A month ago, I was looking for a bounce in Tesla (NASDAQ:TSLA) stock to ideally $825+/-25, fined tuned to $815.

Last week, on April 14, TSLA topped at $780. Was that all she wrote? Was my forecast off by 2.5 to 4.3%? It sure could be so because my margin of error is +/-5%, as no method, not even the Elliott Wave Principle (EWP), can ever be always 100% accurate and exact.

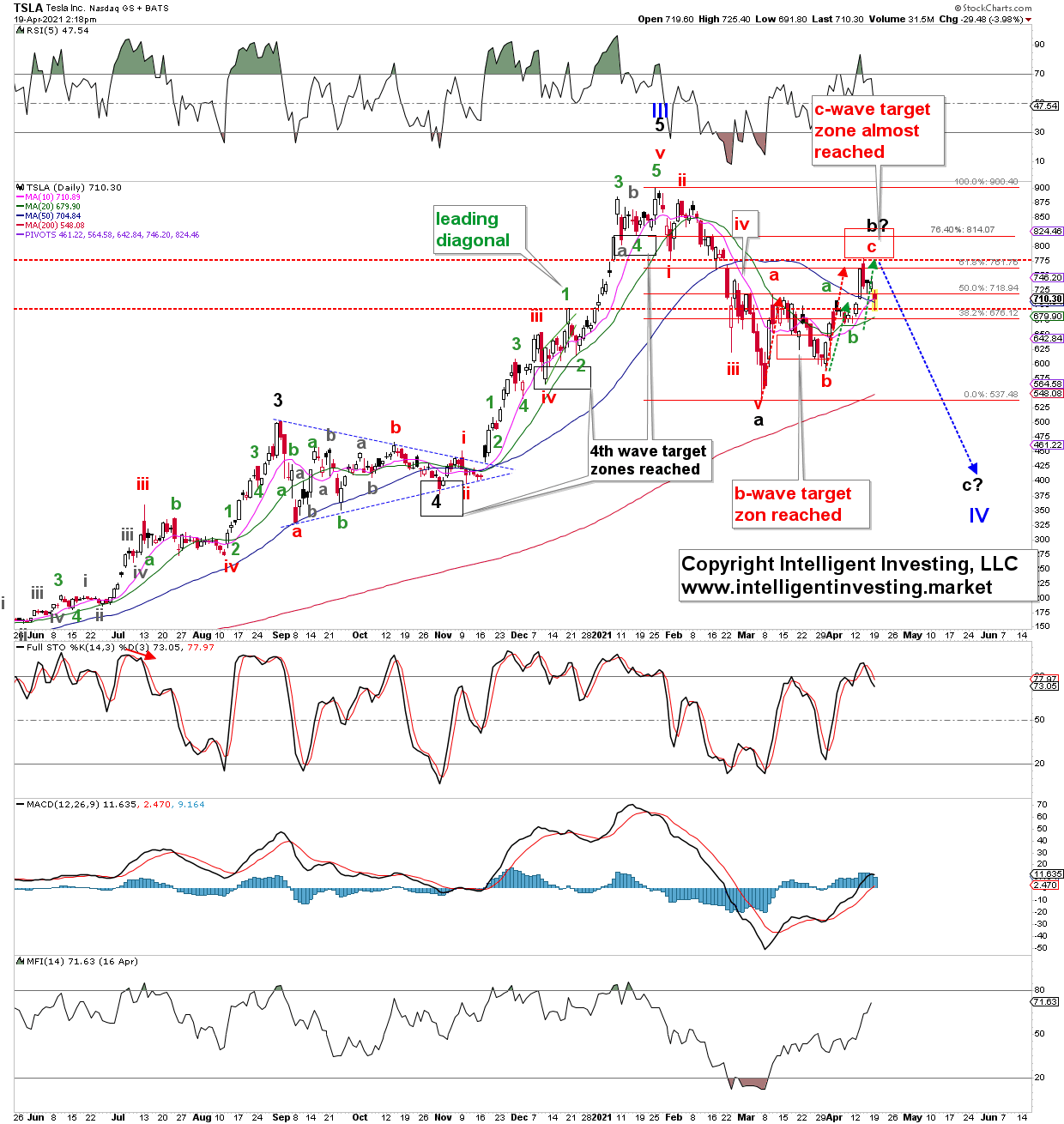

What matters is that using the EWP, I forecasted rather accurately where many prior 4th waves and the recent (red) b-wave would bottom. See the “callouts” in Figure 1 in red and black below. That is why we know the method is reliable, and we should expect it to continue to deliver accordingly.

Figure 1: TSLA daily candlestick chart with EWP Count and Technical Indicators:

The critical question is, as usual in the financial markets, what is next?

Currently, TSLA is right at important Simple Moving Averages (SMA) support, as it is still holding the 10-day, 20-day and 50-day SMA ($711, $680, $705; respectively). If it can keep these SMAs as support, it still has a shot at moving closer, i.e., inside the ideal (red) c-wave target zone because it just fell a little shy of it last week. Besides, the rally since the $539 low made on March 5, labelled as major (black) wave-a, still counts best as only three waves up, after five waves decline. Thus, it is still to be considered a counter-trend rally. The red and green dotted arrows show TSLA reached ideal c=a extensions last week at two different wave degrees: red intermediate and green minor. Thus, technically the “dead-cat” bounce can be complete.

A daily close below the recent (green) minor-b wave low at $668 made on April 8 will be the first severe warning for TLSA bulls that the stock is on its way down to the ideal $450+/-25 zone. Full confirmation of this path lower will be achieved on a daily close below the (red) intermediate-a wave low at $591 made on March 30. Conversely, TSLA bulls need to rally the price back above last week’s high to target the $825+/-25 zone.

Bottom Line: The anticipated, detailed EWP count shared over the last several updates has unfolded well. Last week, TSLA fell marginally short of the ideal dead-cat bounce upside target. Still, if it was indeed only a counter-trend rally, it should not be too surprising because “in bear markets upside disappoints and downside surprises.” If TSLA remains below $780, I now prefer to look lower to ideally $450+/-25. From there, I expect a sizeable multi-month rally to new all-time highs.