Do not count the Eurozone out just yet. Economic recovery picked up speed in Q4 - GDP +1.1, y/y and +0.3%, q/q. Numbers like this would suggest that the region has one once again found firmer footing after a couple of recessions pushed unemployment to record highs and led the periphery countries into all sorts of economic, political and social troubles.

The above expectations GDP headline is the third straight quarter of growth for the Euro-zone. Not surprisingly, the expansion was led again by the regions backbone – Germany. What's so much more encouraging is that economic growth actually spread to the struggling regions – France, Italy and Spain. The numbers remain relative, they are a plus for Europe but certainly lag behind the economies of the US, UK and Japan.

Another concern would be, that despite the positive headline print, the actual economic growth rate remains below the rates that typically occur after recessions. It would suggest that Europe would have problems reducing their record unemployment numbers and issues increasing output that would help the peripheries reduce their debt load.

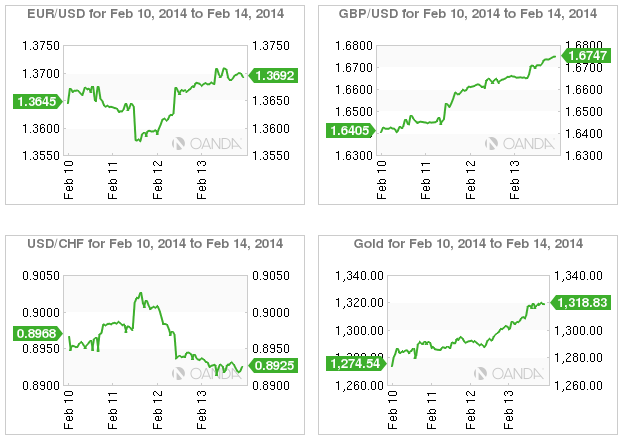

Where does that leave the ECB? It takes some pressure off the Euro-policy makers to make any immediate policy changes, but will they be pro-active and keep the "foot on the gas"? This week ECB members commented on the possibility of negative deposit rates and the market is pricing in further easing as early as next month.The ECB has remained the most ‘dovish' of the party and it’s a matter of when and not if they ease monetary conditions further. However, after Draghi and company kept record low rates on hold last week they indicated they needed more time to analyze incoming data and GDP is one of them.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI