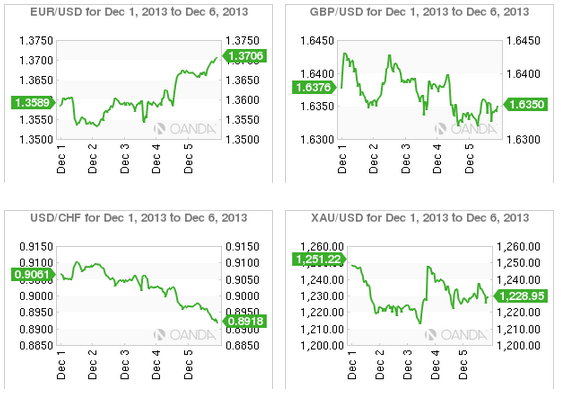

Is December too early for the Fed to begin tapering? The way that some of the emerging markets currencies have been trading would suggest that many believe that could be the case. Friday's stronger than anticipated November non-farm payroll report was expected to go some ways to support Bernanke and company to begin paring back on their $85b a month-bond-buying program. That should have led to the USD rallying against Emerging Market currencies. Instead, the knee-jerk pro-tapering trades got battered in a market reversal. For instances, the ZAR rallied +1% against the dollar from being -1% weaker before the headline release. It seems that the market is comfortable pricing out a potential December taper believing that there will not be enough support amongst the voting Fed members to push through a December taper start. In fact the next FOMC meeting in two weeks time has probably come too soon.

The +203k NFP print was at best "in-line" with expectations, it did not exceed. The bear steepening in US 2/10's treasuries should have continued, in fact it flattened after the job announcement when real-money started buying UST's and pulled longer term yields off their highs. A stronger dollar would favor higher US yields further out the curve. Even November presented a somewhat healthy drop in the unemployment rate to +7% given how the participation rate also happened to tick up. But Analysts note that’s mostly a recovery from a shutdown-driven drop in participation in October. Ben will probably have to back away from his forward guidance of +6.5% threshold employment rate for the start of rate hikes. Even this week's pain trade, a strong EUR outright, continues to find support on good US data. For some, December remains in the picture, however January 2014 is still more probable.

Original post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.