- Dollar Bulls were looking for a stronger NFP print

- Canada part-time hires at four-year high

- USD/CAD better bid on dollar pullbacks

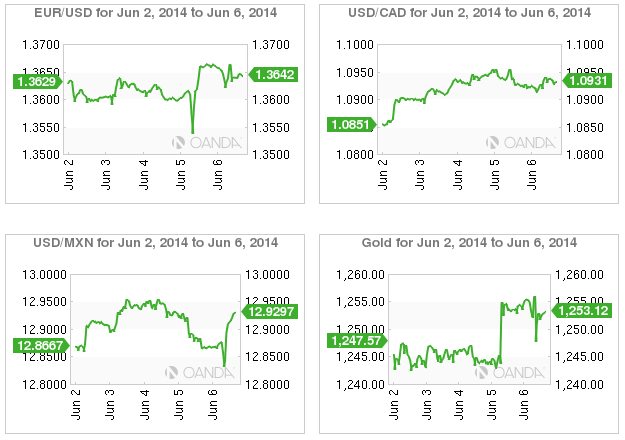

It's taken five years, but it's finally happened. The US has come full circle in its economic recovery with Friday's NFP print (+217k, +6.3% UE). The US economy lost -8.7m jobs during the "Great Recession" and the May payroll print has managed to push the needle just above that total loss. Digger deeper, the long-term unemployed are now showing signs of getting work, with people unemployed more than 26 weeks falling -78k and those unemployed 15-26 weeks declining another -92k. The average workweek was unchanged at 34.5 hours as expected, but hourly earnings were slightly stronger than anticipated.

In retrospect, payrolls hit the median forecast in every single component. However, some details do worry, like the 'diffusion index' or the breadth was disappointing. It fell to 62.7 from 65.9 with low paying jobs again dominating the landscape (education, healthcare, leisure and services etc.). The low paying factor certainly is not a strong dollar friendly variable. With the Fed willing to promote lower for longer, a "mighty" dollar or dollar bulls, would require a real strong jobs report for support and Friday's was not it. Coupled with the EUR positional shenanigans, the May report has done very little to remove the dollars obstacles in the short-term.

Canada managed to nearly wipe out the dismal job losses in the April report (-28.9k) by hiring the largest number of part-time workers (+54.9k) in almost four-years in May. Canada added +25.8k new jobs last month, but an uptick in number of job seekers into the labor force pushed the unemployment rate higher to +7%. The number of full time jobs actually fell -29.1k, which suggests that the real pace of hiring is gradually decelerating.

Canadian numbers like these certainly support the neutral stance being taken by Governor Poloz at the BoC (+1% since September 2010) and especially so with no signs of wage inflation. The loonie continues to remain under pressure ($1.0941), with corporate buyers of USD laddered below the figure and down to 1.0868. On the topside, most dollar seller speculators seem to have backed off for the time being. The next resistance levels continue to be the $1.0975 and the psychological $1.1000 handle.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI