail sales are flagging because, after six years of industry sales gains, momentum can no longer be sustained by available buyers.

Another red flag: Sales incentives crept up 11% last month compared with the prior May, exceeding $3,000 per vehicle on average, Autodata reports. Incentives include increased use of subsidized leases that help keep car payments low even as sticker prices rise.

It gets pretty confusing when mixing month-over-month with year-over-year sales on top of seasonal adjustments that factor in the number of days in the month.

Adding to the confusion, sales are annualized at a seasonally-adjusted rate effectively multiplying errors in monthly numbers.

Finally, “sales” are recorded when product is shipped to dealers, not when consumers buy cars.

Sales are up, down, or flat depending on your timeframe, whether you count foreign sales, whether or not you believe the seasonal adjustments are accurate, and whether or not shipments to dealers constitute sales.

Year-Over-Year Numbers

Bear in mind that domestic sales add to GDP while foreign sales subtract. Thus, whatever you believe sales were, this was not a strong report.

Factor in rising dealer incentives and piling up inventories and today’s report looks downright grim.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI