The Hoot

Actionable ideas for the busy trader delivered daily right up front

How about that? Last night I wrote " it's not out of the question that we get yet another small-range doji day of indecision" and that's exactly what we got, with the Dow finishing up just over 2 and a half points and the SPX down just 0.18. So we remain in the dog days, waiting in Casablanca, or for Godot - heck, I'm running out of metaphors here. This is getting monotonous. Let's scan the charts for any sign of a shake-up on the way.

The technicals (daily)

The Dow: Lately, the Dow has been giving a clinic on reversal candlesticks. Just look at the last seven candles here: shooting star, inverted hammer, green spinning top, red spinning top, green hanging man, red hanging man, and today a perfect doji. Every one a bearish warning, every one rejected. And so we remain stuck in a narrow range. The only difference today is that RSI has now finally started to come down from overbought and the stochastic looks like it may be unthreading itself as a bearish crossover. But once again, we're going to need confirmation before calling an end to the congestion.

The VIX: After hitting a five year low yesterday as I noted, the VIX today staged a big comeback with an 8.39% bounce that took it right out of its descending RTC for a bullish setup. It also sent the RSI and stochastic turning back up from oversold. This all seems to suggest more upside to follow which would be bad for stocks.

Market index futures: Tonight all three futures are down at 1:12 AM EDT with ES lower by 0.27%. Today gave us a classic doji, making five straight reversal candles here too. So far, the new candle developing seems to suggest a move lower, but we've seen this movie before. At 1398 right now, we're still inside the recent congestion range. I do note though that RSI has come off its recent 100 readings. And perhaps of greater importance, we are now trading entirely outside the latest rising RTC and that's a bearish setup. This is the best case I can make for lower prices Wednesday. Unless ES can trade back up over 1403 on Wednesday, the bear case will become much stronger.

ES daily pivot: Tonight the pivot bumps up from 1400.25 to 1402.75. We moved back under the old level after today's close and are now even more below the new number, a bearish sign. Note also how the pivot is now the same value is the right edge of the RTC. It's mostly coincidence, but it reinforces the importance of that level.

Dollar index: Today the dollar gained 0.05% but that was enough to create a classic morning star pattern, which is a pretty good bullish reversal sign. The indicators are also now rising off oversold. I'd say further gains for the dollar are possible on Wednesday.

Euro: While the dollar gained a bit today, the euro gave us a perfect doji warning that yesterday's bullish RTC setup might not carry through. And in the evening session so far, it is trading lower which, along with declining indicators suggest that there may be more downside on Wednesday.

Transportation: Last night I mentioned the possibility of a bullish RTC setup here and today the trans obliged with just that, gaining 0.39%. If we go higher on Wednesday, that would be a bullish trigger, but the indicators seem to suggest downward pressure. Note too that they tried, but failed to break over the 200 day MA at 5102 today. I'm not convinced they're going to be able to move higher again on Wednesday.

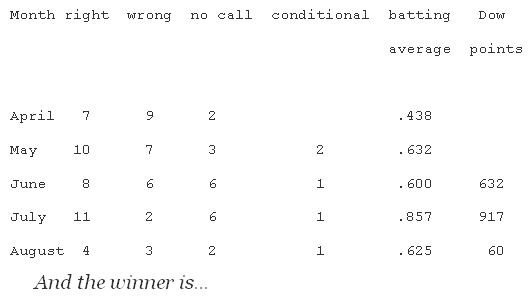

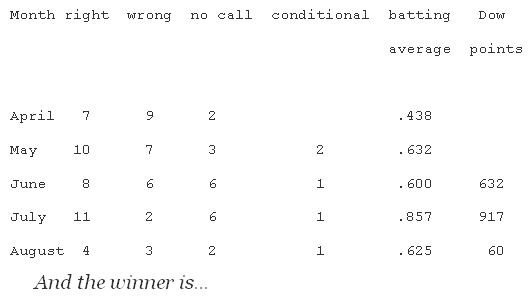

Accuracy (daily calls):

Looking over the charts, three things stand out: the big move up in the VIX, indicators starting to come off extreme overbought levels in the Dow and ES, and candles riding the edge of RTC's suggesting the rising trend may be over. I've been saying for days now that I think the next move (when the market finally does decide to move) will be lower. However, the hourly ES chart is still not showing the break, so given the current environment, I'm just going to have to call

If I absolutely had to guess, I'd say we're going lower, but in this environment confirmation is required. In the meantime, I continue to hold my position in SDS, which amazingly enough closed today at the exact same level where I bought it last week.

Disclaimer: (My lawyer made me do it) This blog is not trading or investment advice, account management or direction. All trades listed here are presented only as examples of the author's personal trading style. Investing entails significant risk and trading entails even greater risks. Act accordingly.

Actionable ideas for the busy trader delivered daily right up front

- Wednesday uncertain..

- ES pivot 1402.75. Holding below is bearish.

- Rest of week bias lower technically.

- Monthly outlook: bias up.

- ES Fantasy Trader remains short at 1395.00.

How about that? Last night I wrote " it's not out of the question that we get yet another small-range doji day of indecision" and that's exactly what we got, with the Dow finishing up just over 2 and a half points and the SPX down just 0.18. So we remain in the dog days, waiting in Casablanca, or for Godot - heck, I'm running out of metaphors here. This is getting monotonous. Let's scan the charts for any sign of a shake-up on the way.

The technicals (daily)

The Dow: Lately, the Dow has been giving a clinic on reversal candlesticks. Just look at the last seven candles here: shooting star, inverted hammer, green spinning top, red spinning top, green hanging man, red hanging man, and today a perfect doji. Every one a bearish warning, every one rejected. And so we remain stuck in a narrow range. The only difference today is that RSI has now finally started to come down from overbought and the stochastic looks like it may be unthreading itself as a bearish crossover. But once again, we're going to need confirmation before calling an end to the congestion.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The VIX: After hitting a five year low yesterday as I noted, the VIX today staged a big comeback with an 8.39% bounce that took it right out of its descending RTC for a bullish setup. It also sent the RSI and stochastic turning back up from oversold. This all seems to suggest more upside to follow which would be bad for stocks.

Market index futures: Tonight all three futures are down at 1:12 AM EDT with ES lower by 0.27%. Today gave us a classic doji, making five straight reversal candles here too. So far, the new candle developing seems to suggest a move lower, but we've seen this movie before. At 1398 right now, we're still inside the recent congestion range. I do note though that RSI has come off its recent 100 readings. And perhaps of greater importance, we are now trading entirely outside the latest rising RTC and that's a bearish setup. This is the best case I can make for lower prices Wednesday. Unless ES can trade back up over 1403 on Wednesday, the bear case will become much stronger.

ES daily pivot: Tonight the pivot bumps up from 1400.25 to 1402.75. We moved back under the old level after today's close and are now even more below the new number, a bearish sign. Note also how the pivot is now the same value is the right edge of the RTC. It's mostly coincidence, but it reinforces the importance of that level.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Dollar index: Today the dollar gained 0.05% but that was enough to create a classic morning star pattern, which is a pretty good bullish reversal sign. The indicators are also now rising off oversold. I'd say further gains for the dollar are possible on Wednesday.

Euro: While the dollar gained a bit today, the euro gave us a perfect doji warning that yesterday's bullish RTC setup might not carry through. And in the evening session so far, it is trading lower which, along with declining indicators suggest that there may be more downside on Wednesday.

Transportation: Last night I mentioned the possibility of a bullish RTC setup here and today the trans obliged with just that, gaining 0.39%. If we go higher on Wednesday, that would be a bullish trigger, but the indicators seem to suggest downward pressure. Note too that they tried, but failed to break over the 200 day MA at 5102 today. I'm not convinced they're going to be able to move higher again on Wednesday.

Accuracy (daily calls):

Looking over the charts, three things stand out: the big move up in the VIX, indicators starting to come off extreme overbought levels in the Dow and ES, and candles riding the edge of RTC's suggesting the rising trend may be over. I've been saying for days now that I think the next move (when the market finally does decide to move) will be lower. However, the hourly ES chart is still not showing the break, so given the current environment, I'm just going to have to call

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Wednesday uncertain.If I absolutely had to guess, I'd say we're going lower, but in this environment confirmation is required. In the meantime, I continue to hold my position in SDS, which amazingly enough closed today at the exact same level where I bought it last week.

Disclaimer: (My lawyer made me do it) This blog is not trading or investment advice, account management or direction. All trades listed here are presented only as examples of the author's personal trading style. Investing entails significant risk and trading entails even greater risks. Act accordingly.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.