This week, Federal Reserve Chair, Janet Yellen, performed admirably during her Congressional testimony before the House of Representatives. Investors and politicians were looking for any sign of potential weakness in the Fed’s new chief after she succeeded Ben Bernanke, but none was to be found and few, if any, were disappointed.

Yellen made clear that the Fed’s game plan is to continue to follow Bernanke’s blueprint for the gradual reduction of the Bank’s massive bond-buying program for the time being. However, recently disappointing reports have a few analysts rethinking the depth of their bullishness for the U.S. economy. Last Thursday, U.S. retail sales data for January slipped lower (-0.4%), month-over-month, well below expectations. Adding to that dour news was word December’s results were also revised to negative territory.

The headline print was the steepest one-month decline in 18-months for sales. Excluding automobile sales, January’s sales were flat, while core-sales (ex-autos, gas, and building materials) came in down -0.3%; expectations were for a +0.2% rise. The reason for the slip: icy weather. The biggest burden on the report was sagging auto sales, which was abundantly clear in American sales numbers released by the major auto manufacturers last week. Add the weather-impacted report to the miss in the January purchasing managers’ index for manufacturing, and the monthly jobs numbers, and there is reason enough to consider revising U.S. growth rates. Many analysts are beginning to cut American fourth-quarter 2013 and first-quarter 2014 growth forecasts due to the despairing data – the first quarter is tracking at +0.9% versus +1.9%, while the fourth quarter is pared to +2.5% from +2.8%.

The U.S. economy is the "beacon for capital markets." However, the present global economic recovery has six unusual characteristics which distinguish it from recoveries of the past, and it is altering the strength of "the" recovery. This will obviously have a knock-on effect on financial markets and monetary policies. The indictors that need to be taken into consideration when looking at the big picture include:

• Global trade continues to lag.

• Credit is not picking up and continues to languish.

• Long-term interest rates are not rallying – a flatter U.S. yield curve.

• Inflation is benign or continues to fall – the eurozone is concerned about deflation.

• Commodity prices remain on the "back-foot".

• Finally, when considering U.S. employment, note the labor participation rate – it continues to decline – never a good sign.

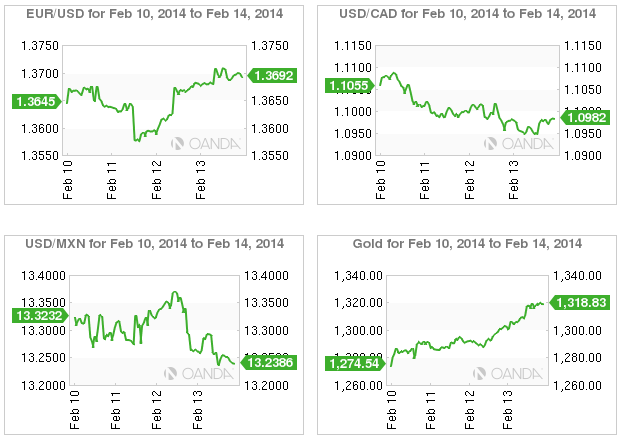

One needs to be looking beyond weather to see a clearer picture. The lack of volatility in forex can be blamed on the Group of 10 monetary policies – with the lack of deviation in interest rates, central bank rhetoric is doing most of the currency price guidance for now.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI