Nvidia shares jump after resuming H20 sales in China, announcing new processor

The Hoot

Actionable ideas for the busy trader delivered daily right up front

Hah - last night I was wanting to call Tuesday higher but got scared away out of fear of more news/rumors out of Italy. Well on Tuesday Italy just fell off the world map and the Dow climbed 116 points. Oh well - nothing ventured, nothing lost. Now let's see if we can make some money on Wednesday by staring intently at the charts.

The technicals (daily)

The Dow: Last night I was thinking that Monday's sell-off was overblown and I guess when Mr. Market woke up this morning he agreed, sending the Dow up 116 to retrace half of Monday's losses., That was enough to eke out a bullish stochastic crossover and just send us out of the latest descending RTC for a bullish setup. So the confused and confusing action continues as we bob along between bullish and bearish. The last four days have been down, up, down, up. In fact we haven't had a run of more than two days in the same direction in over a month now, since January 25th. However, having now gotten a bullish stochastic crossover, the first since December 28th, this chart looks like it might be ready to move higher.

The VIX: The VIX came back to earth today, falling 11.16% after Monday's monster pop and proving once again what I always say - that the VIX rarely spends more than a day or two above its upper BB. I kind of outsmarted myself by pointing to the summer of 2011 when the VIX just kept going up, but this is not the summer of 2011. Tuesday's fall was stopped only by the 200 day MA, on the dot at 16.87. But with the VIX once again overbought and a fresh bearish stochastic crossover in place, I'm wagering on more downside here on Wednesday.

Market index futures:Tonight all three futures are barely lower at 1:35 AM EST with ES down by 0.08%. Tuesday's ES candle had the flavor of a DCB with somewhat muted gains in comparison to the Dow. But it was enough to throw the new developing candle out of the descending RTC we're in for a bullish setup. If ES closes above 1487 on Wednesday, that will confirm the setup. Any lower returns us to the RTC.

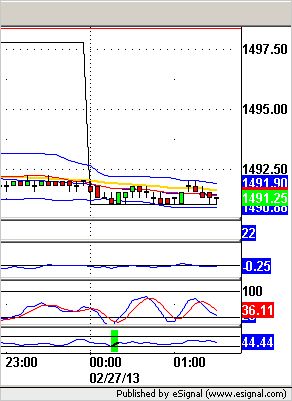

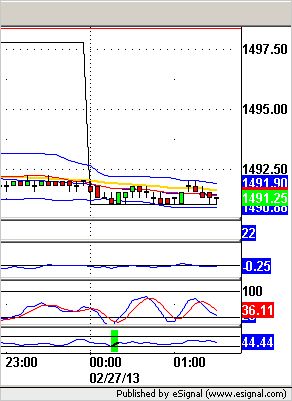

ES daily pivot: Tonight the pivot inches up from 1497.83 to 1491.00 even. With ES essentially flat in the overnight so far, this now puts us just above the new pivot. As I write, ES has made three attempts to break under, all of which have been rejected. Just look at this chart and see how the pivot acts as support. The pivot is the black line. Note how since midnight, ES has touched this line no fewer than ten times in 5 minute bars, just in 90 minutes, but has not gone one single tick below. Pretty strange stuff, eh kids? Remaining above would be bullish.

Dollar index:The dollar continued its climb on Tuesday putting in a spindly gap-up doji .that at least warns of the possibility of a move lower on Wednesday. That idea is supported by highly overbought indicators, with RSI now over 98 for the past three days in a row.

Euro: And like the dollar, the euro put in a doji of its own on Tuesday, this one gapping down to keep it in a descending RTC. And the euro is correspondingly oversold. So far the overnight action seems to be confirming the doji, with the euro now up a healthy 0.15% and breaking above its daily pivot as I write. This says higher euro to me.

Transportation:The trans put in a small morning star on Tuesday just above support at 5787 and their stochastic is about to execute a bullish crossover, so I'd not be surprised to see a move higher here on Wednesday.

So tonight we have pretty much an absence of any bearish pin action on Tuesday following Monday's rout. Then we've got ES bumping along its pivot. As I write, each successive 5 minute bar keeps trying to break under but keeps getting rejected. Call it the bots, the PPT, the banksters or the phase of the moon, but someone or something is propping up ES at 1491.00 tonight. So I'm going to make a conditional call: if ES stays above its pivot by mid-morning Wednesday, we close higher. If we break under convincingly, then we close lower.

ES Fantasy Trader

Portfolio stats: the account remains at $99,125 after 6 trades (5 for 6 total, 2 for 2 longs, 3 for 4 short) starting from $100,000 on 1/1/13. Tonight we're standing aside again. With no real trend in sight, I'm just not willing to pull the trigger.

Actionable ideas for the busy trader delivered daily right up front

- Wednesday higher if ES pivot holds, else lower....

- ES pivot 1491.00. Holding above is bullish..

- Rest of week bias uncertain technically.

- Monthly outlook: bias lower.

- ES Fantasy Trader standing aside.

Hah - last night I was wanting to call Tuesday higher but got scared away out of fear of more news/rumors out of Italy. Well on Tuesday Italy just fell off the world map and the Dow climbed 116 points. Oh well - nothing ventured, nothing lost. Now let's see if we can make some money on Wednesday by staring intently at the charts.

The technicals (daily)

The Dow: Last night I was thinking that Monday's sell-off was overblown and I guess when Mr. Market woke up this morning he agreed, sending the Dow up 116 to retrace half of Monday's losses., That was enough to eke out a bullish stochastic crossover and just send us out of the latest descending RTC for a bullish setup. So the confused and confusing action continues as we bob along between bullish and bearish. The last four days have been down, up, down, up. In fact we haven't had a run of more than two days in the same direction in over a month now, since January 25th. However, having now gotten a bullish stochastic crossover, the first since December 28th, this chart looks like it might be ready to move higher.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The VIX: The VIX came back to earth today, falling 11.16% after Monday's monster pop and proving once again what I always say - that the VIX rarely spends more than a day or two above its upper BB. I kind of outsmarted myself by pointing to the summer of 2011 when the VIX just kept going up, but this is not the summer of 2011. Tuesday's fall was stopped only by the 200 day MA, on the dot at 16.87. But with the VIX once again overbought and a fresh bearish stochastic crossover in place, I'm wagering on more downside here on Wednesday.

Market index futures:Tonight all three futures are barely lower at 1:35 AM EST with ES down by 0.08%. Tuesday's ES candle had the flavor of a DCB with somewhat muted gains in comparison to the Dow. But it was enough to throw the new developing candle out of the descending RTC we're in for a bullish setup. If ES closes above 1487 on Wednesday, that will confirm the setup. Any lower returns us to the RTC.

ES daily pivot: Tonight the pivot inches up from 1497.83 to 1491.00 even. With ES essentially flat in the overnight so far, this now puts us just above the new pivot. As I write, ES has made three attempts to break under, all of which have been rejected. Just look at this chart and see how the pivot acts as support. The pivot is the black line. Note how since midnight, ES has touched this line no fewer than ten times in 5 minute bars, just in 90 minutes, but has not gone one single tick below. Pretty strange stuff, eh kids? Remaining above would be bullish.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Dollar index:The dollar continued its climb on Tuesday putting in a spindly gap-up doji .that at least warns of the possibility of a move lower on Wednesday. That idea is supported by highly overbought indicators, with RSI now over 98 for the past three days in a row.

Euro: And like the dollar, the euro put in a doji of its own on Tuesday, this one gapping down to keep it in a descending RTC. And the euro is correspondingly oversold. So far the overnight action seems to be confirming the doji, with the euro now up a healthy 0.15% and breaking above its daily pivot as I write. This says higher euro to me.

Transportation:The trans put in a small morning star on Tuesday just above support at 5787 and their stochastic is about to execute a bullish crossover, so I'd not be surprised to see a move higher here on Wednesday.

So tonight we have pretty much an absence of any bearish pin action on Tuesday following Monday's rout. Then we've got ES bumping along its pivot. As I write, each successive 5 minute bar keeps trying to break under but keeps getting rejected. Call it the bots, the PPT, the banksters or the phase of the moon, but someone or something is propping up ES at 1491.00 tonight. So I'm going to make a conditional call: if ES stays above its pivot by mid-morning Wednesday, we close higher. If we break under convincingly, then we close lower.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

ES Fantasy Trader

Portfolio stats: the account remains at $99,125 after 6 trades (5 for 6 total, 2 for 2 longs, 3 for 4 short) starting from $100,000 on 1/1/13. Tonight we're standing aside again. With no real trend in sight, I'm just not willing to pull the trigger.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI