Expect Bernanke to play down the significance of one employment number – Friday’s headline print will do little to clarify the Fed’s QE tapering debate and by default the dollar’s position. This will make for a relatively volatile summer in FX, and by default making each future data point release to take on more significance.

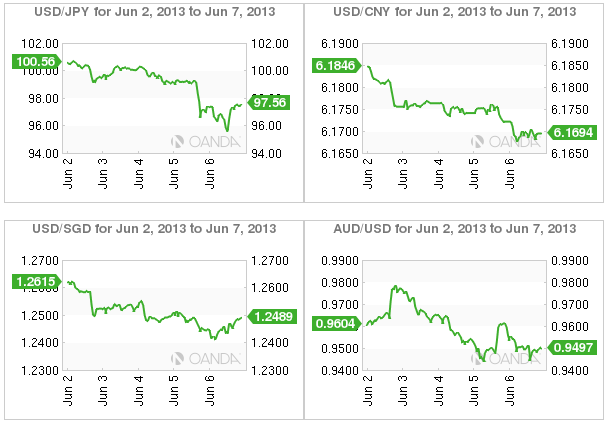

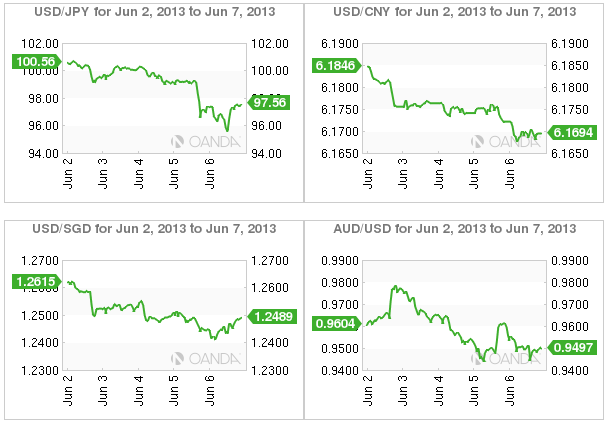

All of this will become a bigger headache for Abenomics. This week’s breakdown in the Nikkei and USD/JPY will have many who have entered into the two most crowded trades (long Nikkei and short Yen) worried. The wild Yen move is trying to confirm technically, what many have believed was a correction of Abenomic rallies, may in fact be considered a reversal, especially now that the Nikkei has broken through its -25% correction level and USD/JPY printing a sub- ¥96.00 low.

Not making it any easier for the dollar and any equity bull this week is that the volume being traded is on the rise – signs of potential mass liquidation will only lead to similar moves like last Thursday’s ‘currency panic attack.’ The dollars positive reaction to the NFP release just shows how much of the mighty ‘buck’ had been oversold in the previous sessions on panic momentum.

What’s Japan to do to stem Abenomics opposition? The MoF will have to consider how far they can test the remaining G20 members if they ever contemplate implementing any “possible intervention.” Finance Minister Aso said that they are watching the currency moves, and there is no immediate need to intervene. Economic finance Minister Amari has indicated that equities and FX moves will continue to be driven by external factors.

All of this will become a bigger headache for Abenomics. This week’s breakdown in the Nikkei and USD/JPY will have many who have entered into the two most crowded trades (long Nikkei and short Yen) worried. The wild Yen move is trying to confirm technically, what many have believed was a correction of Abenomic rallies, may in fact be considered a reversal, especially now that the Nikkei has broken through its -25% correction level and USD/JPY printing a sub- ¥96.00 low.

Not making it any easier for the dollar and any equity bull this week is that the volume being traded is on the rise – signs of potential mass liquidation will only lead to similar moves like last Thursday’s ‘currency panic attack.’ The dollars positive reaction to the NFP release just shows how much of the mighty ‘buck’ had been oversold in the previous sessions on panic momentum.

What’s Japan to do to stem Abenomics opposition? The MoF will have to consider how far they can test the remaining G20 members if they ever contemplate implementing any “possible intervention.” Finance Minister Aso said that they are watching the currency moves, and there is no immediate need to intervene. Economic finance Minister Amari has indicated that equities and FX moves will continue to be driven by external factors.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.