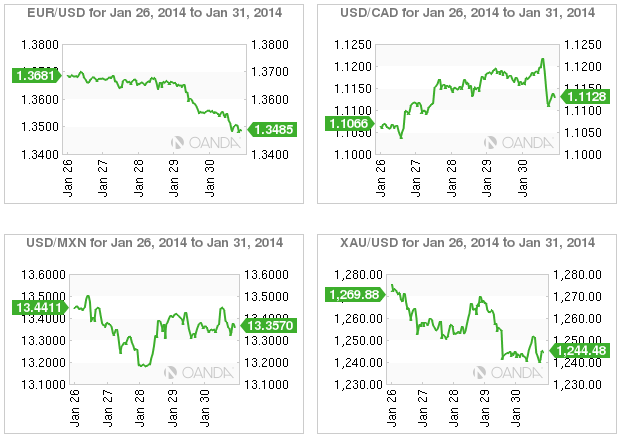

Canada's November's growth number on Friday hit expectations of a +0.2% monthly gain. On the face of it all looked fine, however, the sub-indices happened to push the CAD to a new intraday low. The energy sector reported its usual strength, but both the manufacturing and agriculture categories declined and pushed the loonie through the psychological 1.12 handle for the first time in five years.

Will the monthly growth headline be enough to suppress the idea that Governor Poloz at the Bank of Canada is contemplating a rate cut to promote economic growth? The BoC has made its next monetary choice explicitly data dependent and a growth print like this would suggest a hike rather than an ease in monetary policy. The weak is doing the BoC work, as the underperforming currency will eventually push the country's tepid inflation rate higher.

Certainly not helping policy makers in the relative weak jobs situation. StatsCan reported earlier this month that Canada lost -46k jobs in December, pushing the unemployment rate to +7.2%. New data this week revealed that Canada lost -27.6k jobs in November rather than the reported gain of +21k in their highly coveted 'labor market report.' The new data - based on a census of Canada Revenue Agency data and a survey of 15,000 employers — is considered by economists to be more reliable, but not reported on as heavily as the touted labor report. Despite the reports long-term trends remaining the same will the revision shown up next week and cause more problems for the loonie?

The loonie is closing out the week on the front foot, mostly on the back of month end-demand. Earlier, the CAD had taken a beating from the dollar bulls who used GDP as an excuse to push their way through option barriers at 1.12 and weak stops in the high twenty’s. The commodity sensitive currency continues to remain vulnerable, lobbed into the underperforming commodity basket that has been hurt by China's questionable growth potential. Dollar buyers lurk on on all CAD rallies.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.