The current low volatility regime across markets is virtually unprecedented. In fact, the last time we experienced anything remotely similar was May 2007, just before the early rumblings of the Global Financial Crisis kicked off a tumultuous summer across global markets. It is fair to say that we are in the midst of a low volatility positive feedback cycle in which low volatility begets lower volatility:

While utilizing technical analysis on the VIX is often quite ineffective, the falling wedge which has formed since late January is clear as day and one must wonder how much longer volatility (both realized and implied) can remain dormant. The answer might be not much longer especially when one considers the flashing red lights of historic levels of investor complacency:

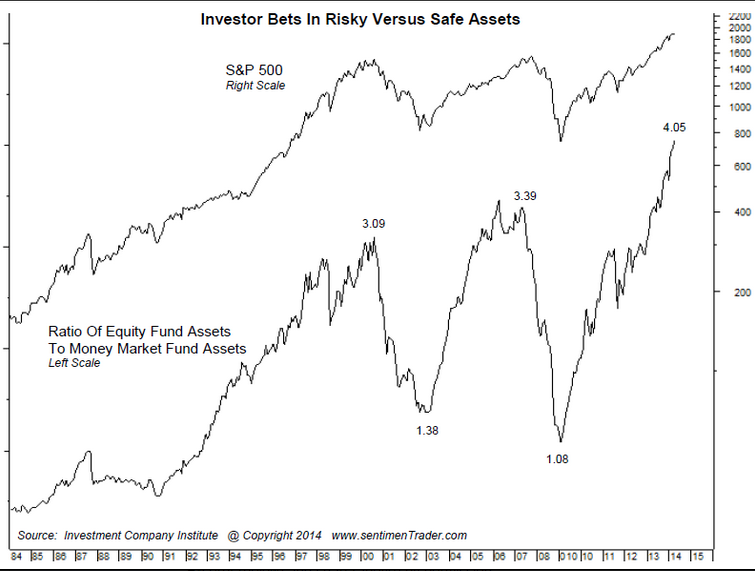

Chart from Mike Shedlock: Investor Bets in Risky vs. Safe Assets Hits Record High

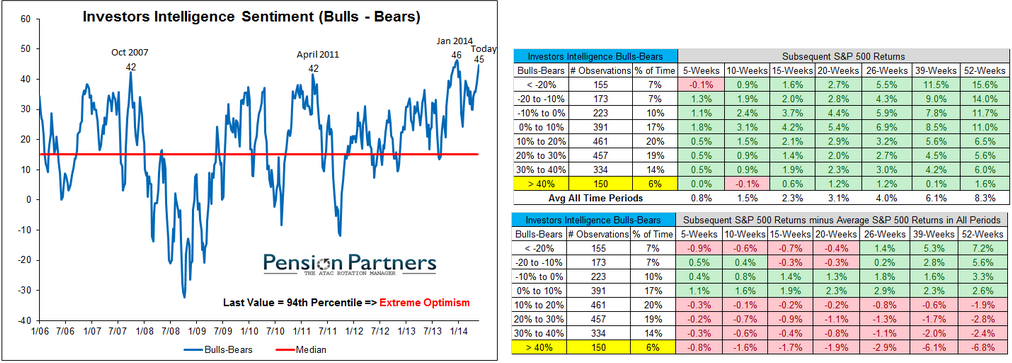

Bull-Bear Ratio above October ’07 level

“Rule number one: most things will prove to be cyclical. Rule number two: some of the greatest opportunities for gain and loss come when other people forget rule number one.” ~ Howard Marks (The Most Important Thing)

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI