Beginning in December of last year, following the announcement by OPEC of a cut in oil production, I've discussed the “headwinds” that persist against a sustained rise in oil prices.

“The supply/demand dynamics currently suggest that oil prices and energy-related investments could find a long-term bottom within the next year or so following the next recession. However, it does not mean those investments will repeat the run witnessed prior to 2008 or 2014. Such is the hope of many investors currently as their ‘recency bias’ tends to overshadow the potential of the underlying fundamental dynamics.”

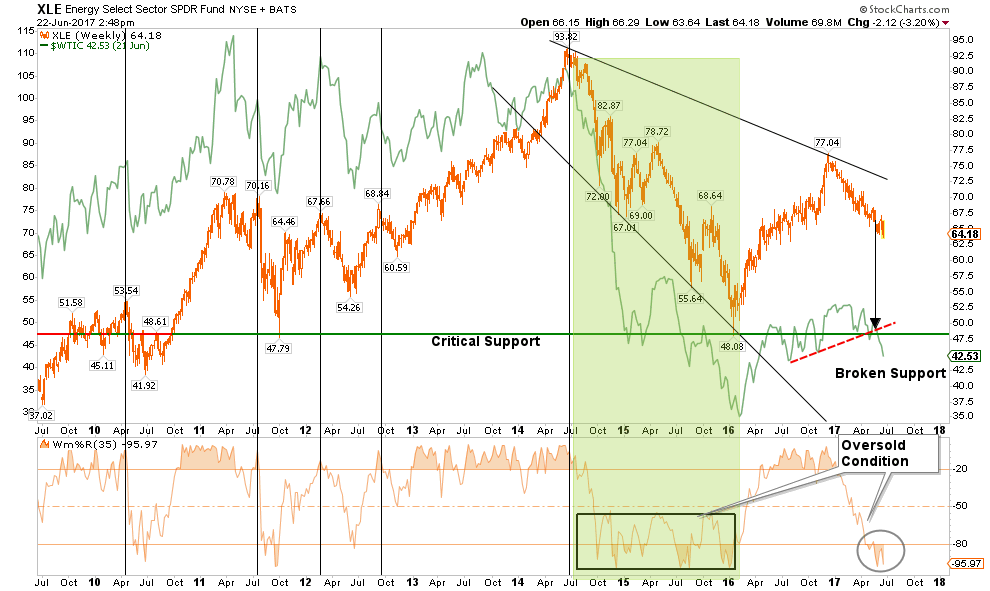

After exiting the energy space in April 2014, there have been small tradeable opportunities within the energy sector but the trend remains sorely negative. The recent pounding of both oil prices, and the energy-related sector, continues to support the repeated warnings to remain clear of the space for now.

“Energy continues to struggle after breaking its 50-dma and broke its 200-dma two weeks ago. While energy had a bit of a bounce last week, and tested resistance at the 50-dma, the bounce failed and the trend continues to materially weaken. Energy is very close to a major sector sell signal. Remain heavily underweight energy for the time being.”

Since then energy stocks (via Energy Select Sector SPDR (NYSE:XLE)) have continued to deteriorate and oil prices have now broken important support. The next major level of support for oil prices on a weekly basis is $42.50/bbl. A failure there leaves little support until $35/bbl.

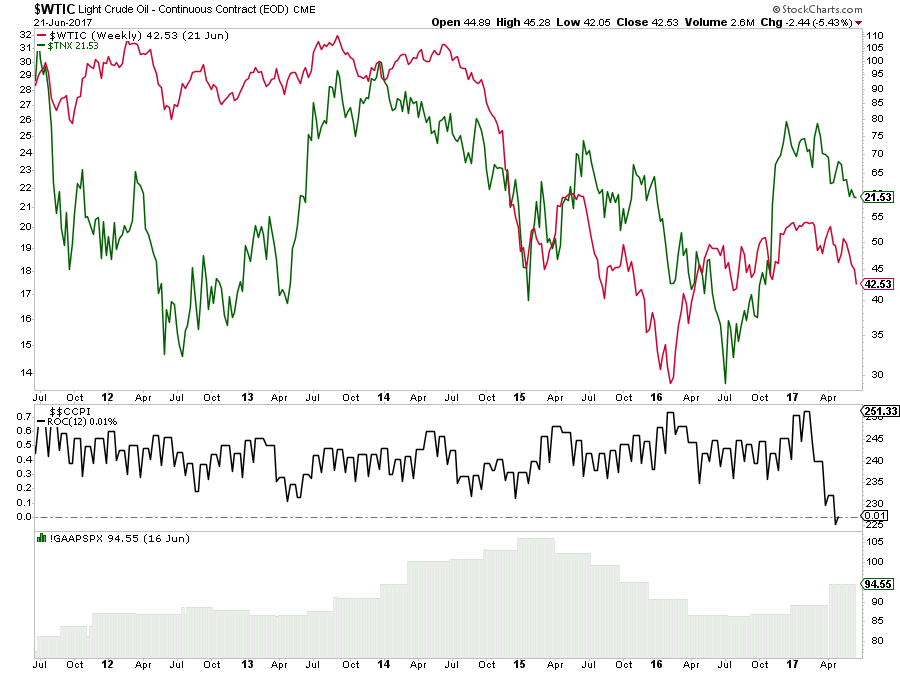

However, there is more to the price of oil than just weakness in the energy sector. Oil prices are also a reflection of what is happening in the actual economy. The Fed should be paying closer attention to what is happening in oil prices. As shown below, the decline in oil prices suggests not only a real lack of inflationary pressures but also a threat to the mild recovery in earnings in the last quarter. This weakness is also feeding back through the interest rate complex as well.

As I stated Thursday:

“While the Federal Reserve clearly should not raise rates further in the current environment, it is clear they will remain on their current path. This is because, I believe, the Fed understands that economic cycles do not last forever, and we are closer to the next recession than not. While raising rates will accelerate a potential recession and a significant market correction, from the Fed’s perspective it might be the ‘lesser of two evils. Being caught near the ‘zero bound’ at the onset of a recession leaves few options for the Federal Reserve to stabilize an economic decline.

In other words, they already likely realize they are screwed.”

There are ample data points suggesting the Fed has already “missed their window” for hiking rates. At this juncture, it is much more likely we will be talking about restarting QE in 2018 rather than how the “reduction of the balance sheet” is proceeding. Of course, such a conversation will most likely flow in conjunction with the onset of a “recessionary drag” in the economy and a decline in asset prices.

However, for now, “hope” remains the emotion of choice.