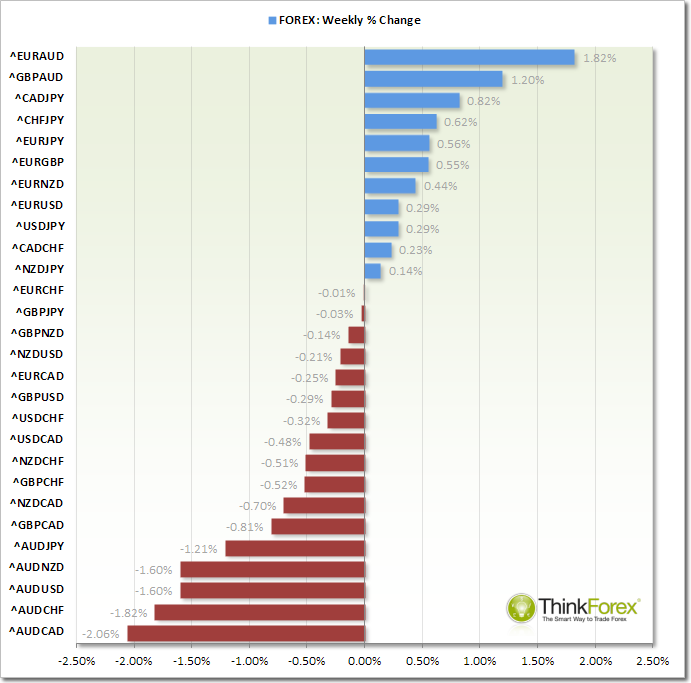

By reviewing and comparing market % performance we can gain a quick and convenient insight into where money is flowing to (and from) to help us refine our trading watchlist for the days or weeks ahead...

AUD: Weekly and daily timeframes are techncally bearish with increased momentum. No change in out look as the AUD continues to look weak.

CAD: Closed the week in the green

CHF: The daily is still technically within an uptrend although the weekly has produced a shooting star reversal which reaises the possibility of weakness on the near-term.

EUR: Shooting Star Reversal on Weekly which also failed to trade upto the 1.3825 swing high. Potential for near-term weakness is a possibility.

JPY: Bearish momentum has been lost and futures charts had a sideways ranging week at a support level. This raises the potential for a bullish retracement before a resumption of losses.

GBP: The past 2 weekly candles have produced 2 bearish closes with high test spikes. Frida's close also produced a Bearish outside day to suggest potential weakness on the near-term.

NZD: A mixed picture with the Kiwi and the futures charts are still trading within a complex correction.

USD: Our target of 80.50 was hit on Friday before reversing and closing the session with a shooting star reversal.

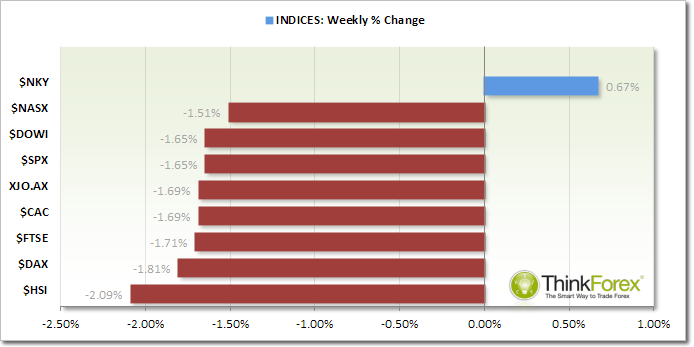

INDICIES:

US Equities closed down for the 2nd consecutive week from their record highs and closed the week at their lows. Near-term bias remains bearish although weekly and daily timeframes are still technically within an uptrend.

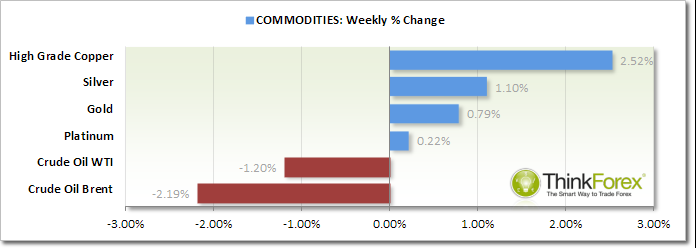

COMMODITIES:

WTI has retraced some of the previous week’s gain which may provide buying opportunities. The break above the 95.60 swing high threatened the bearish trend and this level may provide support as the week progresses.

Gold produced an Inverted Hammer on the weekly chart to suggest sideways trading or a bullish correction. Bearish momentum is declining, however we are still trading within a bearish channel a break below 1205 opens up 1200 and 1180.

DISCLAIMER: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market.

If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade. A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au .The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI