Stock market today: S&P 500 ekes out gain as Trump says open to deals on tariffs

Over the past few days various measures of breadth have show quite a bit of weakness. As I noted in this post, large market declines come when breadth is already weak. With such weak readings the odds have increased that this decline will be 10% or more. Below are some breadth examples.

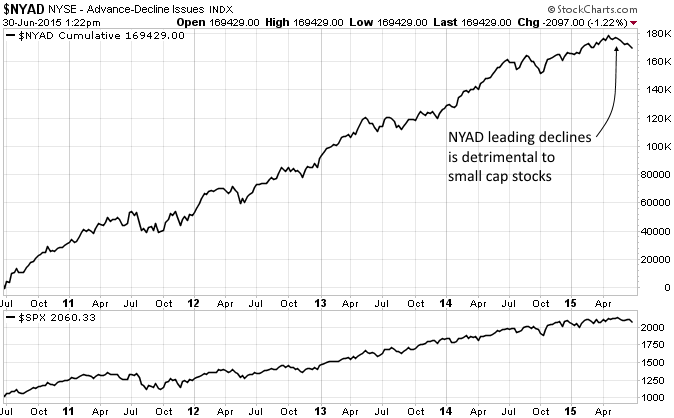

First is NYSE Advance/Declines. They led the current decline in the S&P 500 Index (SPX). Small caps are especially sensitive to this condition.

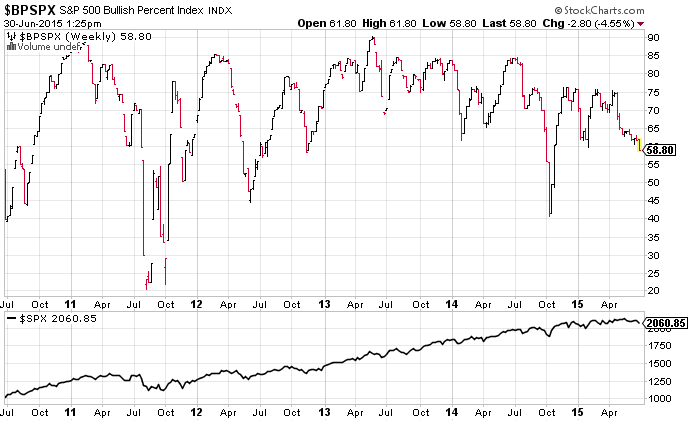

Next is the Bullish Percent Index (BPSPX). It currently has less than 60% of the stocks in SPX with bullish point and figure charts. This indicates a significant number of stocks in down trends.

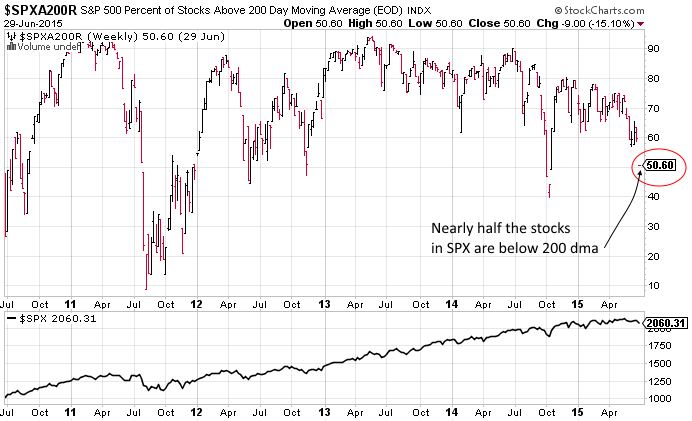

Last is the percent of stocks in SPX that are below their 200 day moving average. Nearly 50% of SPX stocks are below their 200 dma.

With all three measures of breadth showing significant weakness, a signal from my market risk indicator should be taken seriously.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI