Here's a quick note looking at some charts created using data from the latest weekly equity sentiment poll I've been running. As a reminder, the Weekly Equity Sentiment Poll uses Twitter polling and distinguishes between whether respondents are bullish or bearish primarily on the back of fundamental vs technical analysis reasons.

But first, a matter of milestones - this is the 30th week that the equity sentiment poll has been held now! So we're starting to get a decent time series behind it which will help with drawing out insights and trends.

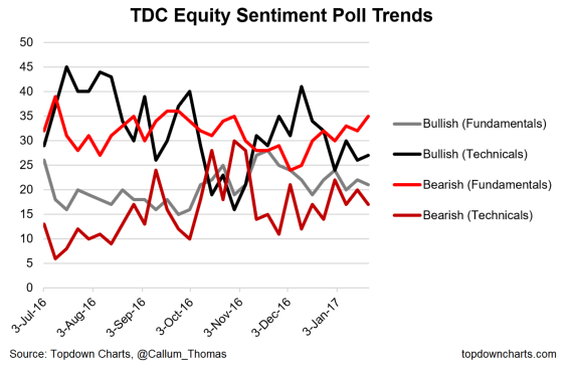

The regular chart comes first with the weekly poll results across the 4 options. This week saw "bearish for fundamental reasons" rise to its highest point since September (likewise fundamental bullishness fell slightly). On the other hand the technicals sentiment went in the opposite direction.

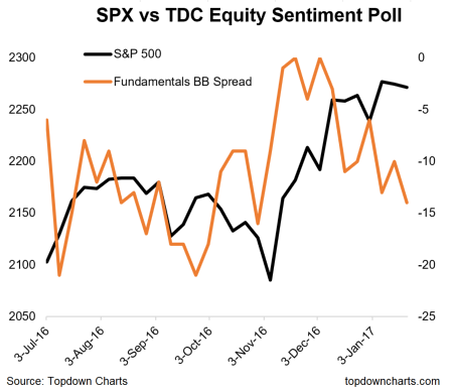

The next graph shows the S&P 500 compared to the fundamentals bull-bear spread. I've previously pointed out how the fundamentals bull/bear spread seems to have a slight lead on market prices. Thus it's an ominous sign that we see the fundamentals spread making a noticeable decline in recent weeks. This could be a warning sign of an impending correction or selloff and technical analysts would call this bearish divergence.

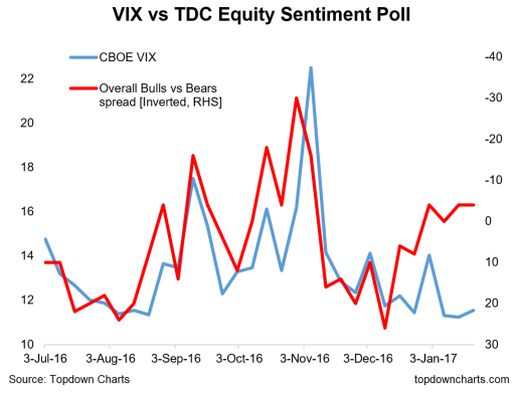

If that one didn't scare you then this one might. It shows the overall bulls vs bears difference against the CBOE VIX. There is an interesting divergence there with the bull-bear spread suggesting a VIX level more towards 16 than 11. The main way that the VIX moves higher is by markets falling, so it's definitely one to keep on the radar, 16 is not catastrophic but it would be consistent with a 5-10% correction.

Summary

The charts in this week's Twitter equity sentiment poll show a couple of warning signs. This tends to line up with some of the bearish signals I've been highlighting in the S&P500 #ChartStorm. More broadly, expectations have been bid up high, economic surprise indexes have gone to extremes, and stock market enthusiasm about Trump has been palpable.

At this point it would not take much at all to trigger a selloff. Thus a short-term cautious bias for equity exposure seems warranted.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI