Following the RBA decision last week, this week, the central bank torch will be passed to the BoC. Although we don’t expect this Bank to cut interest rates further, it would be interesting to see whether officials will decide to expand their QE purchases. As for the economic data, Australia’s employment report for March and China’s GDP for Q1 are also on this week’s agenda.

On Monday, the economic calendar is empty as it is Easter Monday in most nations under our radar. Markets in Europe, Australia and New Zealand are be closed.

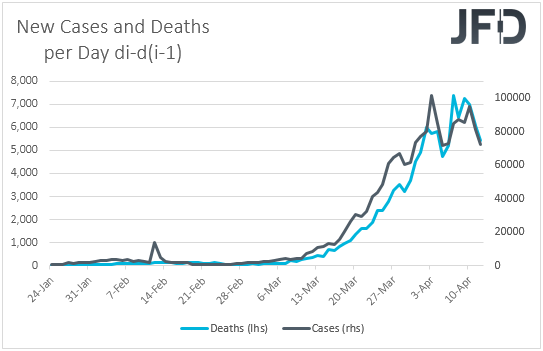

Once again, market participants may keep their gaze locked on numbers and headlines surrounding the coronavirus outbreak. On Sunday, both infected cases and deaths slowed worldwide, increasing the chances that the pandemic may have started leveling off. That said, we are still reluctant to trust a long-lasting recovery in the broader market sentiment. Just a day of new records may be enough to spark fresh fears and prompt investors to abandon risk-linked assets in favor of safe-havens. Even if we have already reached the peak in the outbreak, we believe that the lockdown measures could be extended for a while more, if indeed governments around the globe want to contain the virus. And when we get a free movement permission, many people may still be hesitant to get out of their homes and start spending. Thus, the economic wounds could drag well into the second quarter.

On Tuesday, during the Asian morning, Australia’s NAB business confidence index for March is coming out, but no forecast is currently available. In February, the index slid to -4 from -1, and we wouldn’t be surprised if it slides further into the negative territory. After all, the economic damages around the globe due to the coronavirus fast-spreading have been more severe during the month of March. What’s more, given how much emphasis the RBA places on employment and wage growth, we will pay extra attention to the Labor costs sub-index, the QoQ rolling rate of which held steady at +0.9% in February.

Later in the day, we get the US NFIB small business optimism index for March, for which there is no forecast, but due to the pandemic fast-spreading, we would see the risks as tilted to the downside. Just for the record, February’s print was at 104.5.

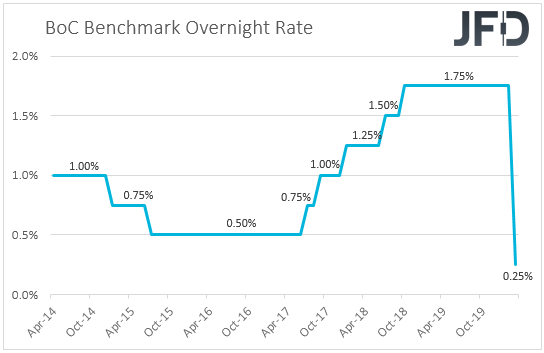

On Wednesday, the spotlight is likely to fall on the BoC interest rate decision. On March 27th, the Bank decided to slash interest rates to 0.25% and to launch a QE program in order to safeguard its economy from the effects of the coronavirus’s spreading. The Governing Council highlighted its readiness to take further action to support the economy and the financial system, but noted that the policy rate is now to its effective lower bound.

Last Thursday, the employment report for March disappointed largely, with the unemployment rate surging to 7.8% from 5.6% and the net change in employment revealing that more than 1mn jobs have been lost, which is the worst print in Canada’s history, at least since we can find data from. This may have increased the chances for more stimulus by the BoC, but bearing in mind that officials clearly noted that the policy rate has reached its effective lower bound, we don’t expect a rate cut at this gathering. Maybe officials will decide to expand their QE program, which could prove slightly negative for the Canadian dollar. However, if the latest slowdown in the coronavirus infected cases continues for a few more days, officials may decide to hold off from acting in order to see whether this improvement will continue and whether the already adopted measures have been having the desired effects on the Canadian economy.

As for Wednesday’s data, during the Asian trading, China’s trade balance for March is due to be released and the forecast suggests that the nation’s USD 7.09bn deficit has turned into a USD 19.10bn surplus. However, the details are not so encouraging as both exports and imports are expected to have continued sliding. The trade balance will turn into a surplus just because exports may have fallen at a slower pace than in February, and because imports may have slid more.

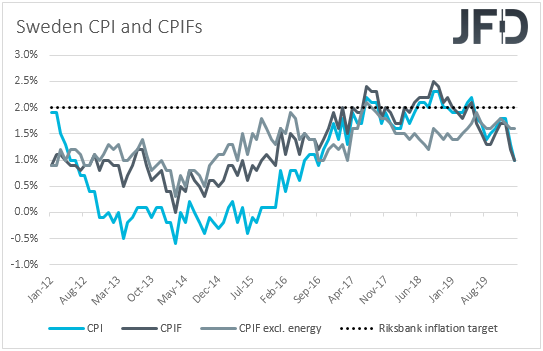

Later in the day, we have Sweden’s CPIs for March. Both the CPI and CPIF rates are forecast to have declined to +0.7% yoy from +1.0%, but as we have noted several times, we prefer to pay more attention to the core CPIF rate, which excludes the volatile items of energy. In February, that rate held steady at +1.6% yoy.

On the 16th and 19th of March, the Riksbank decided to extend its bond purchases this year by up to SEK 300bn in order to mitigate the effects of the pandemic, while on March 26th, officials decided to initiate purchases of commercial paper issued by Swedish non-financial corporations. It appears that Swedish policymakers do not want to cut rates back into negative waters, and that’s why they are expanding their purchases. If the core CPIF rate stays close to its current levels, this would mean that the slide in the headline prints is mostly due to the tumble in oil prices and may encourage officials to wait for a while more before deciding whether additional measures are needed, especially if the slowdown in global infected cases continues. However, a notable slowdown in core inflation may prompt policymakers to act again and expand further their QE purchases.

From the US, we get retail sales, industrial production, both for March, and the New York Empire state manufacturing index for April. Both the headline and core sales are expected to have tumbled 7.0% mom and 4.0% mom, after sliding 0.5% and 0.4% respectively. Those will be the biggest declines since we can find data from, but bearing in mind that investors already know that the US economy was hit hard due to the virus in March, big slides are unlikely to disappoint. The same applies to the industrial production, which is also expected to have slid notably.

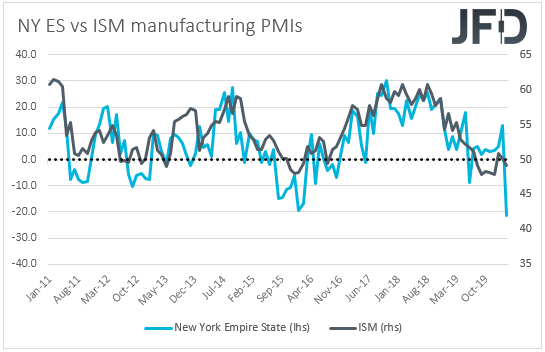

Market participants may pay some extra attention to the New York Empire state index this time around. Although there are signs that the pandemic may be levelling off, this manufacturing index is expected to have fallen further into the negative territory, to -35.00 from -21.50, which may be an early omen that the sector’s wounds may drag for more than previously anticipated. A larger than expected tumble could raise questions as to whether the Markit and ISM manufacturing prints for the US as a whole will disappoint as well.

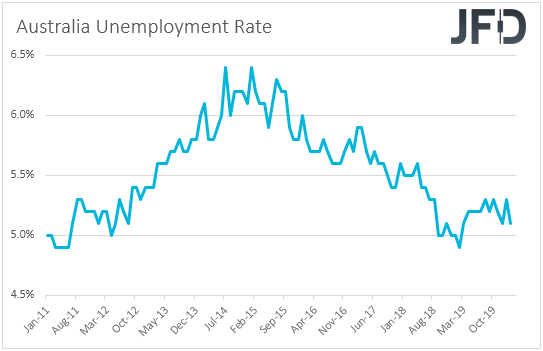

On Thursday, during the Asian morning, we get Australia’s employment report for March. The unemployment rate is forecast to have risen to 5.5% from 5.1%, while the net change in employment is expected to show a 40.0k slide in jobs, after the economy added 26.7k in February.

At their most recent gathering, last week, RBA policymakers left monetary policy unchanged and offered some details with regards to their QE program. They noted that they will do what is necessary to achieve a 3-year yield target of 0.25%, with the target expected to remain in place until progress is being made towards the goals for full employment and inflation. However, they added that if conditions continue to improve, it is likely that smaller and less frequent purchases of government bonds will be required.

After saying that interest rates have reached their effective lower bound at the prior meeting, the aforementioned points suggest that there is very little chance of expanding their QE program. On the contrary, they could soon scale it back if the spreading of the coronavirus continues to level off. It would be interesting though to see whether a disappointing jobs report – with the unemployment rate rising further above the 4.5% threshold which the RBA expects to start generating inflationary pressures – will force them to change their minds and start considering a QE expansion.

Later in the day, we get Germany’s final inflation data for March, but as it is always the case, they are expected to confirm their preliminary estimates. Eurozone’s industrial production for February is also due to be released and the forecast points to a 0.2% mom slide after a 2.3% increase in January.

From the US, we have building permits and housing starts for March, as well as the Philly Fed manufacturing index for April. Both building permits and housing starts are expected to have declined somewhat, while the Philly Fed index is forecast to have slid to -30.0 from -12.7. Similarly, with the New York Empire State index, this could be an early sign over whether the damages in the manufacturing sector would drag more than previously estimated.

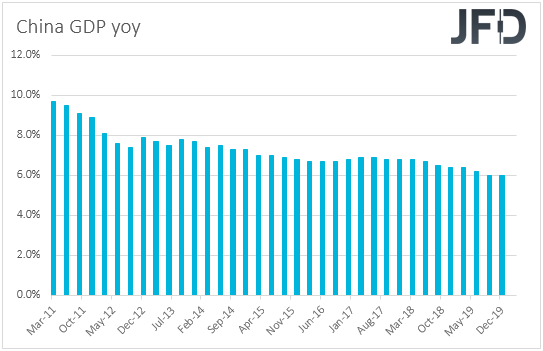

Finally, on Friday, in Asia, we get China’s GDP for Q1, as well as retail sales, industrial production and fixed asset investment, all for March. The nation’s economy is all but certain to have shrank in the first three months of the year, due to the coronavirus outbreak, with the market consensus pointing to a 6.0% contraction. Retail sales, industrial production and fixed asset investment are all expected to have continued sliding in March, but at a slower pace than in February. Bearing in mind that the spreading of the virus in China slowed notably during the third month of this year, we wouldn’t be surprised if we get better readings. The big question is whether the economy has started recovering in the second quarter after the nation has lifted several restrictive measures.

As for the rest of Friday’s data, the only worth mentioning is Eurozone’s final CPIs for March, which, as always, are expected to confirm their initial prints.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI