This weeks Emerging Markets FX landscape bore witness to some extreme price action moves, well beyond the "Fragile Five" that will surely have convinced many investors to contemplate cutting exposure to the region even further.

The EM price movement is not just about the Fed's tapering plans – investors are also trying to adjust their portfolios to the global market concerns as to whether China can smoothly deleverage its financial sector, and on the timing of the Fed's first rate hike as QE draws to a close.

Currently, there are no obvious reasons to want to buy the region, in fact the EM currencies with current account deficits and low FX reserves will remain the most vulnerable. Topping many analysts' lists and source of potential contagion remains the Turkish Lira (TRY). Political constraints on the Turkish Central Bank (CBRT) and dwindling FX reserves would suggest that the country faces a massive battle to stem the loss of market confidence that has certainly widened this week.

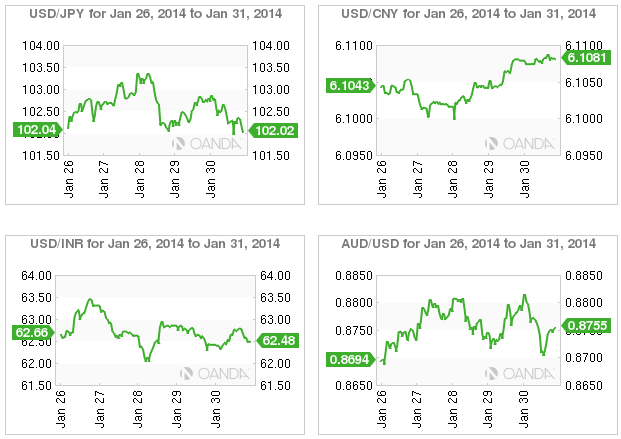

After the initial euphoria of the CBRT aggressive rate hike earlier in the week, the TRY continues to trade lower and is ending this Friday's Euro session on fresh day-lows (2.2832). The market continues to gravitate towards the relative safety of the JPY and the USD after both weak Euro inflation numbers and a disappointing German December sales data print early Friday morning is not helping the 18-member single currency's plight.

China's growth prospects are a global concern, with many analysts beginning to slash their Q1 2014 growth forecast from their prior call of 7.4% to a new growth rate of 6%. The governments reform agenda rolled out late last year were greeted with some euphoria by the market. Now that the dust has settled, it's naïve to suspect that the implementation of reforms could proceed without causing some economic pain to the worlds second largest economy. China continues to face the "three R's: retreat in growth, structural reforms, and credit risks."