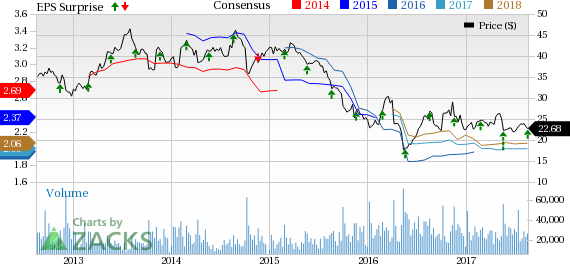

The Gap Inc. (NYSE:GPS) gained 5.5% in yesterday’s after-market trading session, as the company raised its fiscal 2017 earnings outlook, following the better-than-expected second quarter results. While the quarter marked the second consecutive positive earnings surprise, it was Gap’s fifth straight quarter of sales beat. Comparable store sales (comps) also continued to witness strength for the third time in a row, mainly driven by sturdy performance of Old Navy. The company’s focus on enhancing product quality and quick response to the changing consumer trends also helped the results.

However, foreign currency continued to play foul, resulting in the year-over-year decline in both the top and bottom lines. Nevertheless, yesterday’s upside drove this Zacks Rank #2 (Buy) stock’s last three months’ performance to a solid 7.9%, which shows a marked improvement in comparison to the industry’s 9.4% decline.

Q2 Highlights

Gap’s adjusted earnings of 58 cents a share surpassed the Zacks Consensus Estimate of 52 cents, though it slid 3.3% from 60 cents earned in the year-ago period. Currency dented earnings per share growth to the tune of about 3 percentage points. On a GAAP basis, earnings came in at 68 cents, compared with 31 cents recorded in the year-ago period.

Net sales dipped 1.4% to $3,799 million, with foreign currency translations bearing an adverse impact of $37 million. Also, international store closures impacted net sales. However, the top-line fared better than the Zacks Consensus Estimate of $3,765 million. Further, comps climbed 1%, against a 2% decline recorded in the year-ago period.

Comps continued to gain from robust Old Navy performance, which was fueled by improved traffic. This was partly offset by persistent softness across Banana Republic. As for the Gap brand, though comps dipped year over year, it improved sequentially thanks to better products. Looking at numbers, Old Nay comps grew 5%, whereas Gap and Banana Republic suffered 1% and 5%, respectively.

Margins

Gross profit rose 2.9% to $1,479 million, with the gross margin expanding 160 basis points (bps) to 38.9%. Adjusted gross margin grew 120 bps, attributable to a 110 bps increase in merchandise margins and 10 bps rent and occupancy expenses leverage.

Operating income surged 61.6% to $451 million, while operating margin expanded about 470 bps to 11.9%. However, the adjusted operating margin contracted 90 bps to 10.2%, owing to higher adjusted operating expenses. These expenses stemmed from greater payroll costs, along with investments in digital and customer service initiatives.

Financials

Gap ended the quarter with cash and cash equivalents of $1,609 million, long-term debt of $1,248 million, and total shareholders’ equity of $2,945 million.

During the first half, the company generated cash flow from operations of $486 million and incurred capital expenditures of $275 million. The company had free cash flow of $270 million on a year-to-date basis.

For fiscal 2017, management projects capital expenditure of approximately $625 million, excluding the planned $200 million spending associated with reconstructing the Fishkill distribution center.

Coming to Gap’s shareholder-friendly moves for the second quarter, the company paid dividend of 23 cents per share and bought back 4.5 million shares for $100 million. Year to date, the company payed $182 million as dividend. Additionally, on Aug 10, the company declared third-quarter dividend of 23 cents per share. Looking ahead, the company plans to make buybacks worth roughly $100 million in the third quarter.

Store Updates

In the quarter under review, Gap introduced 22 stores, while shuttering 32 stores. Of the stores opened, 15 were company-operated and 7 were franchise. Similarly, the stores closed included 22 company-operated and 10 franchise stores. Thus, the company ended the quarter with 3,642 outlets in 47 countries, of which 3,179 were company-operated and 463 were franchise. Gap still anticipates store count for fiscal 2017 to be flat with fiscal 2016 levels.

Outlook

Management remains impressed with its long-term growth endeavors, which mainly revolves around improving customer experience and accelerating responsiveness to their evolving demands. In this regard, Gap remains focused on enhancing product categories and boosting its web and mobile offerings. Encouraged by the progress in these initiatives and a solid first-half performance, the company raised its earnings per share projection for fiscal 2017, while retaining its sales and comps view.

The company now envisions adjusted earnings for the fiscal year in the range of $2.02-$2.10 per share, compared with the previous range of $1.95-$2.05. The Zacks Consensus Estimate is currently pegged at $2.00, which is likely to witness an upward revision following the upbeat outlook. Comps growth is still anticipated to range from flat to marginal improvement. Net sales, are expected to be little lower than this range, owing to the effect from currency woes and fiscal 2016 global store closures.

For the third quarter, management stated that it expects SG&A expenses to increase at a higher rate than the first half. This mainly stems from increased product, marketing and digital investments for the significant back-to-school selling season.

Looking for More? Check these 3 Other Trending Retail Picks

The Children’s Place Inc. (NASDAQ:PLCE) , with a long-term EPS growth rate of 9% sports a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Target Corporation (NYSE:TGT) , also carrying a Zacks Rank #2, has delivered back-to-back positive earnings surprises in the last two quarters.

Five Below Inc. (NASDAQ:FIVE) , with a long-term EPS growth rate of 28.5%, carries a Zacks Rank #2.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

See Stocks Now>>

Gap, Inc. (The) (GPS): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Five Below, Inc. (FIVE): Free Stock Analysis Report

Original post