Ahead of tomorrow’s FOMC interest-rate decision, some thoughts and data as to whether we can expect any shift from the consensus view expressed in the CME FED Watch, that the FED is going to hold rates despite their preferred measure of inflation, namely the PCE Personal Consumption Expenditure Index finally hitting their 2% target. Moreover, in hitting this target the PCE has posted its biggest gain in more than one year as well as registering a sharp acceleration in its core from 1.6% to 1.9%. The core PCE is an important metric as it strips out volatile food and energy costs. This is significant and it will be interesting to see how this key item of data will be reflected in the FOMC statement and the interest-rate path for the remainder of this year.

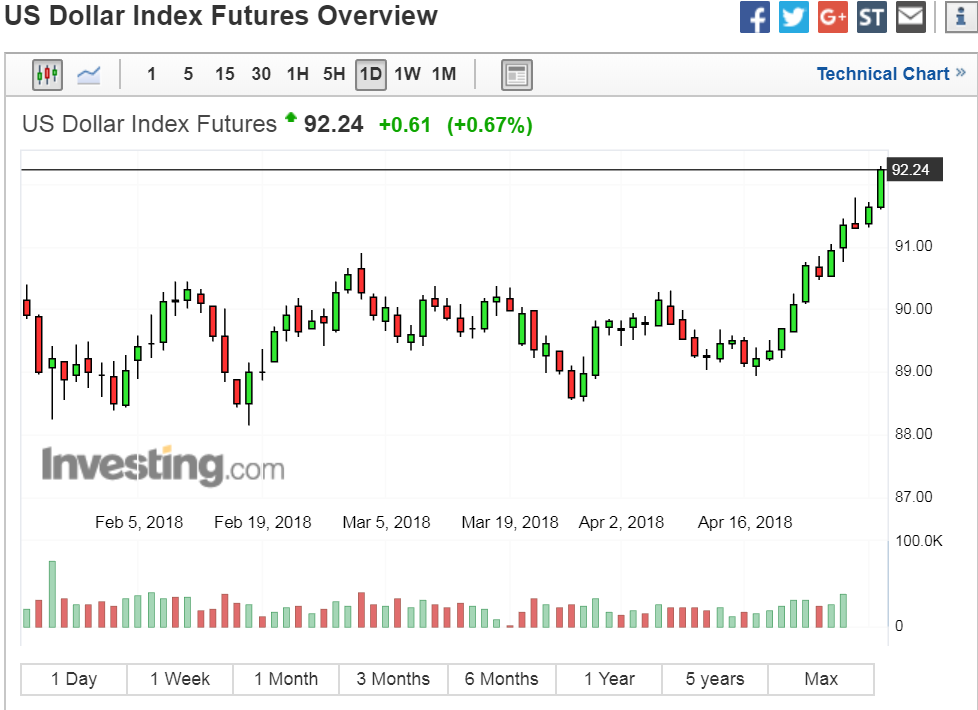

From a technical perspective, the PCE release has, of course, added to the USD’s bullish tone with the Dollar Index breaching both the 91 and 92 price levels. And for the current momentum to be sustained, the index needs to break above 92.25 where a strong close would see the index move to target 92.65 and then on toward 93 and even 94.

This combination of fundamental and technical factors for the USD has had a strong impact on all the major currency pairs with euro-dollar driven lower to test 1.20 and cable suffering not only from USD strength, but also from poor fundamental data and BOE ambivalence toward an interest-rate rise this month.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI