This article reviews the data from the latest weekly sentiment survey we conduct over on Twitter. The survey measures respondents' equity and bond positioning/view – differentiating between whether the view is bullish or bearish for technical or fundamental reasoning. The latest results show a bit of humming and hawing among respondents on the equity front, but a distinct turn to the bearish side for bonds – particularly on the fundamentals outlook.

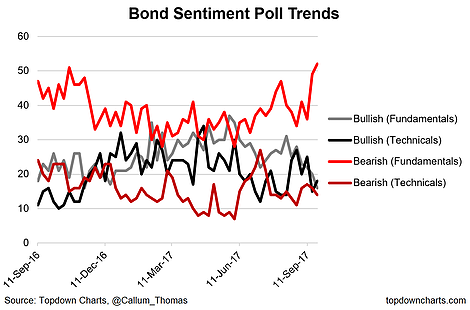

The key event last week was the announcement of Quantitative Tightening by the US Federal Reserve – i.e. the activation of its plan to normalize the balance sheet, starting in October, but systematically and progressively ceasing principal reinvestment for maturing bonds. My view has been that this would be at the margin bearish for bonds, and I would say that this decision is certainly weighing on investors' minds judging by the survey results.

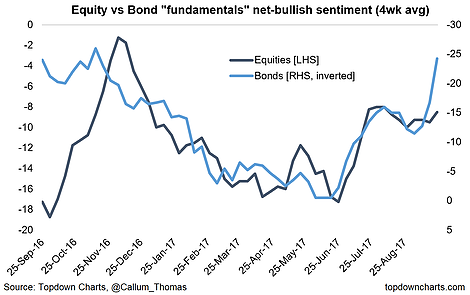

It also potentially helps explain the gap between bond and equity fundamentals sentiment. There has been a pattern of them trading more or less in sync – which makes sense given that better economic conditions are supportive for corporate earnings but typically bearish for bonds. I think this is the key explanation and main driver, but there could be an element of the bond guys thinking conditions are better than the equity guys think. Either way, it's worth pointing out that the last time bond fundamentals sentiment was this bearish it was when the bond selloff or "Trump tantrum" yield spike was unfolding last year – so it could be an omen for the bond market!

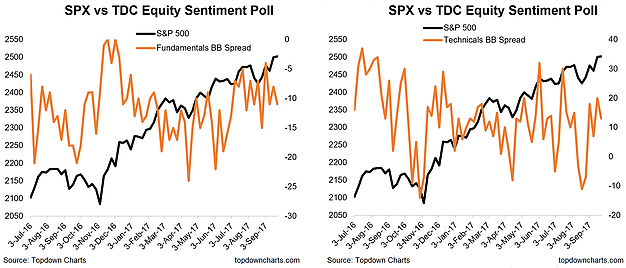

The net-bulls spread (bulls minus bears) for fundamentals and technicals both ticked down slightly in the latest survey – and both are tracking around average levels, as investors look for clues.

But the key highlight in the latest results was on the bond side, with bearish (fundamentals) recording its highest ever reading... and bullish (fundamentals) its second-equal lowest reading. The Fed's announcement of passive Quantitative Tightening was likely a key driver.

Looking at the fundamentals' net-bullish sentiment for bonds and equities there is an interesting divergence underway, with bond fundamentals sentiment plunging to October 2016 levels, and equity fundamentals sentiment only making a mild tick-up. The Fed decision may be the key driver, but divergences between indicators like these can carry important signals and clues for the next step.