Nvidia to resume H20 chip sales in China, announces new processor

Following the RBA monetary policy decision last week, this week, the central bank torch will be passed to the BoC and the ECB. We don’t expect any policy changes from the BoC, but after the Euro-area inflation slid into negative waters, it will be interesting to see whether the ECB will decide to increase its efforts to stimulate the Euro-area economy. We also get the US CPIs for August, while on the political front, another round of Brexit negotiations are set to take place.

Monday is Labor Day in both the US and Canada and thus, the respective markets will stay closed. Elsewhere, the only release worth mentioning on the calendar is China’s trade balance for August, which is already out. The nation’s surplus declined somewhat to USD 58.93bn from USD 62.33bn, with exports accelerating to +9.5% YoY from +7.2%. Imports declined 2.1% YoY after falling 1.4% in July.

On Tuesday, during the Asian morning, Japan’s final GDP for Q2 is due to be released and the forecast points to a small downside revision, to -8.1% QoQ from -7.8%. Australia’s NAB business confidence index for August is also coming out, but no forecast is currently available.

Later, during the EU trading, Germany’s trade balance for July and Eurozone’s final GDP for Q2 are coming out. Germany’s trade surplus is expected to have increased somewhat, while the euro area final GDP is anticipated to confirm its 2nd estimate of -12.1% QoQ.

On Wednesday, the main event is likely to be the BoC monetary policy decision. At its last meeting, the BoC decided to keep interest rates unchanged at +0.25% and noted that they will stay there until the 2% inflation target is sustainably achieved. Officials also added that they will continue with their QE program until the economic recovery is well underway and that they stand ready to adjust their programs if market conditions change.

Since then, inflation data for July showed that the headline CPI rate tumbled to +0.1% YoY from +0.7%, and that the core rate slid to +0.7% YoY from +1.1%. That said, the latest GDP data showed that the Canadian economy performed better than expected in June, despite sliding 38.7% on a QoQ annualized basis, while last Friday’s employment report, even though it missed estimates, it came on the decent side, with the unemployment rate sliding to 10.2% from 10.9%. So, with all that in mind, we don’t expect BoC policymakers to act at this gathering. We believe that they will stand pat and reiterated their readiness to adjust their programs if market conditions change.

As for Wednesday’s data, during the Asian morning, China’s CPI and PPI for August are coming out. The CPI is forecast to have slowed to +2.4% YoY from +2.7%, while the PPI is anticipated to have fallen at a slower pace than in July. Specifically, it is expected to have slid 2.0% YoY after falling 2.4%. Later in the day, from Canada, apart from the BoC interest rate decision, we also get the nation’s housing starts for August. The US JOLTs job openings for July are also due to be released.

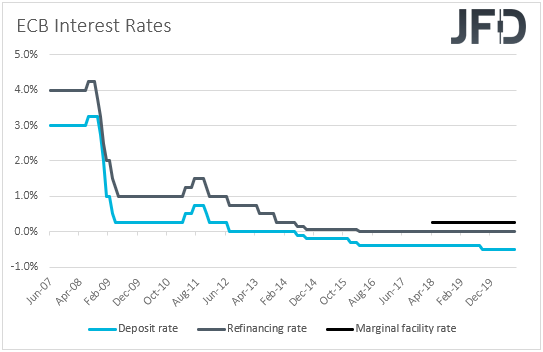

On Thursday, the central bank torch will be passed to the ECB. The last time they met, ECB officials refrained from altering their monetary policy, but stayed ready to adjust all their instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner. At the press conference following the decision, President Lagarde urged EU governments to take action in battling the coronavirus pandemic, with EU leaders eventually agreeing on a EUR 750bn rescue fund. The euro entered a rally mode against its US counterpart, perhaps on hopes that with a fiscal aid, the Eurozone was likely to recovery faster. What may have also helped EUR/USD to march higher was the Fed’s decision to adjust its inflation approach, noting that they will now aim a 2% average inflation, which means extra loose policy for longer.

Having said all that though, after hitting 1.20, EUR/USD came under some selling interest as inflation in the Euro area turned negative in August for the first time since 2018. On top of that, ECB chief Economist Philip Lane said that the EUR/USD exchange rate “does matter” for monetary policy, comments which combined with the negative inflation rate may have raised speculation for additional easing by the ECB. Thus, it would be interesting to see whether the ECB will decide to act at this gathering, or whether it will just prepare the ground for more action at one of its upcoming meetings.

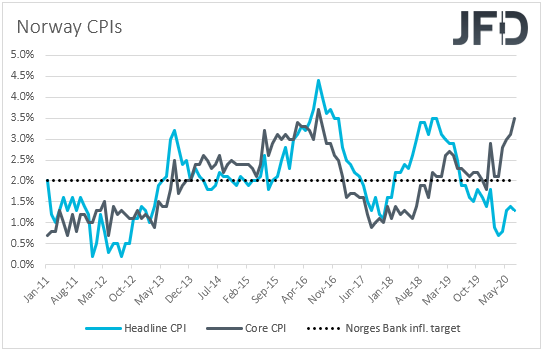

As for Thursday’s economic indicators, during the European morning, Norway’s CPIs for August are coming out. The headline rate is expected to have increased to +1.6% YoY from +1.3%, while the core one is anticipated to have held steady at +3.5%. At its latest meeting, the Norges Bank decided to keep interest rates unchanged at 0.0%, repeating that the outlook and balance of risks suggest that they will most likely stay at that level for some time ahead. Officials acknowledged that the economy is in the midst of a deep downturn, and added that new information largely confirms the picture of the economic developments presented in the June report. The latest GDP data showed that mainland Norway contracted 6.3% in Q2, very close to the Bank’s estimate, and thus, combined with that, a slight improvement in inflation may allow Norges Bank officials to continue sitting comfortably on the sidelines.

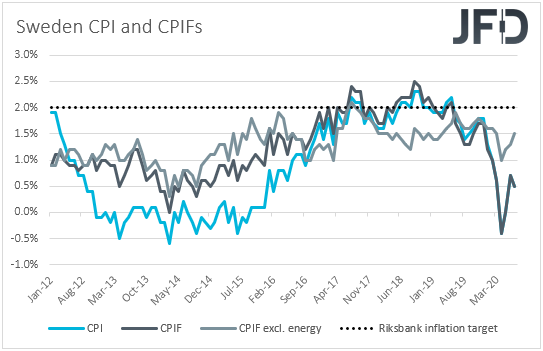

We get inflation data for August from Sweden as well. Both the CPI and CPIF rates are forecast to have increased to +0.9% YoY and +0.8% YoY from +0.5%. That said, as it is always the case, we will pay more attention to the core CPIF rate, which excludes the volatile items of energy. That rate rose to +1.5% YoY in July, from +1.3%. At its latest gathering, the Riksbank decided to extend its framework for its asset purchases from SEK 300bn to SEK 500bn, up to the end of June 2021, while it announced that in September, it will start purchasing corporate bonds. The Board also decided to cut interest rates and extend maturities on lending to banks, despite keeping the repo rate unchanged at 0%. We believe that after acting at its last gathering, even if inflation misses somewhat its forecasts, the Riksbank is unlikely to proceed with changes at its upcoming gathering.

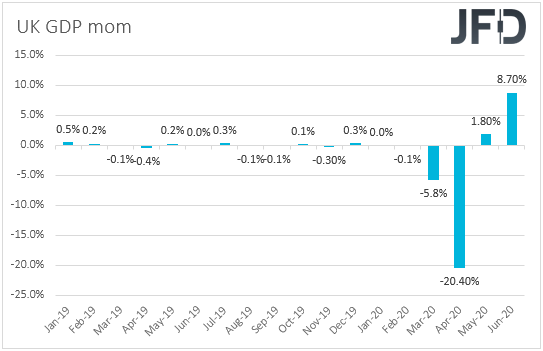

Finally, on Friday, during the European morning, we get the UK monthly GDP for July, alongside the industrial and manufacturing production rates for the month. No forecast is currently available for the monthly GDP rate, but the YoYY one is anticipated to have slid to -21.7% from -1.7%. The industrial and manufacturing production YoY rates are expected to have risen, but to have stayed within negative waters. Specifically, the IP rate is expected to have increased to -8.7% from -12.5%, while the MP one is forecast to have risen to -10.5% from -14.6%. The UK trade balance for July is also coming out.

Having said all that though, focus for GBP traders this week is likely to be mainly on politics rather than economic data. On Tuesday, a new round of Brexit talks is scheduled to begin, but an imminent breakthrough seems unlikely, as the EU and the UK remain far apart in finding common ground. The transition period ends on December 31st, but the deadline for a deal is on October 2nd, less than a month from now, with any potential accord expected to be ratified at an EU summit before the end of the year. With all that in mind, another round of no progress in negotiations may increase the chances for a no-deal Brexit and thereby weigh on the pound.

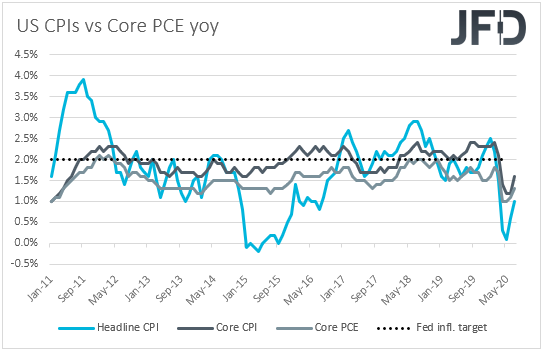

Later in the day, we get the US CPIs for August. The headline rate is anticipated to have increased to +1.2% YoY from +1.0%, while the core one is expected to have held steady at +1.6% YoY. A couple of weeks ago, speaking at the Jackson Hole economic symposium, Fed Chief Powell said that the Fed will now target a 2% average inflation and put emphasis on “broad and inclusive” employment, with the shift motivated by underlying changes to the economy, including lower potential growth, persistently lower interest rates and low inflation. Although he added that the Committee is not tying itself to any particular method to define “average” inflation, this means that the Fed is willing to tolerate above 2% inflation for a while before raising interest rates, which implies extra-loose monetary policy for longer. What’s more, in the minutes of the latest FOMC gathering, it was revealed that additional accommodation may be required. Thus, taking all this into account, we doubt that a small acceleration in inflation will alter policymakers’ plans with regards to monetary policy.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.