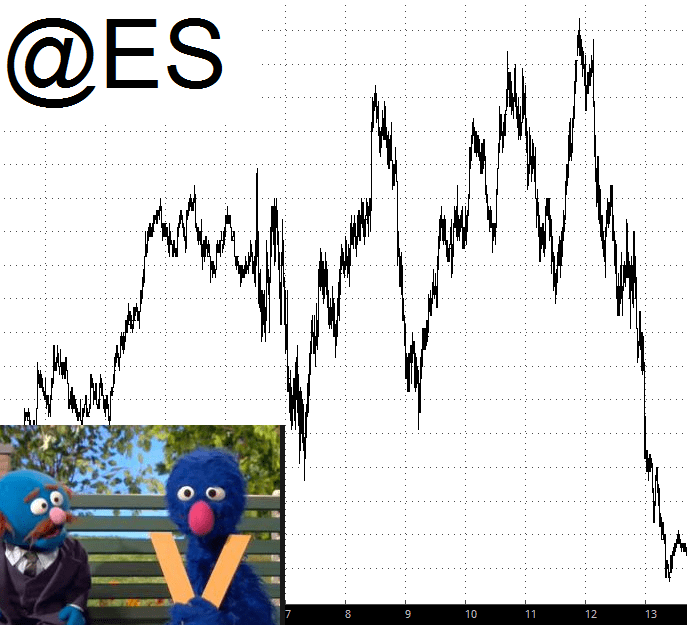

What a day! This was pretty much all anyone needed to follow the markets:

But let’s back up a bit.

I woke up at 5:15 to get ready for a long day. I figured if I started driving from Milwaukee early, at 5:45 a.m., I’d make it to tastytrade easily.

Nope. About 20 miles outside Chicago, everything was solid red. Google Maps took me off the freeway and had me driving through Skokie, Sokol, and some godforsaken towns that I hope I never see again. after I told my colleagues the pathway I took to get there, their faces turned ashen. “Do NOT ever get off the freeway”, they cautioned. Errr, OK. It took me 2 1/2 hours to make an other 80 minute trip.

Anyway, the market day was absolutely nutty and indecisive. Specifically:

I managed to run the blog, keep my stops up-to-date, prep for my show, be a guest on a couple of segments, and do my regular show. When I dashed out of the studio, there were 20 minutes left in the trading day, and the ES was barely red. Once I was safely on the road, I checked my phone, and the ES had closed down nearly 20. So – – – total craziness.

For myself, I remain relatively lightly short with 50 positions and about 150% commitment. I am VERY uncertain right now about how big a bounce we’re going to get, or if the bounce is already over. I feel extremely confident about what the market will look like in 2 months, but not in 2 days. Thus, I think I’m going to keep taking it relatively easy. Because, yes, I have 50 shorts, but there are 57 other items that I would LIKE to short, but only at good prices.