Rarely when employment reports containing a lot of diverse information can be interpreted unequivocally. Today’s data are no exception.

Positive:

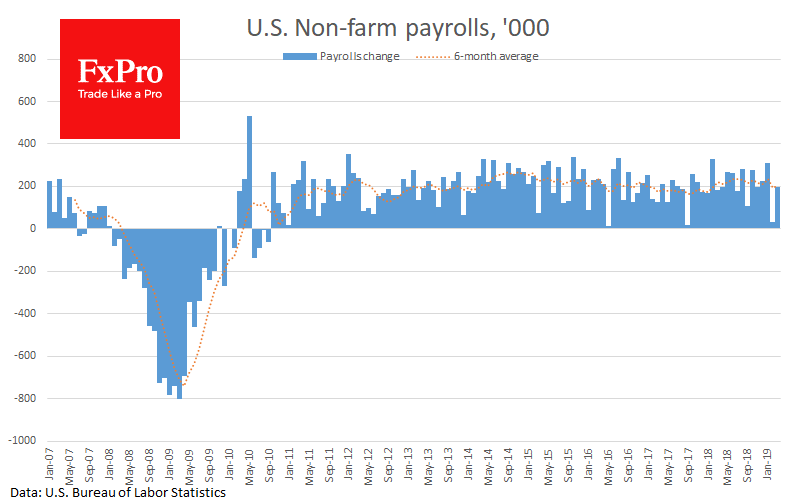

The increase in the number of employed by 196K against the expected 172K.

Revision of data for February from 20K to 33K.

Neutral:

Unemployment rate at 3.8%, as expected, and as it was in February.

The workweek is 34.5 as expected.

Negative:

Reduction of 6K jobs in the manufacturing sector (an increase of 11K was expected).

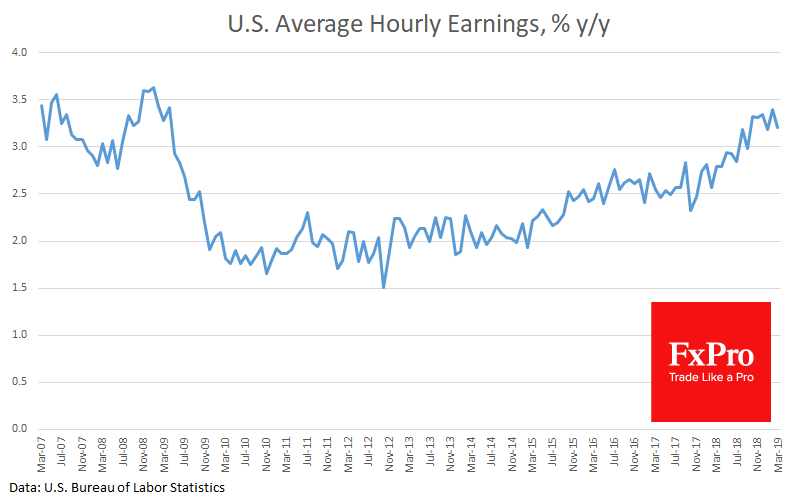

Wage growth of only 0.1% m/m and 3.2% y/y against expectations of 0.3% m/m and 3.4% y/y.

The unexpected decline in the share of the workforce from 62.2% to 63.0%.

In our opinion, there are more important negative moments in the published report. The decline in the share of the economically active population virtually makes the unemployment rate lower than it would be. The decline in wage growth rates once again creates space to soften the Fed’s rhetoric, because more than eight years of employment growth have not shape-shifted into inflationary pressure. This is bad news for the dollar, as it will strengthen speculation around possible rates cut. Previously, we have repeatedly seen how wage data triggers dollar trends for the next several weeks. And now the market reaction can be stretched in time.

However, at the moment, the dollar, in fact, did not change to the main competitors, as weak wage data were balanced by slightly stronger than expected statistics on the increase in the number of employed.

Alexander Kuptsikevich, the FxPro analyst

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.