The yen continues to be driven lower by Japan's fundamentals. And unlike in previous periods, the yen has often declined recently even when the S&P500 was lower. JPY is losing its status of a safe haven currency (see discussion). Yes, this seems to be a difficult concept for some FX traders, but that has been the reality for now. There are just too many fundamental risks to be long the yen these days (see discussion). USD/JPY" title="USD/JPY" width="616" height="377">

USD/JPY" title="USD/JPY" width="616" height="377">

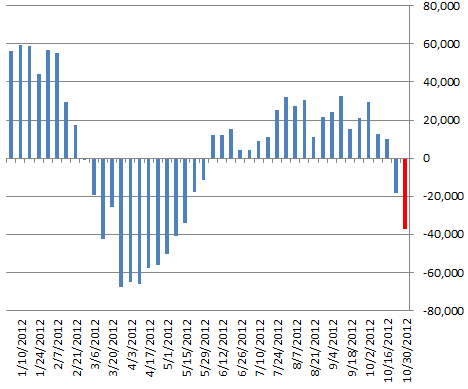

And traders in fact have turned increasingly short the yen as seen from the speculative exposures in the futures markets.

NASDAQ: The net amount of investor cash betting the yen would fall more than doubled in the past week, government data showed Friday.

As of October 30, investors had increased their net short yen position to $5.8 billion, the largest short yen position since May 8. The previous week investors held a net $2.8 billion short yen position, according to the Commodity Futures Trading Commission.

Here is the latest from the CFTC.

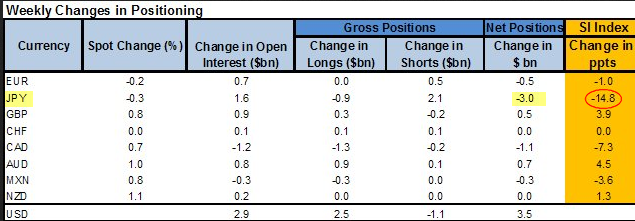

The GS JPY Sentiment Index has turned lower as well based on the changes in net positions.

Goldman: After switching to net short JPY positioning last week, JPY net speculative positioning continued to move further into short territory in this week's COT report. Net positioning now stands at -$5.8 bn, with most of the change coming from an increase of speculative short positioning in the currency. Our JPY Sentiment Index fell by another 14.8 points on the week, and is now at 24.0, the lowest reading of all eight currencies covered in the report.

Of course at some point one would need to put on a contrarian hat and ask the question if the yen is oversold. For now, however, taking a contrarian view on JPY may be premature.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.